Nine for 2024, Pt 1: From fragility to resilience

This year was a year of significant new beginnings for pharma and healthcare, yet, it was still impacted by the long-term fallouts of the pandemic. 2024 will inherit the challenges of 2023 and see the future path worked out for many major market events from the year just gone, as discussed in this first of a two-part perspective from IQVIA EMEA Thought Leadership. Significant 2023 events impacting even further in 2024 include the readout of SELECT, Novo Nordisk’s outcomes trial for its obesity agent, Wegovy, which showed exciting and far-reaching potential for the agent to make major impact on serious cardiovascular disease, with a 20% reduction in a composite endpoint of cardiovascular death, non-fatal myocardial infarction, or non-fatal stroke.

This has kicked off the market for managing obesity as a path to managing serious cardiovascular disease, markets which will become very significant very rapidly, with the potential to change and challenge healthcare systems in a way not seen by non-COVID treatments since the Hepatitis C agents launched a decade ago. 2024 will see competition rise and payers respond to the obesity/CV-Met markets.1

2023 therapeutic initiations also included the approval of the first ever CRISPR based therapy, Casgevy, in the UK, followed shortly by the US, for the treatment of Sickle Cell disease and Beta Thalassaemia. 2024 will be the year when the realities of pricing and accessing this revolutionary approach becomes apparent, with long term implications for gene editing technologies.2

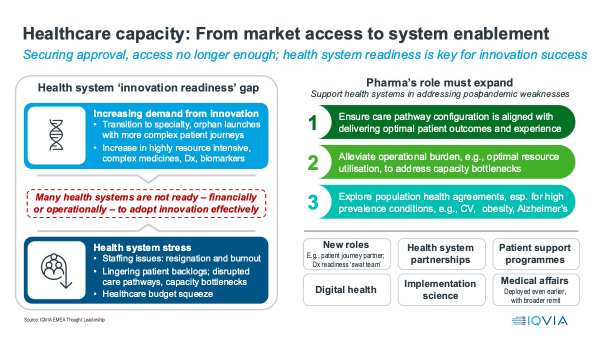

In 2024, these therapeutic innovations, and others, will throw one of the key challenges facing healthcare systems into sharp relief - the gap between the demands the introduction of new therapies make on healthcare systems, and healthcare systems’ capacity to deliver on those demands.

From market access to system enablement: The growth of the healthcare capacity gap as a challenge to the uptake of innovation

2024 will see the healthcare capacity gap challenge remain, with consequences for the uptake of new innovation. This gap between the demands sophisticated medicines make on healthcare system capacity in terms of healthcare professional time, training, infrastructural bottlenecks (such as lack of infusion chairs), health system spend, and planning, has grown dramatically with the rise of increasingly specialist medicines.

Whereas the primary care blockbusters of yesteryear required a single visit to a family doctor for prescription of an oral medicine the patient took themselves, today’s gene and cell therapies require multiple highly trained personnel, and complex planning to administer and follow up. Even away from the extreme end of pharmacotherapeutic sophistication, cancer patients will now have multiple diagnostic tests for the right pharmacotherapeutic choice.

While this undoubtedly improves treatment, it comes with costs – both direct expense, including capital expenditure if infrastructure is the bottleneck, and time. While the capacity gap was present pre-COVID, the pandemic widened it dramatically, because it diverted resources for routine healthcare treatment, created backlogs, drove new treatment demands from changed settings and patterns of care and new conditions in Long COVID, and drove staff burnout. An IQVIA study showed that, across the lead five European countries and the US, the majority of healthcare professionals (53%-74%) were still reporting that understaffing due to resignation and burnout remains a significant problem in 2023.

Capacity gaps reduce the ability of healthcare professionals and healthcare systems to optimally adopt new healthcare technologies; they slow change and reduce resilience, with real consequences for the introduction of innovation. In 2024, more than ever, companies must think holistically about the impact of their new medicine or technology on healthcare systems. The days of “Market Access” meaning budget access alone will be comprehensively over in 2024. This means earlier, broader engagement with health systems to plan the introduction of the new healthcare technology with maximum benefit and minimum disruption. As market access becomes system enablement, pharmaceutical companies will create new roles, explore health system partnerships, invest further in digital health and patient support programmes, implementation science, and medical affairs.

