Should pharma companies outsource clinical trials?

Jeremy Spivey

Cutting Edge Information

Throughout our clinical trials month, many different experts within this field have been sharing their opinions. Today we hear from Jeremy Spivey about clinical trial outsourcing, and whether pharma companies should be looking to this as a way of saving time, effort and money.

A recent news story suggested that unnecessary clinical trials procedures cost the pharmaceutical industry around US $5 billion a year. One way of cutting down on unnecessary procedures is clinical trial outsourcing, as, if planned and chosen correctly, it can save a company time, effort and money.

We speak with Senior Research Analyst, Jeremy Spivey, on his opinions regarding the advantages and challenges to clinical trial outsourcing, looking at who the best person within a company is to decide which activities are outsourced, global differences in clinical trials and how to overcome any unexpected problems, for example, within patient recruitment.

HB: Hi Jeremy, thanks for speaking to me. So why should pharmaceutical companies outsource clinical trials?

JS: Companies should absolutely consider outsourcing components of a trial that lie outside of its area of expertise. Companies that are initiating clinical trials in markets in which they’ve never worked before, for instance, would do well to have a vendor on the ground coordinating activities in those markets. If a company is just getting active in a new therapeutic area, vendors are also likely to have strong relationships with physicians that can provide trial sites.

,

"Even when a company has an established in-house team, however, it may make sense to outsource some activities."

,

Even when a company has an established in-house team, however, it may make sense to outsource some activities. If the clinical team encounters an increased workload that is only short-term, it might not make sense to hire new staff for those positions. In these cases, CROs, which are often used to preparing quickly for new time-sensitive projects, are probably the best route for companies to get things done quickly and correctly.

HB: Who, within a company, is involved in determining which activities are outsourced?

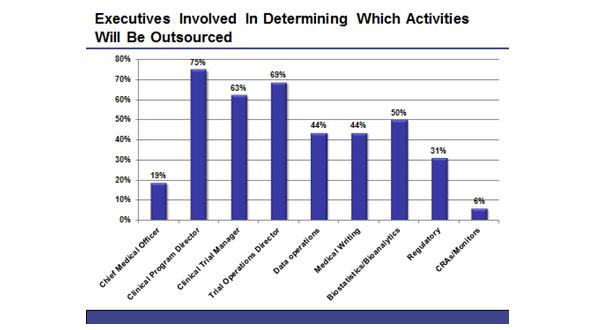

JS: The three functions, which are involved at a majority of companies, are the clinical program director, the clinical trial manager and the trial operations director (a list of executives involved is provided below, in figure 1). In most cases, these decisions are not handled by C-Level staff, but are delegated to high-level clinical executives. In nearly half of companies, however, the directors of individual trial functions will also have some input into what activities are outsourced.

Figure 1: The employees involved in determining which clinical trials activities will be outsourced within a company.

HB: What are some of the key challenges in clinical outsourcing and how do you overcome them?

JS: Three major challenges in clinical outsourcing are contracting delays, comparing vendors and aligning interests.

1. Contracting delays: some companies contracting for the first time are surprised at how long it can take to handle contracting. It takes companies around three months to move from the RFP process to project kickoff (Phase 1 is generally shorter than this, while Phase 3 is sometimes longer).

Companies can sidestep some of the wait by using a preferred vendor system: vendors which have been pre-approved for partnerships have master agreements already in place. In these cases, evaluating the partner’s capabilities has already been done ahead of time, and many elements of the contract negotiation have been handled in the master agreement, which can save several weeks of time.

Preferred vendors do have other advantages: since they work with the company on multiple projects, they don’t require time to adapt to the systems and procedures used by the contracting companies. There’s also more business on the line than a single trial, which can cause them to be more invested in the trial’s administration than they might otherwise be.

On the other hand, some companies don’t use preferred vendors because of the drawbacks. Vendors can sometimes become complacent, as they’ve been pre-approved and face limited competition. A requirement to use preferred vendors also drastically reduces the number of CROs that can perform the tasks. Oftentimes, niche providers that could do the job very well aren’t on the preferred vendor list because they’re too small to be approved for multiple projects ahead of time.

