Solving pharma’s supply chain issues in sub-Saharan Africa

As IMS Health launches a new white paper exploring supply chain issues relating to medicines in sub-Saharan Africa (SSA), lead author Daniel Rosen explains how more efficient private sector distribution models are needed to reduce the cost of medicines to the patient.

As growth opportunities continue to move away from the traditional pharmaceutical markets, most multinational drugmakers have Africa in the sights of their expanding global footprint. In particular the private market and the continent's growing middle classes, where the incidence of chronic disease is growing sharply, is where much of this attention is likely to be focused. Africa is a continent ripe with potential, but the challenges for developing a viable market strategy are formidable, with distribution being consistently one of the largest challenges for drugmakers. Inefficient or expensive distribution increases the final price to patient, reducing volume sales and hurting family finances in the largely out-of-pocket private market for medicines. That said, the problems in African distribution also provide an opportunity for those willing to take on this challenge.

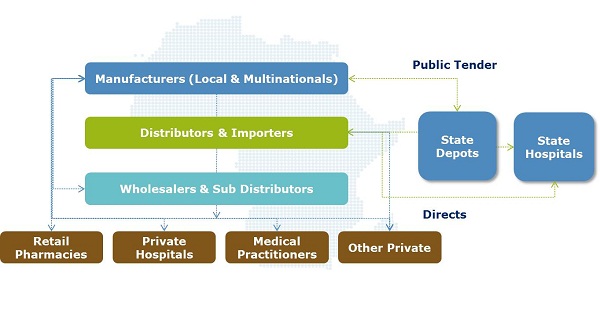

The pharmaceutical supply chain is often a 'hidden' element within healthcare systems – the elaborate pathway between a medicine leaving the manufacturer and being dispensed to the patient. Regulated importers, wholesalers and retailers sit in the middle, playing a vital role in ensuring constant supply of high quality medicines to the medical front line (see figure 1).

But in SSA a unique pharmaceutical industry supply chain landscape has developed, which sees the region having some of the highest branded drug prices in the world, despite also demonstrating some of the lowest average incomes for its population.1,2 Data from the World Health Organization (WHO) and Health Action international (HAI) shows that the out-of-pocket consumer prices for a basket of 50 medicines in essential therapy areas were 20.9 times higher than the International Reference Price (IRP) for original brands in SSA, around double the prices of brands in all other low income emerging market regions with the exception of Latin America.

This is not because pharmaceutical manufacturers are making more money off their medicines, but instead the complexity of the supply chain adds incrementally to the cost of medicines such that typically the price of a medicine triples between the manufacturer and the patient.3 New solutions are essential if multinationals are to flourish in Africa.

Exclusive private distributors dominate a fragmented supply chain

Historically, the delivery of free, or at least subsidized, essential medicines in Africa driven by the pandemic crises around HIV/AIDS, tuberculosis and malaria meant that the non-governmental organizations and donors developed their own distribution networks or tapped into public ones.

As a consequence, smaller local private distributors tended to focus on the lower-volume, higher-priced branded medicines, leading to fragmented and inefficient distribution system, driven by two major factors:

1. Lack of consolidation: Efficient distribution favours consolidation to achieve economies of scale but not so much as to prevent competition. In Africa, consolidation has been stifled by the inability of private distributors to access the higher-volume sections of the market, and by a long history of exclusivity agreements between pharmaceutical companies and distributors that has made direct competition in distribution not impossible, but more difficult. This in turn has disincentivised investment in modernisation.

2. Lack of innovation: There is competition in distribution in Africa, especially in generics, and manufacturers can change distribution partner in a market provided they have control of their own product dossier. However, multinational companies haven't reviewed supplier relations regularly enough, and they haven't reviewed their distribution models as Africa has grow from a small side business to a strategically important destination. This has allowed some to become complacent. The use of geographic exclusivity worked well when Africa was a low interest destination for selling pharmaceuticals. The model was low risk and provided a steady revenue stream, but equally in didn't incentivise innovation and entrepreneurship and encourage the use of sub-distributors which has driven up the price to patient and kept distribution fragmented.

Figure 1: An overview of pharmaceutical supply chain stakeholders in SSA

Figure 1: An overview of pharmaceutical supply chain stakeholders in SSAIn addition to a high level of import reliance and as a result of factors outlined above, downstream supply chain stakeholders such as importers, wholesalers, sub-wholesalers and retailers each typically add a minimum of 25% of the manufacturer sale price (MSP).

Patients feel the impact of high-priced medicines

By the time a medicine reaches the patient its MSP has typically trebled, if not more so. When placed in the context of African private healthcare schemes being few and far between, and a general consumer mindset that more expensive, branded medicines are of higher quality, the resultant situation for patients is less than optimal.

There are, of course, regional variations in the above picture, with French West Africa called out for having better distribution structure in place than much of the rest of the continent. However, the underlying theme is one of patients paying the price for overly high distribution costs, which can only be tackled by introducing new distribution models that are more efficient.

