BioXcel shares rise on result of Alzheimer’s drug probe

Shares in BioXcel Therapeutics rose more than 31% in early trading today after the biotech said an independent audit of a phase 3 trial of its Alzheimer’s disease therapy BXCL501 endorsed the data’s integrity and reliability.

The audit was carried out after questions about the integrity of the data emerged this summer when a fraud investigation was set up focusing on one of the investigation sites involved in the TRANQUILITY II study.

The revelation of the probe wreaked havoc with BioXcel’s shares, wiping out big gains for the stock after the results of the trial were announced, which had prompted predictions that BXCL501's peak sales potential could be as high as $1 billion.

In a statement issued this morning, BioXcel said the audit had revealed “no evidence of misconduct or fraud found beyond instance previously reported,” clearing the way to proceed with regulatory filings for the drug, intended as a treatment for agitation in Alzheimer’s patients aged 65 or older.

If approved for the new indication, BXCL501 would be a rival to Lundbeck and Otsuka’s Rexulti (brexpiprazole), which became the first drug to be approved by the FDA to treat agitation associated with Alzheimer’s earlier this year.

The audit consisted of a review of records from over 50% of subjects enrolled at the trial site to identify any additional instance of misconduct or fraud, and to evaluate the data “for eligibility, safety, and efficacy data.”

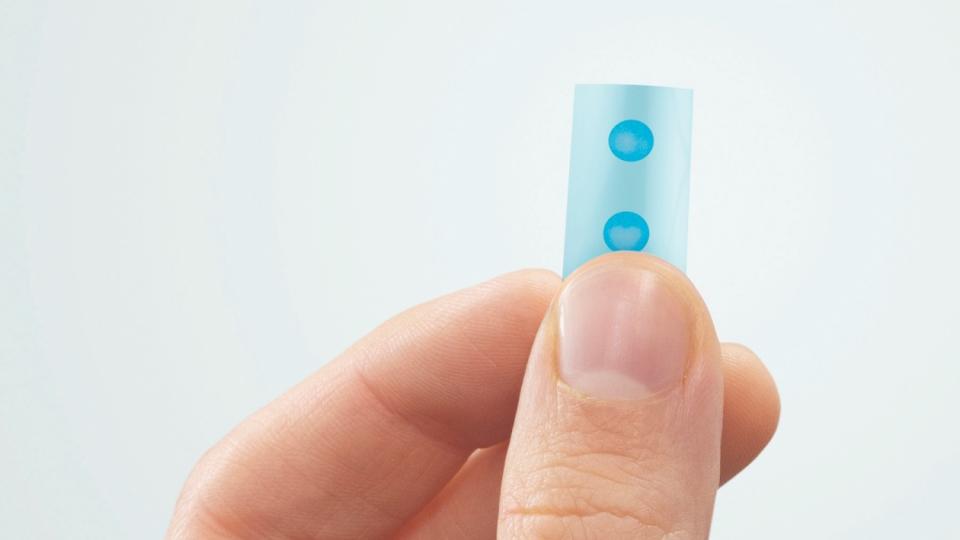

BioXcel’s chief executive, Vimal Mehta, said the company recently had a meeting with the FDA to discuss plans for the programme and intends to include the audit findings in its planned marketing application for the drug, which is an oral film formulation of dexmedetomidine.

“We expect to receive the FDA meeting minutes in the first half of November, and intend to provide an update on additional steps for the TRANQUILITY programme and a potential [filing] in our upcoming third quarter financial results,” added Mehta.

Shares are currently trading at just over $3, a long way off its 52-week high of more than $34. The formulation is already approved under the Igalmi trade name as a therapy for agitation in people with schizophrenia or bipolar disorder, but use in Alzheimer’s could unlock a big new market for the drug and potentially support blockbuster-level sales.

In the second quarter of this year, BioXcel reported Igalmi sales of $457,000, up from $206,000 in the first three months of the year. The glacial growth of the drug prompted the company to implement a cost-cutting drive earlier this year, narrowing its focus to BXCL501 and cutting its workforce in half in a bid to extend its cash runway into the middle of next year.

It ended the second quarter with $127.5 million in cash and posted a net loss in the period of $53.5 million.