Supply Chain Security: Strengthening the basics

Healthcare system capacity gaps are apparent not only in challenges in handling new innovation, but also in the provision of off-patent medicines that make up the vast majority of volume of treatment, and the backbone of populations health management.

Active pharmaceutical ingredient (API) manufacturing concentrated into a smaller number of countries in the past few decades. Now, 60% of APIs are manufactured in either China or India. The COVID-19 pandemic laid bare the concentration and fragility of the global supply chain. In 2023 in the US, record medicines shortages were reported, with a mid-2023 survey by the American Society of Health Systems Pharmacists finding 99% of over 1,000 respondents reporting medicines shortages.3

Root causes of shortages can include inflexible purchasing frameworks for generics, which operate on thin margins, lead to concentration of production to a handful of suppliers and, therefore, product withdrawals for economic reasons can have huge implications. As standards diverge and global tensions increase, the risk of non-cooperation and export bans rises. Global supply chains are frequently opaque, and data collection on shortages is incomplete, and predictive tools to identify future risks are few.

2024 will see increasing recognition that policy solutions are required to increase resilience, including an EU “Critical Medicines Act” and the WHO’s draft pandemic accord. Changes to legislation seek to track supply and incentivise diversity of supply, whether through near-shoring or forming trusted partnerships, funding for investment into production of key products and reimbursement flexibility to accommodate market fluctuations challenges, but the solutions will be neither easy nor quick. In mid-2023, the FDA announced a year’s delay to enforcement of the Drug Supply Chain Security Act until 27th November 2024, giving drug manufacturers and distributors more time to prepare for compliance.

Deep or broad? Global pharma’s strategic choice

The global pharmaceutical market’s value has also been very heavily focused on a small number of countries – just seven markets – the US, Japan, Germany, France, UK, Italy, and Spain have historically accounted for more than 80% of world Rx value. If innovative new agents are the focus, concentration is even higher – close to 90% of cumulative first five-year sales in these markets. The pendulum is swinging back, however, as 2023 saw these seven markets hold 76% of global value, and innovative prescription medicine sales have been growing faster outside the lead seven markets. Whilst for decades the default presumption has been of increasing global integration of the pharmaceutical market, in 2023 and 2024 there are still harmonisation initiatives, and forces such as localisation of manufacturing will be stronger.

If the concentration of the global market is (slightly) reversing, what does this mean for the strategic choices that global pharmaceutical companies must make? Companies have two (not necessarily mutually exclusive) choices – go deep or go broad.

For the last decade and a half, as specialty products have driven the world’s value growth, going deep into a small group of high-income markets, led by the top seven, has been a proven winner. Two trends are reversing this tide - first, the continuing healthcare budgetary challenge across higher income markets as a consequence of the pandemic and economic crisis, coupled with the macro-legislative events of the IRA in the US and the proposed EU revision of pharmaceutical legislation.

These events could squeeze profitability, while the combination of economic austerity with healthcare system fragility has already led to average lower sales uptake for innovative medicines in the leading seven markets since the pandemic. Second, the renaissance in innovation for mass chronic diseases of ageing, led by cardio-metabolism and obesity, demands access to large populations of patients beyond the lead seven markets.

Going broad trades some profit margin for large patient populations from growing and ageing middle classes in lower- and middle-income countries. To fully realise this, companies must be prepared to manage local prices and address access gaps. For example, with patient support programmes, where state provision is incomplete, and (in China especially) compete effectively with local companies. Once again, health system enablement is critical to a breadth approach to global markets.

As 2024 sees the pendulum swing back from ever-increasing focus on a small number of high-income markets, the strategic choice for global pharmaceutical companies will not be either/or, but both, with a broader spread of markets where portfolio changes require it.

As cardiometabolic markets expand dramatically, there will be a fundamental change in where prescription medicine value growth is being driven. Companies will need to break out of the old thinking of market access as budget access across the core higher income countries and low- and middle-income countries. The solutions applied will be various, but the principle is consistent: success from 2024 onwards means pharmaceutical companies must engage healthcare systems as partners to address the common interest of getting the right medicines to patients.

References

- https://www.ashp.org/-/media/assets/drug-shortages/docs/ASHP-2023-Drug-Shortages-Survey-Report.pdf

- https://www.iqvia.com/library/white-papers/a-renaissance-for-cardiometabolic-innovation

- https://www.iqvia.com/blogs/2023/07/rewriting-the-code-gene-editing-therapeutics