Patient-centric Pharma: Brave new world or same old empty promises? Part two

Hedley Rees continues his exploration of the concept of 'patient-centric pharma' and discusses some prevailing industry assumptions that have driven some unhelpful behaviours in the industry.

(Continued from "Patient-centric Pharma: Brave new world or same old empty promises?")

Yep - still the same old empty promises...!

Part one concluded that present moves towards patient-centricity are, indeed, empty promises. The emerging contention was that so long as the 'find it, file it, flog it' culture remains deeply encoded into the industry psyche, patients will always take a back seat; and not just patients – many of the stakeholders in the industry will find themselves sidelined too. The basic assumptions1,2 associated with the 20th century paradigm are now diametrically opposed to the needs of an industry facing massive change in its external environment. Hardly a day goes by without industry pundits regurgitating permutations of a growing list of pressures – patent cliff, generic competition, government cost containment, stratified and personalised medicine, regulatory hurdles, value based pricing – the list goes on... and unless these assumptions change, the industry won't be able to react effectively to the pressures.

So let's take a stab at unearthing those underlying assumptions that have driven unhelpful behaviours in the industry, with a view to find what is holding things back.

The prevailing industry assumptions

Below is a brief list of the assumptions that appear, at least to the author, to prevail:

• The starting point for new products is scientific discovery. This involves a relentless search by talented scientists, leaving no stone unturned in seeking out molecules that have the potential to cure unmet medical needs (ie blockbusters).

• These molecules must be patented to keep possible competition at bay.

• Once patented, the clock is ticking so press on as quickly as possible into the clinic – little time to spend checking the molecule for suitability to meet the rigours of market supply.

• The vast majority are going to fail, so keep investment to a minimum until late stage clinical trials.

• Regulators hold the golden key of approval – keep them happy but only tell them what they ask for.

• Once a drug is approved, mega high prices are necessary because drug development is astronomically expensive.

Are these assumptions still valid?

For those who believe these assumptions do not generally prevail, or who believe these are broadly correct but are perfectly valid for the 21st century, read no further – it is likely the mind-set gap to be bridged is too great. For those remaining, maybe we should explore why the assertion that these assumptions are no longer valid.

"So let's take a stab at unearthing those underlying assumptions that have driven unhelpful behaviours in the industry..."

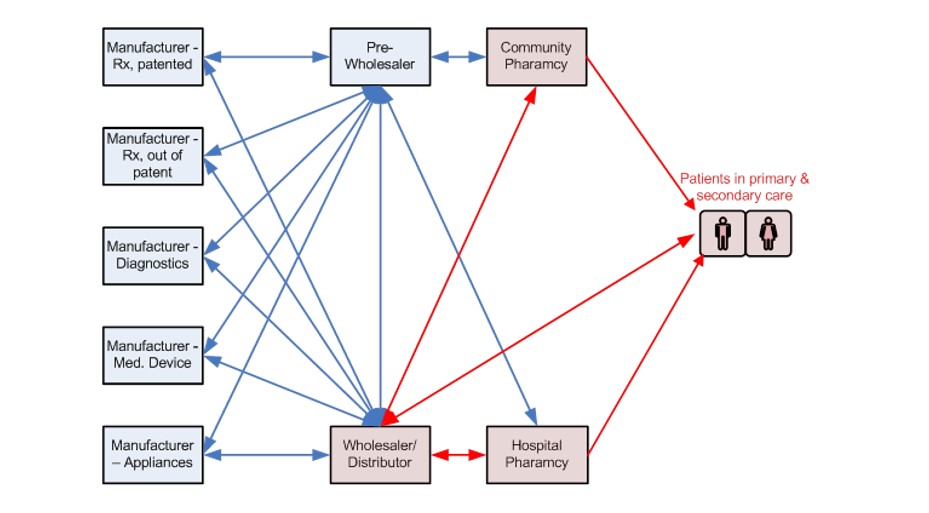

Firstly, the low-hanging fruit for discovery is all but picked; clinical trial results are increasing highlighting significant cohorts of patients not responding to drugs under development; biologics and advanced therapy medicinal products (ATMPs) of gene / cell therapy and tissue engineering are moving on afoot. These are all potentially patient specific, and require close coordination of sampling, testing, diagnosis, treatment and aftercare. The one-size-fits-all approach of the 20th century will not cope. Anyone in need of convincing should refer to Figure 1, which shows the present route of products to market, from manufacturer to patient bedside. You will see a plethora of manufacturers of Rx, generics, diagnostics, medical devices and appliances all completely dis-connected; they in turn are divorced from patients at the interface with wholesalers, distributors and pharmacies. What chance is there for this hands-off arrangement to support 21st century therapies?

