NCVR: What's the true price of negotiation?

A country’s ability to open trials quickly is a key consideration for commercial sponsors planning programmes of research globally. In recent years, particularly post-pandemic, UK study set-up times have been perceived as being less competitive than our European counterparts.

Conversely, this October marked the start of stage two of the UK’s National Contract Value Review (NCVR), a system-wide process change to expedite the study set-up process. Entering this second stage puts the UK firmly in the vanguard as the first nation to mandate a standardised, national approach to both study costing and contracting for commercial contract research.

This latest step change follows NCVR stage one, which demonstrated that UK study set-up times have already been cut by a third, on average. During stage one - 12 months from October 2022 to September 2023 - price negotiations with individual NHS organisations were still possible. Stage 2, which commenced in October 2023, brings an end to all local negotiations and is set to further improve set-up timelines and predictability of trial pricing across the UK.

This is excellent news for commercial sponsors considering the UK for their next trial. However, it’s not just about speed, predictability, and efficiency. It’s also about faster and more equitable access to cutting-edge treatments for patients.

Evolution, not revolution

To understand why, rewind 30 years.

A commercial sponsor setting up a multisite trial negotiates with each individual NHS organisation separately. Firstly, on the resources required to fulfil the protocol; how many nurse hours, clinician hours, blood tests, syringes, dressings - right down to the refreshments for participants (hold that thought). Then, secondly, on the price per item for ‘all of the above’ to ensure 100% full cost recovery for the NHS, a publicly funded healthcare system. This resulted in considerable variation in resource allocation and pricing across different sites. Next, each NHS organisation - operating as a separate legal entity - brings their own version of a Clinical Trial Contract to the table, as did each commercial company.

This provides the basis for the complex tug of war of costing and contracting negotiations which follows. The contract variations and lack of transparency driving the impetus to negotiate. Budget discussions had been known to spiral into miniscule detail, such as debating who pays for the participant’s toast after a fasting for a blood sample (yes, as real life example). Multiply that by 10 sites… you get the picture.

All this fuels a sense of ‘winning’ at the cost of the bigger goal - getting trials open to participants.

Fast-forward to 2008 when two tools are available in the UK; a costing template (since 2008) and model contracts (since 2001) for different types of trials. Both are optional and can be modified. Sites and companies using them generally agreed that they provided a better starting point for cost and contract negotiations, frequently shortening the overall process. Yet, significant variation could still occur.

Now, fast-forward to October 2023. For every commercial clinical trial, a single study resource review takes place between the commercial sponsor and one NHS organisation. Once agreed, the resource review is cascaded to all participating NHS organisations, where their localised price list is applied. This is a pre-defined UK wide methodology that ensures full cost recovery accounting for aspects such as geographical variation or outsourcing. These tools are interdependent - the output from this national costing tool is inserted directly into an unmodifiable standard contract. In summary, our NHS is locking the door to local negotiation.

Supporting the speed and spread of research

This creates a transparent, fair system for research to be carried out across the UK. In this new world, bartering about tea bags suddenly has ethical implications because, in essence, negotiation outside of the system can only slow down access to cutting edge treatments for patients.

For those sponsors fully embracing NCVR, factors such as price and contract terms negotiation cease to influence site selection decisions. Conversations about disease prevalence and clinical need begin to carry more weight. Consequently, NCVR is making the NHS an even playing field that supports, not only the speed of research, but also the spread of research. Sites that may not have been on a sponsor's radar previously now enjoy better visibility.

By enabling better distribution of research across the UK, does NCVR have the potential to better support the commercial sponsors' endeavours to make their research more inclusive? Could NCVR become a mechanism for reaching communities that are currently under-served by research? Ongoing work to incorporate equity of access elements, such as population diversity and coastal rurality factors, into the NCVR processes and tools suggests this is the case. It’s food for thought and one to watch.

One thing is for certain, when fully adhered to, NCVR is a win-win-win situation for patients, commercial sponsors, and NHS organisations alike. Admittedly, there have been a few teething problems, but no more than expected when pioneering a progressive approach to costing and contracting on this scale.

