BioSenic slumps as it sidelines bone repair therapy

Belgian biotech BioSenic has suspended a phase 2b trial of ALLOB – a stem cell-derived therapy designed to accelerate bone fracture healing – after it was unable to show efficacy.

The programme has been placed on hold while BioSenic re-evaluates the timing of ALLOB for bone repair but, in the meantime, the company has focused its attention on its other clinical-stage candidate for graft versus host disease (GVHD).

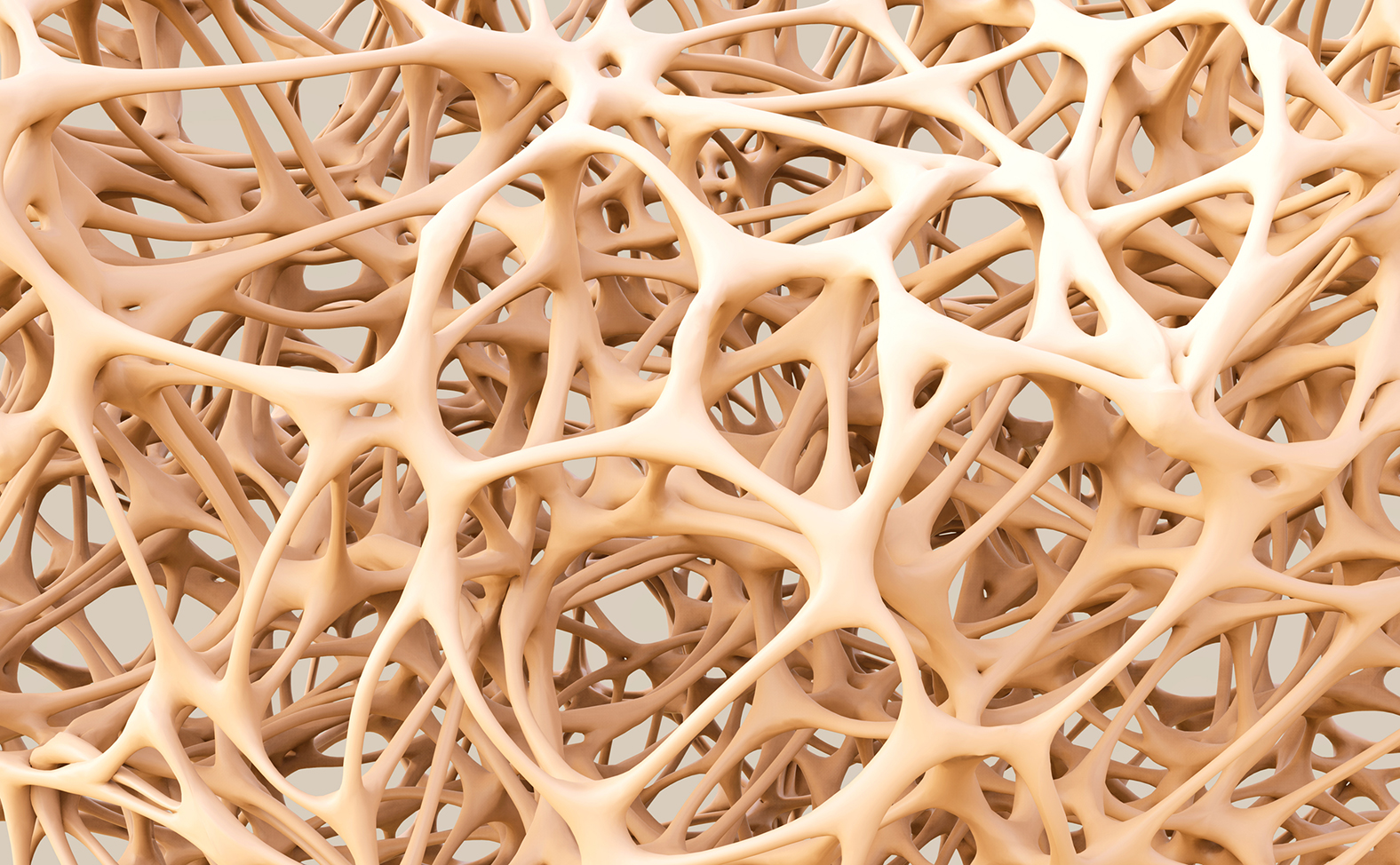

ALLOB is a cell therapy based on stem cell-derived osteoblasts, which are involved in forming new bone material. It was previously developed by Bone Therapeutics, which transformed into BioSenic last year via a reverse merger with Medsenic after running short of funding.

In the 57-patient phase 2b trial of ALLOB, the therapy was unable to speed up the fracture healing process in patients with breaks to the tibia (shin bone) that were taking longer than expected to knit together. That is in contrast to an earlier phase 2a study, where administration of ALLOB after 3.5 to 7 months did show evidence of quicker healing, according to the biotech.

There were signs that BioSenic may be uncertain about the prospects for ALLOB when it revised the clinical trial protocol last year to trim down the number of patients in the study, setting a new threshold for determining whether its effects were clinically meaningful that it said was more “objective” – and would also give it an earlier readout on the programme’s viability.

For now, the company isn’t giving much away on the data, other than to note that the safety of the therapy was “excellent”, but chief executive Lieven Huysse said that the totality of data now suggests that ALLOB should be administered “outside the acute early post-traumatic inflammatory period”.

The demise of ALLOB means BioSenic is now concentrated on oral arsenic trioxide (OATO), which came from Medsenic and is in preparation for a phase 3 trial in chronic GVHD, a complication of transplant procedures.

Losing ALLOB as a going concern is a big blow to the company, particularly as it was a candidate for out-licensing, and the company’s cash reserves have continued to dwindle since the merger.

BioSenic ended the first quarter with just €1.45 million, against a predicted 2023 cash burn of approximately €10 million to €12 million, making new financing a priority if it is to press ahead with its OATO development plans.

Shares in the company were on the slide this morning, down more than 18% at the time of writing as investors reacted to the ALLOB news.