Figure 1: The Route from Manufacturer to Market – Direct Patient Contact is with 3rd Parties (in red)

This has occurred because of the intense focus on molecules and science has led the industry to disown the real world of making and supplying products to customer markets. This industry has succeeded in defying gravity to date, but no company survives in the long term without building a base of customers and repeatedly satisfying their needs. This begs the question of whether the current trend of 'outsourcing' discovery research to more nimble biotechs is another attempt to defy gravity that is likely to fail.

"There was a time when testing in humans was the only way to get a measure of the potential for a drug."

Next, we look at the patented molecule on route to regulatory approval. There was a time when testing in humans was the only way to get a measure of the potential for a drug. These days, the technology has moved on exponentially to much better predict possible outcomes ahead of human administration – yet the paradigm doesn't allow the necessary investment of time or resource at that critical early stage; and the lack of investment doesn't just impact proper screening of molecules, it also results in supply chains that are complex and heavily outsourced, difficult to control in terms of quality, cost and lead-time. Pharma supply chains have never been under such attack from governments, regulators and other key stakeholders – and it's getting worse not better3.

Speaking of regulators, what of the relationship of the industry with Pharma? Historically, the industry has been hanging on to mum's apron strings for grim death. What mum says, goes. This was necessary in the early days, as the path to maturity has to take its course, but it shows little sign of changing. This is a crucial issue, as only those developing, making and selling drugs have the power to change matters, and they must ultimately take ownership of patient safety and wellbeing. There are signs the dialogue is improving; we can only hope it continues.

Finally, there's the astronomically high price of drugs due to all that investment that went in to development. Again, that is another false assumption, in that the vast majority of the company's investment went into failed compounds – 95% plus of the investment in drug development lay on the cutting room floor.

Given the above, it should be possible for stakeholders to assess 'brave new world' claims, such as patient-centricity, at a much deeper level. Are the drug developers spending time with patients, or is it just the marketing and PR folk? Are manufacturers actively talking with wholesalers, distributors and pharmacies to bridge the gap with their customers? Is discovery research held responsible for predicable failures that happen once compounds have left their hands? Readers can make up their own list of questions.

"Pharma supply chains have never been under such attack from governments, regulators and other key stakeholders – and it's getting worse not better."

What would it take to enter a brave new world?

In Part one, I mentioned the fact that regulators had been pressing for over 10 years for pharma to adopt modern manufacturing practices, with little or no response. Similarly, they have been pushing for reductions in attrition rates, with little or no effect – in fact Tufts has reported it is actually getting worse4. Their plea has been to develop and make products and services in the way exemplar sectors do. To date this has all fallen on deaf ears.

If, per chance one day, the penny drops and the ears prick up, we may find some new enlightened assumptions taking hold, such as:

• Pharma is in the business of designing, making and selling products to paying customers that are central to their core mission in life.

• The starting point for new products is patients and healthcare practitioners in the primary and secondary care setting, with specific medical needs, often complex.

• The end-user value proposition must be fully understood and is the primary driver of the end-to-end supply (or value) chain, with all stages of manufacture and supply being aligned to deliver on that proposition.

• Failure to get a drug to market is bad, not the unavoidable cost of doing business. Everything should be done to prove a molecule's viability before being tested in animals and humans.

• The key to regulatory approval is not with the regulator, it's with the companies developing drugs, taking the lead on patient wellbeing.

• Markets should be properly segmented, based on a deep understanding of patient needs and outcomes.

