Part One: Overcoming challenges and seizing opportunities in global market access for rare and complex conditions

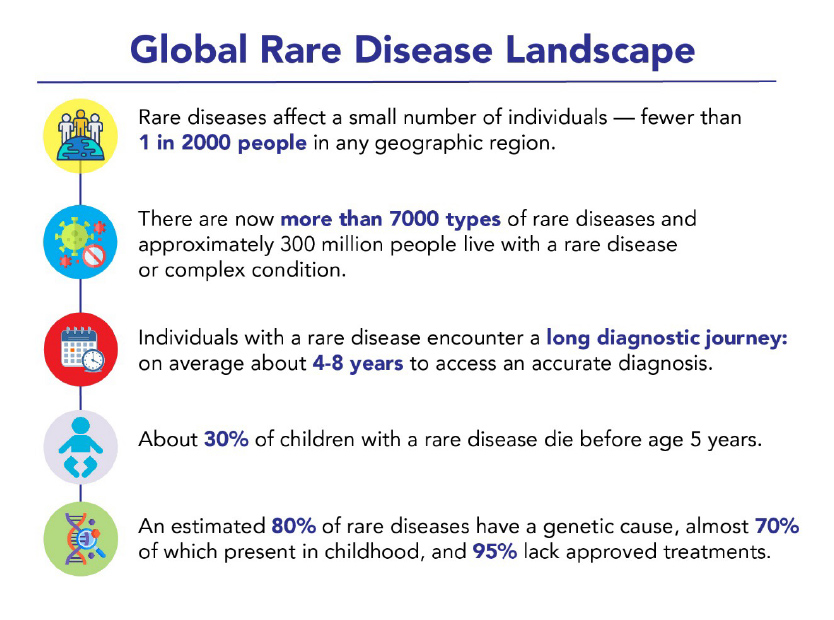

The outlook for drug development to treat rare diseases looks encouraging, offering hope to the 300 million people globally facing the significant challenges of these often-overlooked conditions.

However, for pharmaceutical manufacturers, navigating the path to effectively launch these transformative therapies in global markets is complex. Companies must address a multitude of evolving access challenges, including varying approaches to reimbursement across the globe, choosing the optimal pricing strategy that works globally and at the individual country level, and the increased demand for risk sharing outcomes-based access agreements that rely on the generation of real-world evidence.

Growing global opportunities in the rare and orphan drug market

Today, 36 million people in the European Union (EU) and 30 million in the US with a rare disease face the harsh reality of a lengthy diagnostic journey, limited research into and awareness of their conditions, and a lack of approved treatments. Currently, less than 5% of all rare diseases have approved therapies available on the market.

Data Source: The Lancet Global Health

There are strong expectations that drug spending and growth will accelerate globally over the next few years, though the pace will differ by country, as will key drivers such as volume and price. By 2028, specialty medicines are projected to account for over 40% of total global spending on medicines, with more than half of that expenditure occurring in leading developed markets. This growth is partially being driven by the increased number of drugs being developed and receiving regulatory approval to treat rare diseases.

In the US, for example, the Food and Drug Administration (FDA) Center for Drug Evaluation and Research (CDER) demonstrated its commitment to hastening the development of treatments for patients with rare diseases. By launching the Accelerating Rare disease Cures (ARC) Program to promote scientific and regulatory innovation in 2022, over half of all the novel drugs and biologics approved by the FDA were aimed at preventing, diagnosing, or treating rare disease by 2023.

As of Q2 2024, the FDA approved 15 new drugs targeting rare diseases, including several for rare cancers. Additionally, the US Orphan Drug Approval Law, enacted more than 40 years ago, continues to encourage pharmaceutical companies to develop treatments for rare diseases by providing incentives such as extended market exclusivity and enhanced tax credits.

In the EU, the Committee for Orphan Medicinal Products (COMP), the European Medicines Agency's (EMA) committee responsible for recommending orphan designation of medicines for rare diseases, has introduced incentives to develop new treatments that include reduced regulatory fees, expedited review processes and an additional two years of market exclusivity for approved drugs treating rare diseases. In the first three months of 2024, EMA had already granted orphan drug designation to 22 drugs affecting 25 different rare diseases.

Navigating country-specific reimbursement landscapes

Successful launch or patient access is not guaranteed by regulatory approval of a drug. Finding the right balance between embracing innovation and ensuring affordable access to costly, yet transformative, therapies for rare disease remains a challenge for manufacturers.

Successful go-to-market strategies need to take into account several key factors, such as the high costs of medications, the potential lack of clinical trial data and the specific challenges associated with curative treatments. Additionally, the reimbursement processes for drugs differ greatly depending on the region, often influenced by whether a health technology assessment (HTA) is mandated by payers.

Throughout the world, there is wide variability in HTA requirements. To harmonise the description of an HTA from country to country, an international joint task group provides this definition: an HTA is a “multidisciplinary process that uses explicit methods to determine the value of a health technology at different points in its lifecycle. The purpose is to inform decision-making to promote an equitable, efficient, and high-quality health system.”

HTA informs decision-making related to drug pricing and reimbursement recommendations by taking into consideration efficacy and safety data from registration trials, patient health-related quality of life (HRQoL) measurements, life-expectancy impacts, and cost data. HTAs support coverage and reimbursement decisions, clinical guidelines, and policy decisions that contribute to better patient outcomes and the efficient use of healthcare resources.

Overall HTA recommendations are shaped by societal and divergent cultural values, resulting in very different practices among international HTA jurisdictions. HTA may be mandated at national or regional levels in Europe and countries such as Australia and Canada. Additionally, collaboration among national HTA bodies is increasing, as evidenced by the upcoming Joint Clinical Assessment (JCA) in the EU, which will be implemented in January 2025.

In contrast to many developed countries, the US does not have a national HTA programme to broadly evaluate, guide coverage, and pricing decisions. Each private and public payer independently makes its own coverage decisions and conducts separate price negotiations.

The road to successful global market access remains intricate and multifaceted. The supportive regulatory environments in both the US and the EU signal a commitment to advancing treatments for rare conditions, yet, the challenge lies in ensuring that these innovative therapies are not only approved, but also accessible and affordable for patients who need them. Looking ahead, fostering collaboration among stakeholders, including manufacturers, payers, regulators and patient advocacy groups, will be crucial in overcoming these challenges. By aligning efforts to streamline processes and enhance understanding of the true value of these therapies, we can transform the lives of the millions affected by rare diseases and create a more equitable healthcare landscape for all. In part two, navigating pricing, real-world outcomes, and accessibility issues will be covered.