Medical devices: the future is emerging markets

Jim Furniss

GfK Bridgehead

Our article today continues this month’s emerging markets focus. Looking specifically at the healthcare industry, Jim Furniss discusses the increase in growth in emerging markets such as China and India. He provides his views on the potential for the medical device companies to work in these countries in order to grow their businesses.

The healthcare industry has recognised for a number of years that there is a great untapped potential in emerging markets. The device market in developed territories such as the US, Europe and Japan has reached saturation and the repercussion of economic recession has restricted growth in recent years. This, coupled with considerable growth in the medical device market in emerging countries, has made medical device companies look to these markets to grow their business. The global CAGR from 2009 to 2012 was expected to be at 5.8%1, whereas in China the compound annual growth rate of the market in the period 2002–2006 was 14.9%2.

These regions are important not only for the growth in sales related to increased adoption of medical devices owing to increased health awareness, but also as a desirable location to build capabilities. As a result there have been a number of acquisitions and partnerships, as an illustration of this, in May, Johnson &, Johnson (China) Investment Ltd announced the acquisition of Guangzhou Bioseal Biotech Company Ltd thus opening the way for Ethicon to immediately enter China.

,

"The healthcare industry has recognised for a number of years that there is a great untapped potential in emerging markets."

,

Increasing expenditures on healthcare in the developing markets, for example construction of hospitals and clinics, and establishment of public / private health insurance, are driving growth in these sectors. For instance the five year plan (2011–15) in China has allocated US$41 billion to develop and equip new hospitals and refurbish the grassroots health service system and in its latest five year plan (12th such plan), India has committed to increasing the government share of healthcare expenditure to 2.5% before the end of the plan in 20173 4. The trend for expenditure on health to increase, along with improvements to the regulatory and market access environment in many emerging markets has also made this an interesting opportunity for medical device companies.

Figure 1: Total health expenditure (THE) % Gross Domestic Product (GDP) for selected countries5

The medical device market is challenging but potentially significant in China

It is expected that the device market in China will reach sales of US$42.8 billion by 20196. Growth is fuelled by a favourable demographic – the aging population increases demand on the healthcare system – and economic environment, where growth continues to be steady with a GDP growth target of 7.5%.

New healthcare reform that began in 2009 and continued through 2011, led to major upgrades of the healthcare system, however, the market remains challenging as healthcare provision is very uneven across the country, favouring urban populations. Of the US$173 billion that was provided by the recent healthcare reform programme, more than US$10 billion was allocated solely for medical device and diagnostic purchases by hospitals and clinics.

Public healthcare remains the mainstay of healthcare provision, with the aim being for 100% government insurance by 2020, and despite personal wealth increasing, the level of private insurance remains very low7. It should also be noted that the Chinese market is characterized by a large number of domestic manufacturers that are able to dramatically undercut prices of foreign manufacturers and despite economic growth, price still remains a key factor especially in rural hospitals.

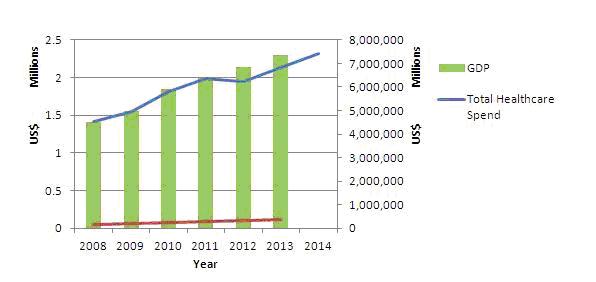

Figure 2: Healthcare spend and GDP in China8

The regulatory authority that oversees the medical devices in China is the State Food and Drug Administration (SFDA). The majority of the administrative powers of the SFDA are in practice delegated to its local branches. The food and drug administrations of the provinces, autonomous regions and municipalities directly under the central government (Local FDAs) are authorised to issue specific licences and product registration certificates to medical device companies.

,

"It is expected that the device market in China will reach sales of US$42.8 billion by 2019."

,

Medical devices are divided into three categories: Class I, II and III relating to their properties, uses and potential risk to the user. In broad terms Class I devices (those under routine administration for their safety and efficacy) are subject to record-filing procedures approved by an authorised Local FDA, Class II devices (those that must be controlled for their safety and efficacy, such as weak laser in-vitro treatment instruments) are registered at the provincial level FDA, and Class III devices (those implanted into the human body and which pose potential risk to human life) are subjected to a more stringent approach that includes going through a prior examination process and then approval from the central SFDA.

As many expected, the regulatory approval procedures for Class II and Class III medical devices are more onerous. In fact, new medical devices falling within Class II and III require clinical trials before the submission of a product registration to SFDA or Local FDAs. The results of the clinical trials must demonstrate the safety and efficacy of the medical device. An additional complication for medical device manufacturers is that different local FDAs may have their own specific examination and approval requirements that go beyond national requirements.

India has a growing medical device market

Increased health awareness, a growing middle class and government health initiatives have significantly grown the market in India. The medical device market is expected to reach US$10.7 billion by 20199. More than 60% of the population pays out-of-pocket for health expenses, however, most of the employed are covered for medical expenses by employer-sponsored health insurance. Additionally, unlike China, more and more people are subscribing to private health insurance outside employer schemes.

,

"Increased health awareness, a growing middle class and government health initiatives have significantly grown the market in India."

,

Through RSBY (the National Health Insurance Plan) the government has taken steps to collaborate with the private sector to offer quality services at a subsidised cost. This is considered the main avenue for increasing access to healthcare. This unique partnership framework between the government and public / private providers of healthcare has been remarkably successful in covering 56 million people.

For medical devices, the Indian government is currently working towards establishing a medical regulatory agency, in addition to new legislation around medical devices, in order to create a fair and legitimate marketplace. This has been a slow process, but the aim is to move towards a market authorisation process that is more transparent and straightforward and based on the European CE mark system.

In lifting their citizens out of poverty and providing better healthcare, China and India are inspiring success stories. However, this is a two-way street and within these markets local companies have been able to position themselves to play major roles in the global medical device market.

References

1. Frost &, Sullivan: APAC's Medical Devices Market ready to skyrocket. Date Published: 17 Jun 2010

2. The Chinese medical device market: Facts and figures. http://www.tmta.ca/attachments/Medical%20Devices%20in%20China.pdf

3. China’s 12th Five-Year Plan. www.uscc.gov/researchpapers/2011/12th-FiveYearPlan_062811.pdf

4. http://planningcommission.gov.in/aboutus/committee/index.php?about=12strindx.htm

5. WHO Data. http://apps.who.int/nha/database/DataExplorerRegime.aspx Accessed May 2012

6. PharmaLive: New Medical Device Review and Outlook 2011. Published March 2011

7. Estimates based on WHO – National Health Accounts

8. ChinaBio LLC. China Pharmaceutical Industry Report. Current Status and Future Growth. November 2010, http://export.business.vic.gov.au/__data/assets/pdf_file/0006/334662/China-Pharmaceutical-Industry-Report.pdf, Bridgehead internal estimates

9. PharmaLive: New Medical Device Review and Outlook 2011. Published March 2011

,

About the author:

Jim Furniss is SVP at Market Access GfK Bridgehead. The article was coordinated by Samantha Morrison, who is a consultant at Market Access, GfK Bridgehead.

GfK Bridgehead is a market access consultancy serving the pharma, medical device and diagnostics industries.

You can contact Jim at jim.furniss@gfk.com and Samantha at samantha.morrison@gfk.com

How can the medical device industry work better together with emerging markets?