Country-specific costing and contracting

The UK’s position as a pathfinder in this space may be countered. This is understandable as comparable approaches in other countries have, in some respects, been ahead of the UK at times. However, at time of writing, the UK is the first nation to mandate a system-wide process for both costing and contracting together at a study level.

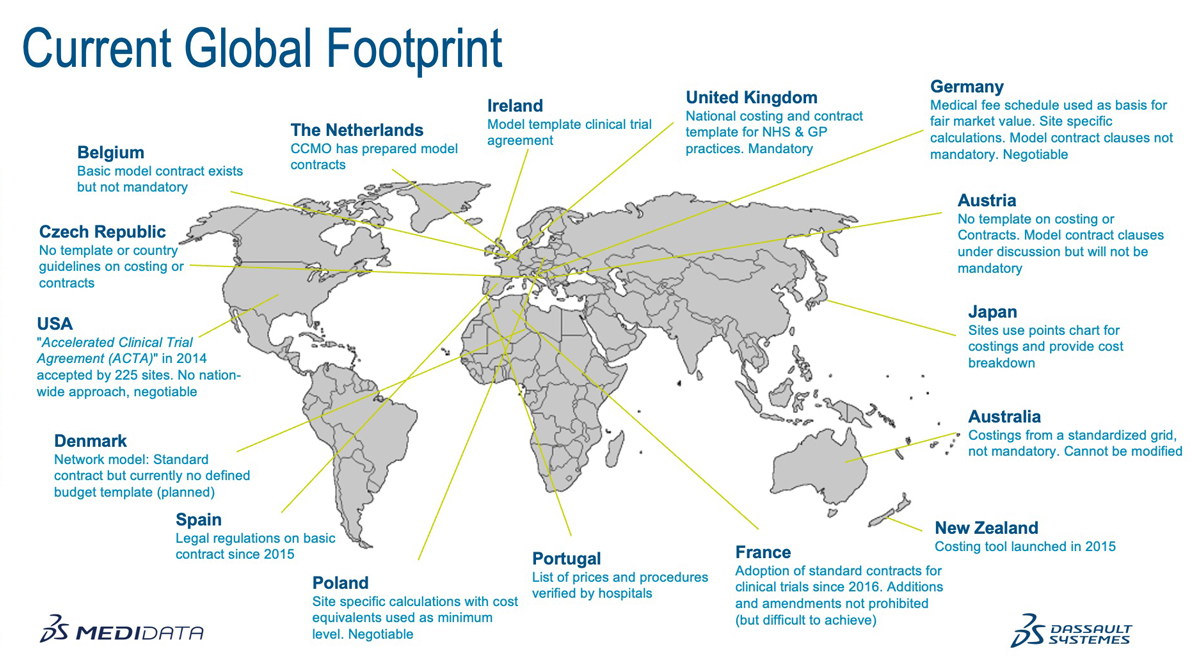

Medidata's Clinical Trial Financial Management recently encapsulated this in its Current Global Footprint diagram, describing where similar approaches have evolved and confirms that the UK is currently ahead of the curve.

Take Spain and France, for example, as highlighted in ABPI’s state of the nation report last autumn. Spain initially introduced regulation on their nationwide model contract in 2015, followed by France in 2016, more recently moving to a legal position prohibiting all negotiation or alterations. The same analysis by Medidata reported that Denmark, the Netherlands, Ireland, and Belgium have all introduced optional standardised contracts. In the USA, the Accelerated Clinical Trial Agreement (ACTA) has been accepted by 225 sites since 2014, but it remains negotiable and is not a nationwide approach.

On the costing side, Portugal and Japan have locked down prices and processes. Australia and New Zealand have frameworks for generating costs that are not mandatory. Poland allows site-specific calculations with minimum cost equivalents that are, again, negotiable.

