Mobile health is app-le of pharma’s eye

In our mHealth focus month, Nicole May takes a look at the expanding mobile health market in the US and the opportunities in this area for pharma, such as smartphone apps and gamification.

The number of mobile health initiatives, like all things mobile, is on the rise. Last month, Pew Research Center published findings about smartphone use in the US. According to the study, 56% of American adults own a smartphone.1 Pew also found in 2012 that a third of cell phone owners have used their phone to look for health information, while almost 20% have at least one downloaded health app.2 In terms of potential for revenue, European trade association GSMA predicts the mHealth market will generate global revenues of about $23 billion by 2017 with the US market benefiting from revenues of $5.9 billion.3 These data point to significant smartphone and health application use, as well as a likely increase in the future should trends continue. The mobile market is growing rapidly, and the mobile health market in particular is exploding relatively unregulated. Nicknamed the "Wild West," this sector has caught the eye of mobile device and app developers and prompted numerous investments and startups.

Pharma specifically is looking to leverage mobile health opportunities. Drug manufacturers are quickly staking out their space on smartphones and tablets, barely having conquered social media platforms. Mobile health apps tailored to a specific drug or therapeutic area offer potential benefits to all players — patient, physician, pharma and even payer. The key is to pinpoint and develop the perfect mHealth pathway to engage the target audience.

Selecting a target audience: patient or physician?

Pharma's two main targets in its mHealth sphere of influence are patients and physicians. Companies have also found success in implementing internally facing initiatives, but these two groups hold the most potential for maximizing the benefits of mHealth. Health apps and mobile-oriented technologies offer a way to engage the patient directly — as companies have found with social media — and serve as effective marketing platforms as well as channels for education, awareness and adherence. A pharma-physician relationship via mobile health pathways is also very beneficial. Physicians in particular have expressed a desire to become more mobile, especially with the industry's growing emphasis on electronic health records. Data from the Manhattan Institute show tablet adoption among physicians has risen to 72%, up from an already high 62% last year — and pharma is taking note.4

Aligning the platform

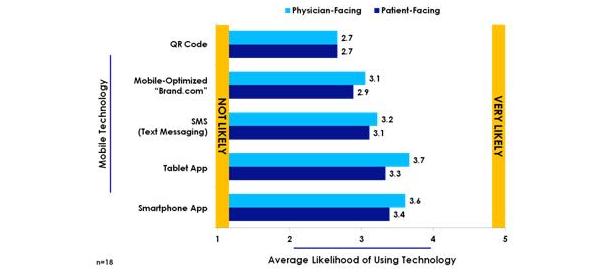

Once a company has pinpointed the audience of its mobile health initiative, the next step is deciding which platform best suits that audience. Research suggests that tablet and smartphone applications are the most common choices among companies looking to enter the mHealth market. Other mobile platforms, such as SMS texting, mobile-optimized "brand.com" and QR codes were also part of many companies' mHealth approaches.

In a recent survey, results found that pharma companies are most likely to invest in patient-facing smartphone apps and physician-facing tablet apps within the next five years (Figure 1). Close behind are SMS texting programs targeting both audiences. QR codes are lower on the priority list of mobile health channels, but many companies are in early stages of initiative development.

Pharma companies are focusing on the most effective pathways in which the app connects with the audience. The report finds patients interact best with applications and texting services on their personal smartphones, whereas physicians prefer tablet-based exchanges. The mobile-optimized website, smartphone app and texting programs are particularly well-suited to patients. Patients are accessing mobile health apps differently than physicians, and smartphone use is much more widespread than tablet use among the general population. Patients and smartphone users overall are looking for a mobile resource accessible via the small screen of their smartphones. Mobile apps and text messaging involve repeated updates and data entries, reminders, on-the-go drug queries, even emergency medical questions. Mobile initiatives targeting patients must be suited to their technology and demands; thus smartphone-specific technology is the winner.

Physicians, while still mobile, are willing to sacrifice a fraction of a device's portability for enhanced usability. Many physicians are likely to use mobile devices to enter data during a patient visit, for which the larger tablet screens are much better suited. Physicians also report using mobile devices for training modules or as a medical reference, uses which are much more accessible on a tablet screen. Pharma is investing more heavily in tablet applications when building mobile initiatives for physicians.

Targeting patients

Aligning the mHealth activity with the audience and application platform is also essential to building a successful mobile initiative. Tablet and smartphone apps are at the center of the mHealth upswing, as they offer pharma countless and still unseen opportunities to interact with both patients and physicians. The likelihood of adopting these technologies also underlines the emphasis of development of these platforms. Let's ignore the QR codes, mobile-optimized sites and even texting campaigns for a second to focus on these currently more worthwhile mHealth channels.