In 2007, the Medicines for Malaria Venture looked into the cost of anti-malarial treatments in Uganda, followed up by a study by the Affordable Medicines Facility – malaria (AMFm) in 2012. What they found was that single source importers were adding up to 70% to the landed price.4,5 With extensive trading commonplace between wholesalers and retailers, the former group was found to typically add up to a 30% mark-up, with the final retailer mark-up often in the region of 120%-200%. For private clinics this figure was even higher – a 900% mark-up in some cases!

"For private clinics this figure was even higher – 900% mark-up in some cases!"

Perhaps unsurprisingly, one conclusion from this study was the need to better understand retailers and what motivates them to stock and sell a particular product. What it also tells you is that while there may not be enough consolidation at the importation and wholesale level, there are also not enough private clinics to compete on price. In effect there are often too many distributors and not enough retailers.

What can the pharmaceutical industry do?

Within the confines of this summary article, it is impossible to explore the solutions in great detail, but seven distinct distribution models can be explored to address this issue, which are covered in more detail in the forthcoming white paper:

• Single agent distribution: As outlined above, this is the model employed by most pharmaceutical companies across sub-Saharan Africa at this time. It typically includes more middle-men and associated margins, but is lower risk, easier to implement and can be effective when seeking to reduce retailer mark-ups.

• Multi-agent distribution: Licensing multiple importers / wholesalers can eliminate middle-men and increase visibility, but reduced volumes per partner can also increase shipping costs and be create unhealthy competition dynamics.

• Post-import / pre-wholesale: Using a single importer and multiple wholesalers (as adopted by Merck) seeks to combine the best elements of single and multi-agent distribution, but can have limited control of retail price and storing products in market comes with risks from foreign currency fluctuation and theft.

• Pre-import / Pre-wholesale: This model, commonly employed in the Francophone and Lusophone countries, removes exclusivity agreements between pharmaceutical manufacturers and importers, allowing stock aggregation offshore before importing with benefits such as high restocking rates and reduced risks around theft / expiry.

• Direct to retailer distribution: For specialist products delivered to a smaller number of treatment centres, this model can be efficient for pharmaceutical companies, but requires more resource on the ground and potentially complex credit agreements, as per those provided by wholesalers.

• Direct to patient distribution: As above, but potentially more complex still resource wise, although mobile technology could play a part in the development of this model of delivery direct to patients.

• Public / NGO / donor piggy back model: Although pharmaceutical manufacturers can have limited influence on these models, they are established and the benefits and pitfalls well documented, so do hold merit where partnerships can be implemented in a hands-off manner.

"This model can be efficient for pharmaceutical companies, but requires more resource on the ground"

Ultimately, there is no one-size-fits-all model and the best one can only be determined by careful analysis of the supply chain volumes and margins at each point. What the most effective models have in common is that they lower the cost of credit for their partners, and typically involve greater risk. Even within a single product / therapeutic area, different regions may benefit from alternative models and existing relationships have to be accounted for in any change of direction.

With Africa projected to have a market value of over $31bn by 2017 and increasing demand from patients for more accessibly-priced medicines, the opportunity for pharma in Africa is significant and new supply chain models worth exploring.

Hear more on the webinar "Supply Chain Optimisation for Africa's Branded Pharmaceuticals: Reducing Price to Patient" on Tue 14th May.

References:

1. Preker, Alexander S.; Kassak, Kassem; Amponsah, Kofi; Dussault, Gilles. 2005. Capacity Building in the HNP Sector : Implementing the Strategic Options for Better Health in Africa. World Bank, Washington, DC. © World Bank. https://openknowledge.worldbank.org/handle/10986/13642 License: CC BY 3.0 Unported.

2. Cameron A, Ewen M, Auton M, Abegunde D. The world medicines situation 2011. Medicine prices, availability and affordability.

3. Yadav P. Differential pricing for pharmaceuticals. UK Department for International Development. 2010.

4. Coghlan R, Auton M, Maija A, Reza J, Banerji J, others. Supply chain and price components of antimalarial medicines: Uganda 2007.

5. Davis B, Ladner J, Sams K, Tekinturhan E, de Korte D, Saba J. Artemisinin-based combination therapy availability and use in the private sector of five AMFm phase 1 countries. Malaria journal. 2013;12(1):135.

About the author:

Daniel Rosen works as a consultant in IMS Health's Thought Leadership team, supporting the creation of market leading perspectives on a wide range of industry relevant issues. Prior to joining IMS Health he was head of BMI's pharmaceuticals coverage on the Middle East and Africa. He has previously authored two papers on the pharmaceutical environment of Sub-Saharan Africa "Africa: A ripe opportunity" (IMS Health) and "The Opportunities in African Healthcare: What China's Entry Means For Multinationals" (BMI).

For more information about IMS Health please visit:

Have your say: What are the right supply chain solutions for pharma in Africa?