The UK’s early work on costing methodology was sought out by other countries. First produced as an Excel sheet back in 2008, early iterations were shared with colleagues in New South Wales, Sweden, and Ireland, to name a few. Evidence of the Canadian Institutes of Health Research (CIHR) citing the UK’s model contract accomplishments can still be viewed in a publication from 2011, stating that, “international peers such as the United Kingdom have been using template agreements for the past decade,” which refers to 2001, when model contracts were introduced.

Germany is our closest comparator country, with recommendations in place for both costing and contracting. In Deutschland, a schedule of costs exists to help achieve fair market value and enables site specific calculations that are negotiable, and the model contract clauses provide guidance for the purpose of negotiation. However, neither the costing nor contract recommendation have been mandated country-wide.

Global costing conversations

While interesting, country comparisons on costing and contracting cannot tell the whole story, as this is just one part of the study set-up process. Where a country’s regulator cannot mandate costs or contracts, they may opt to mandate timeframes instead. In summary, it’s a mixed bag and there are undoubtedly lessons to be learned from other countries.

Medidata is enabling that global conversation via a new Global Costing Task Force. The first meeting took place in October, bringing people together from across the globe to exchange knowledge and experience of costing models and processes. The overarching goal is to help speed up access to cutting edge treatments for patients in a way that is both ethical and equitable.

If anyone needed a catalyst for action, the title of the ABPI report (previously mentioned) spells it out: rescuing patient access to industry clinical trials in the UK. The report claimed that the UK was losing ground against our European counterparts and becoming a less attractive prospect to commercial sponsors. A lower share of global clinical trials means less opportunities for patients to access breakthrough, and potentially life-saving, treatments.

NVCR demonstrates that the UK is upping its game. We are answering the call to action. In the UK, we are fortunate to have a unique National Health Service which, despite being a collection of separate legal entities, has an embedded research infrastructure that enables collaborative working as one organisation for the benefit of patients. But if the conversation about country-wide approaches to costing and contracting is going global, what does that mean for the life sciences industry?

Paradigm shift

System wide changes like NCVR require all stakeholders to engage with the process to deliver the desired results. NHS England has mandated NCVR for NHS organisations to unlock the benefits, but the life sciences industry needs to work with this approach to realise them. Continuing to negotiate beyond the national study level risks undermining the whole process, undermining the UK’s ability to attract global clinical trials, and undermining patient access to new treatments.

For some sponsor organisations, adherence will require culture, skillset, and process changes. Global corporations will need to adapt to optimise the continually evolving country-specific approaches to costing and contracting because negotiation in the context of a costing conversation for a clinical trial now has a different meaning. In the UK, the entire concept of the interactive Costing Tool (iCT) is to provide predictable and transparent price calculations for protocol delivery in one tool, supporting accurate budget generation from the outset. That works both ways; the price is the price. If speed is high on your company’s wishlist - why slow down to negotiate? The true price of negotiation is paid by the patients.

This is a collective call to action. We all have a role to play.

About the author

Laura Bousfield

Laura Bousfield

NIHR head of feasibility and start-up

Laura brings her extensive knowledge and experience of NCVR and other tools and services that have been designed to support better distribution of new research opportunities across the UK, while optimising study set-up and performance.

About NIHR

![]()

The National Institute for Health Research (NIHR) is the nation’s largest funder of health and care research. The NIHR:

- Funds, supports and delivers high quality research that benefits the NHS, public health and social care

- Engages and involves patients, carers and the public in order to improve the reach, quality and impact of research

- Attracts, trains and supports the best researchers to tackle the complex health and care challenges of the future

- Invests in world-class infrastructure and a skilled delivery workforce to translate discoveries into improved treatments and services

- Partners with other public funders, charities and industry to maximise the value of research to patients and the economy

The NIHR was established in 2006 to improve the health and wealth of the nation through research and is funded by the Department of Health and Social Care. In addition to its national role, the NIHR supports applied health research for the direct and primary benefit of people in low- and middle-income countries, using UK aid from the UK Government.