If the popularity of Candy Crush is any indication, gamification is an effective strategy for engaging smartphone app users. Games and similar rewards-based incentives can be applied to both health- and non-health related apps. A health app may use gamification as literally as Bristol-Myers Squibb's GoalPost Avenue app or indirectly through a tracking app that rewards daily updates. In any case, gamification entices the user and keeps him returning, providing a foundation for the true value and utility of the app. Though perceptions in pharma remain mixed concerning gamification, research has found that pairing an educational or adherence-promoting app with a gamification element may improve patient and physician engagement.

Apps promoting drug adherence are beneficial to both the user and, in a broader sense, the entire healthcare system. Increased app use encouraging a timely dosing schedule saves the patient and payer money with improved health outcomes. A smartphone app, often accessible at arm's reach at any point in the day, serves as an efficient reminder to patients struggling with drug adherence. Coupled with a gamification strategy, an app promoting adherence is particularly effective. One example is Roche's Accu-Chek 360 Diabetes Management app, which allows the user to enter health data to track his disease and communicate results to his doctor. Merck's My Health Matters app allows a patient to track HIV symptoms, set reminders to take medication and communicate results with a healthcare team. Apps paired with a specific drug or device are particularly effective at promoting patient adherence. Sanofi's Auvi-Q app is designed to be paired with its Auvi-Q epinephrine injection device and allows the user to receive training to use the device, be alerted of product expiration, and track family member allergies.

Educational apps are also useful in promoting disease awareness and establishing a relationship with a current or potential customer. Again, an educational app paired with gamification is especially effective at encouraging app download and use. Bristol-Myers Squibb's GoalPost Avenue app harnesses gamification to teach the user about methods of prevention and early signs of melanoma. Astellas' Show Me OAB uses a 3D human model to enable the patient to learn about the overactive bladder disease state and improve communication between patient and doctor.

Targeting physicians

Mobile health resources for physicians are shifted more toward the reference end of the mHealth spectrum, as opposed to patient apps focused on tracking and reminding. These apps generally require less mobility, as they are often used in a healthcare setting, so the tablet platform makes more sense. Apps can be helpful in diagnosing patients. One example is Merck's CardioLinks tablet app, which allows the physician to enter health data and assess and manage patient cardiovascular risk at the point of care. Apps are also valuable as portable but vast medical references and drug- or therapeutic area-specific resources. The Lilly Oncology CT Resource serves as a reference for physicians looking for oncology clinical trials and even encourages communication between physicians.

Mobile health apps, à la social media, also enable a unique communication pathway between physician and drug manufacturer. Some companies include a way for physicians to contact the company directly within a medical literature app, to the benefit of both players. Pfizer Pro offers physicians the opportunity to request samples and a savings card through the app, as well as order patient literature and access clinical resources. The Amgen Medical Information app enables a physician to access scientific and clinical information. This app also allows physicians to an inquiry directly to Amgen MedInfo regarding an Amgen product and even schedule appointments with Amgen representatives.6

Maximize opportunities of mHealth

Success with mobile health technology will depend on effective alignment by pharma of the appropriate audience, platform and activity. Gamification may help encourage use, but an app must provide value to the user to achieve longevity. Apps mentioned here, along with many others available to mobile users, highlight promising possibilities of a pharma-sponsored mHealth strategy. With continued investment by pharma, these valuable mobile pathways will benefit patients, physicians, pharma and the healthcare system overall.

References

1. http://www.pewinternet.org/Reports/2013/Smartphone-Ownership-2013.aspx

2. http://pewinternet.org/~/media//Files/Reports/2012/PIP_MobileHealth2012_FINAL.pdf

3. http://www.emdt.co.uk/article/jvosinterview

4. http://mobihealthnews.com/21733/manhattan-72-percent-of-physicians-have-tablets/

5. http://www.cuttingedgeinfo.com/research/marketing/mobile-health/

6. All apps available through Google's Play store or Apple's iTunes store

About the author:

Nicole May is a Research Analyst at Cutting Edge Information, a life sciences benchmarking firm in sunny Durham, NC. She has conducted research across many topics of pharma and biotech including clinical development, portfolio management and market access. She also serves as Party Minister of CEI's Friday Lunch Club, exploring the food scene of what is arguably the South's Tastiest Town. Connect with Nicole on LinkedIn or contact her at Nicole_May@cuttingedgeinfo.com.

How can pharma create a successful mhealth strategy?