BMS gets FDA approval for Krazati in colorectal cancer

Bristol-Myers Squibb’s KRAS inhibitor Krazati has been approved for a second indication, colorectal cancer (CRC), which could inject some much-needed sales growth into the product.

The FDA has given accelerated approval to Krazati (adagrasib) as a combination with Eli Lilly’s anti-EGFR-antibody Erbitux (cetuximab) to treat patients with KRAS G12C-mutated, locally advanced, or metastatic CRC who have previously received chemotherapy.

At the moment there are two KRAS inhibitors on the market, Krazati and Amgen’s Lumakras (sotorasib), which are both approved as second-line monotherapies for KRAS G12C-mutated non-small cell lung cancer (NSCLC) and in clinical testing for first-line use.

BMS claimed rights to Krazati when it acquired Mirati Therapeutics last year in a $5.8 billion deal.

So far, neither of the KRAS drugs have lived up to their initial sales expectations, with Amgen reporting that sales of its first-to-market drug reached $280 million last year. Mirati, meanwhile, said that Krazati brought in just $36 million in the first nine months of 2023, ahead of BMS’ acquisition, and BMS recorded $21 million in sales in the first quarter of 2024.

Both drugs have accelerated approval in the NSCLC indication and, while Amgen suffered a setback when its confirmatory trial to convert that to a full approval missed the mark, BMS said earlier this year that its confirmatory study was positive, with a significant improvement in progression-free survival (PFS).

Now, with approval in CRC, it has an opportunity to catch and potentially overtake its rival, although Amgen has also reported positive pivotal trial results in KRAS G12C-mutated colorectal cancer for Lumakras in combination with its own EGFR drug Vectibix (panitumumab).

The CRC approval comes on the back of BMS' phase 1/2 KRYSTAL-1 study, which showed that Krazati was able to achieve an overall response rate of 34% and a median duration of response of 5.8 months. The FDA gave the new indication a priority review.

GlobalData recently predicted that the market for KRAS-targeting drugs in oncology could reach $4 billion by 2029, with Lumakras and Krazati accounting for around $1.4 billion of that total. Morningstar analyst Damien Conover said after the CRC approval that Krazati could become a $1 billion product, justifying BMS’ takeover of Mirati.

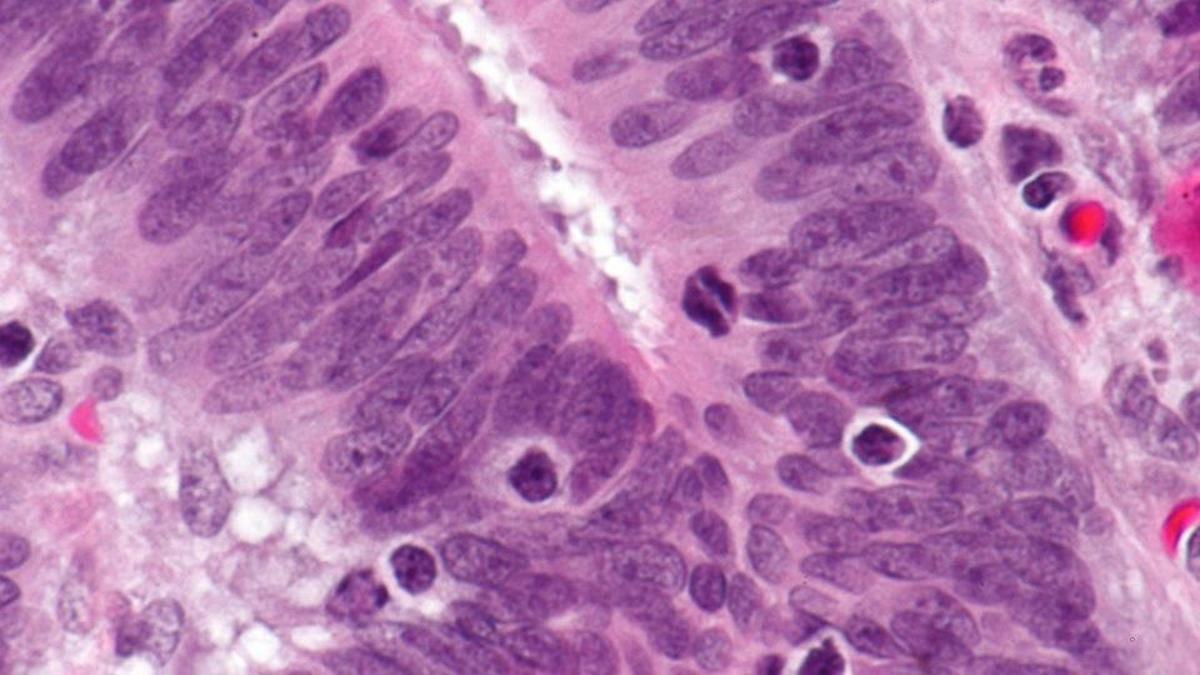

KRAS is the most frequently mutated oncogene in human cancer and drives the disease in up to 50% of patients with CRC, according to BMS. The KRAS G12C mutation occurs in approximately 3% to 4% of CRC cases.