Spin-out biotechs: bridging the gap between academia and pharma

Dr Rich Ferrie

UMIP

Dr Rich Ferrie, Director of IP Commercialisation at UMIP, The University of Manchester’s agent for intellectual property commercialisation, looks at the issues in bridging the gap between academia and pharma.

The Big Pharma R&,D model is broken, and increasingly, the large monoliths are laying off research staff and looking to externalise this activity. Open innovation is in vogue, and Universities, spin-out companies and biotechs all feature in the drug discovery and development ecosystem. So, what are the critical success factors for forming viable University spin-out companies in this space and what more can be done to embrace innovative University technologies?

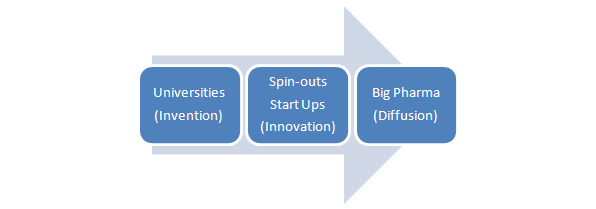

Figure 1: Schumpeterian trilogy applied to the pharma ecosystem.

,

The start point for most University spin-outs is an enthusiastic academic team and some interesting science, usually resulting from curiosity-led research. In biotech, this might be identifying a new pathway involved in disease, a novel technology platform from which new drugs may arise or, increasingly, possibilities for re-purposing existing therapies. Whilst enthusiasm and passion are vital ingredients in sustaining any new venture, more often than not it’s accompanied by commercial naivety – so it’s essential to validate the trajectory of proposed development activities rigorously. Even at this stage, dialogue with industry can confirm the value proposition and inform the development plan, and an awareness of downstream regulatory issues is essential, if unnecessary experimental iterations are to be avoided.

But let’s not spin-out too soon – a poorly financed spin-out, overburdened with a flabby patent portfolio it can ill afford to prosecute, does nobody any favours – so careful consideration of the timing of patent filings and spinning out is essential. Indeed it makes sense to tap into as much non-dilutable grant funding as possible before company formation, so incubation of the technology in the University setting is vital to build a critical mass of supportive data. Many Universities, including our own, now operate “Proof-of-Principle” funding streams and, when used in conjunction with translational grant funding, allow such projects to exemplify IP, add significant value and achieve escape velocity.

,

"But let’s not spin-out too soon – a poorly financed spin-out, overburdened with a flabby patent portfolio it can ill afford to prosecute, does nobody any favours..."

,

In parallel with this activity, it’s time to start the courtship dance and find seasoned business management for the new venture. It’s vital to get this right, and careful thought is required to define the core competencies required, even at this early stage. Of course, there is currently no shortage of résumés from ex-pharma personnel, but this isn’t necessarily the right answer now. Here, a proven ability to conceive and execute a credible plan to build shareholder value from the base technology will be essential. Those individuals who have “been there and got the T-shirt” are all too rare in the UK, but there is no substitute for experience, and having someone like this lead fund raising can be a critical success factor.

Lean-burn business plans are fashionable, and investors will want to see their money used to good advantage. Tough decisions need to be made as to which aspects of development will be retained “in house”, and which should be out-sourced or partnered. The resource necessary to manage external development relationships is often woefully underestimated, and care should be taken to choose partners carefully and balance issues of geographical proximity and cost.

It’s at this time, that academics need to decide to what extent they are prepared to commit to the new venture. Will they “jump ship” and become CSO of the venture, will they retain their academic post and be involved in the spin-out in an advisory role, or will some kind of secondment or sabbatical arrangement be possible? For all options, clear demarcation of the founding academics University research and his / her company science is essential, if downstream issues of IP ownership are to be avoided. Locating the company in a biotech incubator helps manage these issues and gives the fledgling business a feeling of independence.

Financing spin-out biotechs has been a real challenge over recent years, and whilst VC investors have focused on later stage “de-risked” propositions, there are now all too few specialist private VC funds able and willing to fund the early stages. In the UK, it’s pleasing to see new funding initiatives such as the MRC / TSB Biomedical Catalyst and the Syncona Fund (Wellcome Trust) begin to operate. Big Pharma corporate venture funds may operate in “strategic” or “arm’s length” modes and can be an attractive source of finance which can prime for a trade sale exit.

,

"The resource necessary to manage external development relationships is often woefully underestimated..."

,

Beyond this, Business Angel consortia need to be brave to operate in this sector where specialist knowledge is vital, capital to market very significant, and attrition rates high. Recently, there has been much interest in “crowd-funding” models, such as Kickstarter, and whether this model has a role to play in financing biotech spin-outs, only time will tell.

And so to the end game, partnering with pharma with a view to securing a trade sale and investor exit. It’s never too early to be thinking about this and constant news flow and company “propaganda” are key. An active presence at partnering events and conferences are key, and the importance of scientist-to-scientist dialogue with pharma, and securing creative development partnerships and collaborations, cannot be overstated. It will be interesting to see how initiatives such as the Stevenage Bioscience Catalyst on the GSK site facilitate these kinds of interactions and provide a symbiotic environment for this type of approach.

The UK still has many of the ingredients for success in spinning out biotechs. As long as its academic research base continues to secure significant governmental funding, opportunities to create new medicines, position for improved patient outcomes and secure positive economic benefits will continue to arise.

About the author:

Dr Rich Ferrie is the Director of IP Commercialisation - Head of UMIP.

Contact details:

T: +44 (0) 161 606 7216

Follow us on Twitter @UMIPnews

UMIP is a division of The University of Manchester IP Limited: www.umi3.com

Will spin-out biotechs bridge the gap between pharma and academia?