The last point strikes at the heart of the issue, and is reinforced with great effect by world renowned marketing guru Professor Malcolm McDonald, former professor of marketing and deputy director at the Cranfield School of Management5: "...apropos of the pharmaceutical industry, there is clearly no such person as a "doctor" or an "administrator." There are certainly no such faceless, average persons as "patients," all to be treated in exactly the same way. Doctors, nurses, and other professional staff recognize this intuitively and treat them as individuals. Surely it is not beyond the wit of this sector to institutionalize this process through effective segmentation. At a stroke, there would be a massive improvement on the part of the public in how they think about this much-criticized (unjustly) sector. All the segmentation work that has been done in this sector proves beyond doubt that just as in any other business, correct market definition and needs-based segmentation are the keys to long-term success and customer–patient satisfaction."

Wise words indeed, Malcolm, Pharma take heed!

Returning to the Metaphor

To finish off, let's return to the metaphor in part one of a family falling on hard times, having to take up gardening in order to put food on the table. Little Johnny, from the previously well-to-do family, found roles reversed as he was now envious of his friend and school mate, Jimmy, who had been helping in the garden all his life. His family had learned over the years to sustain themselves with the only true guaranteed source of food – grown in their own garden.

Such is the challenge now for Pharma. Deciding what are the most nutritious foods to grow? What type of soil is required? Which are the best seeds to use? What to grow in a green-house for replanting and what can go straight outdoors.......etc, etc.

The good news is Pharma's rubbing shoulders with the plants in the garden. The more worrying news is the massive mind-set change required for any family to undo the habits of a lifetime (shopping in the supermarket) and begin a life learning the art and science of gardening.......

In Part 3, we will look at the barriers to be surmounted before meaningful change can start to take effect, and the implications for the industry.

References

1. For more on cultural assumptions: see Schein, Edgar, 'Organisational Culture and Leadership' 3rd Edition, Jossey-Bass

2. For a synopsis of Schein's work on the topic: see Rees, Hedley, 'Supply Chain Management in the Drug Industry: Delivering Patient Value for Pharmaceuticals and Biologics' Wiley 2011 pp 276 - 278

3. Rees, Hedley, "Regaining supply-chain control: Is Pharma missing the target" GMP Review, January 2013

4. Dr Joseph DiMasi, Director of Economic Analysis, Tufts Center for the Study of Drug Development, Tufts University, keynote address, Pharma Integrates 2012, London, 28/11/12

5. For Professor McDonald's full exposition on market segmentation in Pharma, see: Rees, Hedley, 'Supply Chain Management in the Drug Industry: Delivering Patient Value for Pharmaceuticals and Biologics' Wiley 2011 pp 133 - 141

The next article in this series 'Patient-centric Pharma: Brave new world or same old empty promises? Part three' can be viewed here

About the author:

Hedley Rees is author of "Supply Chain Management in the Drug Industry: Delivering Patient Value for Pharmaceuticals and Biologics" (J. Wiley 2011) and is a practising consultant, coach and trainer. He helps healthcare companies build, manage and continuously improve their clinical trial and commercial supply chains and risk profiles.

Hedley Rees is the Managing Consultant at PharmaFlow Limited, a UK based consultancy specializing in supply chain management within the pharmaceutical and life sciences sector. Clients range from large pharmaceutical companies to emerging biotech, and also include investors, lawyers, other consultancies, facility design & build specialists and third party logistics providers (3PLs). Assignments span early stage clinical trial supply chains up to complex multi-product supply networks covering global territories. Prior to this, Hedley held senior positions at Bayer UK, British Biotech, Vernalis, Ortho-Clinical Diagnostics and OSI Pharmaceuticals. His skill set covers the range of competencies from strategic procurement, production and inventory control, distribution logistics, information systems and improvement. His specific interest is in driving industry improvements through the regulatory modernization frameworks of FDAs 21st Century Modernization and ICH Q8 – Q11. His early career was spent as an industrial engineer in the automotive, consumer durables and FMCG sectors.

Hedley holds an Executive MBA from Cranfield University School of Management and is a corporate member of the Chartered Institute of Purchasing and Supply (MCIPS) ), an advisory board member of the international institute for advanced purchasing & supply (IIAPS) and a former member of the UK BioIndustry Association's (BIA) Manufacturing Advisory Committee. He is an advisor to a number of UK Government initiatives driving improvements into the Pharma supply chain and is co-chair of the highly regarded FDA/Xavier University sponsored PharmaLink Conference held in Cincinnati annually. He is also widely published in US and EU pharmaceutical journals.

Closing thought: Are the prevailing industry assumptions still valid?