2. Comparing Vendors: because vendors often report many tasks differently when providing a final quote, it’s very difficult to compare vendors on the prices being attributed to individual activities. At one company covered in the report, rather than allowing the vendor to define what tasks an individual performs, they define the position and the set of tasks performed by a person in that position and then ask for a cost per hour for that position. In this way, costs per unit hour can be equitably compared across all proposals.

,

,

"Smaller pharmaceutical companies recommend working with several niche providers…"

,

,

3. Aligning Interests: when smaller companies outsource clinical trials, they sometimes find that they take a back seat when the CRO signs a larger client. When CROs over-allot their resources, they tend to give preference to the accounts they can least afford to lose. Smaller pharmaceutical companies recommend working with several niche providers to avoid this, because the business means more to these smaller companies and they’re less likely to risk losing it. According to one executive we talked to, the added headache of managing multiple vendors is outweighed by the fact that these smaller vendors are highly invested in the work and therefore make sure the work gets done, and done correctly.

HB: What are the most important factors to consider when outsourcing clinical trials from emerging markets?

JS: Clinical development (outsourced or otherwise) in the emerging markets presents a wide range of challenges. A few challenges include:

• Fears of intellectual-property theft lead companies to produce their products outside of the country, which causes problems getting the product into the country in some cases.

• Cultural misunderstandings can cause confusion in trials. For instance, in Brazil, scheduling appointments during the Roman Catholic holy days is not wise. In India, companies should not use porcine products. Patients are sometimes reluctant to indicate that a therapy isn’t working in some Asian countries, because it may be seen as disrespectful.

• Data standards are a concern. While facilities and practitioners are very good in the most developed areas, more rural areas can have subpar facilities.

A strong CRO can help companies navigate their way through these challenges. If a company has no experience in a geographic region, it will take some time after the establishment of a local office for the company to become acclimated to operating in that country. Until that is the case, companies should at least rely on local expertise through consulting contracts to help navigate their way through the clinical process.

HB: How does patient recruitment fit into outsourcing strategy?

JS: We’ve heard from many executives over the years on the challenges of patient recruitment. Depending on the disease or illness being treated, patient recruitment can be the single most difficult element of a clinical trial. Trials have faced multi-year delays because patient recruitment yielded fewer patients than were necessary.

,

"...companies should at least rely on local expertise through consulting contracts to help navigate their way through the clinical process."

,

The best CROs have relationships with the top physicians in a therapeutic area. These physicians are very used to running clinical trials, and have patients which are interested in participating in trials of cutting-edge therapies. The largest CROs have international lists, and can recruit patients in the countries where they are most easily available. Unexpected delays in clinical trial regulatory approval and patient recruitment are two of the most-unexpected major problems encountered by pharmaceutical companies.

HB: What are your main principles for success within clinical trial outsourcing?

JS: Focus on the endpoints and the deadlines. Most of the people we talked to indicated that price is by far a secondary consideration – shaving a few percentage points off the cost of the trial process is in no way worth delays in product approval that can result from trial mishaps. Competing products are coming to market while your product is delayed, and the patent life of your product in many countries is also fading away during these delays. When communicating with partners, emphasize the importance of clean data that has the ability to prove endpoints being delivered within the specified timelines.

Ensure that your vendors are capable and committed. A poor vendor selection will likely lead to months or years of frustration, disagreements and possible legal entanglement as you try to extricate yourself from the relationship.

Consider the full picture when outsourcing to emerging markets. Clinical trials in the emerging markets offer many willing patients with strong patterns of adherence to treatment. They also offer reduced costs, with many tasks costing only a fraction as much as they would in the United States. They aren’t a panacea, however. Trial sites are often acceptable, but cannot be assumed to have top-quality equipment and administration, and questionable data can jeopardize the entire trial. Dialects are a major concern when it comes to providing patient instruction: there are 22 official languages in India, for instance. Finally, many countries are suspicious of their patients being submitted to questionable, unapproved therapies, and the clinical trial approval process risks getting sidetracked by regulatory scrutiny.

HB: Thanks for sharing your thoughts, Jeremy.

About the author:

Jeremy Spivey is a Senior Research Analyst at Cutting Edge Information in Durham, NC. In addition to his work on clinical reports, Jeremy leads the company’s efforts on pharmaceutical lifecycle management and market research groups. He can be reached at jeremy_spivey@cuttingedgeinfo.com

How can pharma best outsource clinical trials?