‘Predatory’ drugmakers exploit FDA’s unapproved drug scheme; study

An FDA mechanism designed to curb unapproved uses of medicines could be encouraging pharma companies to implement massive price rises for old medicines, says a new report.

An analysis of 23 drugs that have gone through the Unapproved Drugs Initiative (UDI) – which requires their manufacturers to seek approval or remove them from the market – suggests that their manufacturers are cashing in after approval with “significant price increases.”

Just four drugs that have gone through the UDI have seen price hikes of 525% to 1,644%, and have already resulted in $2.66 billion in extra healthcare spending in the US, according to the study by Vizient. That figure could swell to more than $20 billion in future, it estimates.

Vizient’s Dan Kistner says that while the UDI has been implemented with the best of intentions – making sure that drugs used for unapproved indications are in fact safe and effective – the behaviour of some pharma manufacturers is undermining the scheme.

“Depending on the approval, manufacturers receive periods of exclusivity ranging from three to seven years. If a patent is awarded, the manufacturer could have market exclusivity for 20 years,” he notes.

One drug highlighted in the report, vasopressin, has been on the market since 1928 but is now patented until 2035 by Par Sterile Products after it claims FDA approval in 2015.

The wholesale acquisition cost (WAC) has since leaped 1,487%, says Vizient, and the estimated cost to the US healthcare system has rocketed from $30.8 million a year to $510 million last year.

The three other drugs – anaesthetic reversal agent neostigmine, methylsulfate, selenium for nutritional deficiency, and dehydrated alcohol for intractable nerve pain – have also seen big WAC increases that have in each case added hundreds of millions of dollars to healthcare spending, claims Vizient.

“If the other 19 drugs follow similar approval paths, and manufacturers take similar price increases, the additional cost could reach $8.75 billion over five years. The combined impact of the higher costs for these 23 drugs could be $29 billion,” continues Kistner.

Vizient hopes that by exposing the activity to public scrutiny, drug manufacturers will “reconsider these predatory pricing strategies,” which are also making supply vulnerable to disruption.

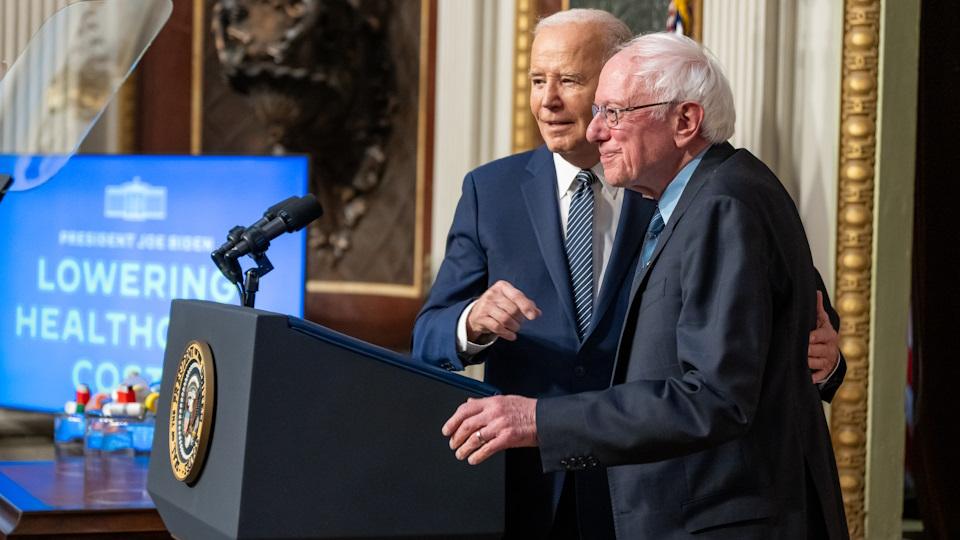

The data will add further fuel to the long-running debate on medicine pricing in the US, which is likely to gather momentum in this election year as both Republicans and Democrats have the issue in their sights.

Both parties have put forward proposals to cut spending on medicines, and there have been some bipartisan initiatives aimed at capping out-of-pocket spending by consumers and seeking rebates from manufacturers if drug prices rise above the background rate of inflation.