J&J tops the pharma market cap charts – but for how long?

Data and analytics firm GlobalData has tracked the market cap and performance of the top 25 pharma companies for the first quarter of this year – and there are some notable changes compared with last year’s Q1, despite the largest companies retaining their places at the top of the pile. Piotr Wnuk reports.

With worldwide pharmaceutical sales at around $1 trillion in 2016, there is nevertheless an Amazon-shaped shadow looming over the industry.

The online retail giant has already changed the way people across the world do their shopping, and the company’s partnership with JP Morgan and Berkshire Hathaway could prove highly disruptive in the US, which is by far and away the largest healthcare market in the world.

While the sentiment is that so-called “middle-men” in the system such as pharmacy benefit managers will be most affected, Amazon’s disruptive influence could also impact on sales for pharma companies indirectly.

And if Amazon fails to make it then other tech firms such as Google are also looking for ways to make inroads into this highly lucrative, but inefficient market by changing the way hospitals and clinics acquire their medicines.

One major pharma CEO who has already addressed the Amazon threat is Alex Gorsky, who is at the helm of the undisputed leader in pharma and healthcare, Johnson & Johnson.

Gorsky has said on record that pharma should be acting as if Amazon is going to make a serious move, but for now J&J has retained its first position in the quarter despite losing over $44bn, as it acquired Swiss biotech Actelion.

While J&J might not be a full pharmaceutical player, still more than half of its revenue comes from medical device and consumer products sales.

There is also a clear strategy that Johnson & Johnson’s future will be powered by its pharmaceutical division. Just last year J&J's pharma sales grew by 17%, which is far faster than the 8% and 3% growth rates posted by its medical device and consumer products segments.

Investors can largely attribute the gains to the continued success of next-generation drugs. This includes the autoimmune-disease drug Stelara, the anticoagulant Xarelto, and the cancer drugs Imbruvica, Zytiga, and Darzalex.

Growth in these top-selling medicines is more than offsetting the declines in J&J's ageing inflammatory diseases blockbuster Remicade, which is off-patent in the US and EU and facing increased competition from biosimilars.

The company has several promising trials in place which will support the opportunity for the expansion and rapid growth of its current portfolio over time.

Combining this with the company's knack for making bolt-on acquisitions, improving margins, and buying back stock, Wall Street projects that overall profit growth will exceed 7% annually over the long term.

Pfizer remained in second position with $211bn followed by Roche, AbbVie, Merck & Co and Amgen.

But the ninth and tenth positions have changed, with Abbott and Bristol-Myers Squibb jumping up the charts compared with last year’s first quarter.

It’s several years since Abbott split from AbbVie, with the former specialising in devices and other healthcare projects, while AbbVie spun out to become a pure play pharma.

But Abbott’s portfolio of products is driving growth, with products such as FreeStyle Libre prick-free blood sugar monitor proving their worth on the market.

BMS has muddled through a difficult period when it saw several drugs lose patent protection. However, the massive success of two recently launched blockbuster drugs is compensating for these losses – such as the Eliquis anticoagulant is recovering lost warfarin market with total sales reaching $5 billion in 2017.

[caption id="attachment_44972" align="alignleft" width="206"] Click to see larger picture[/caption]

Click to see larger picture[/caption]

Cancer immunotherapy Opdivo is also set for success being approved on many markets as a treatment for 11 different types of cancer.

BMS also owns a number of other fast-growing drugs that are driving financial gains. These include the rheumatoid arthritis drug Orencia and the cancer drugs Sprycel, Yervoy, and Empliciti. Combined, these drugs contribute another $5 billion.

The success of BMS and Abbott saw Sanofi and Bayer slide down the GlobalData rankings.

Merck, Novo Nordisk, Celgene, Bayer, Biogen, Sanofi, Roche, Novartis, J&J and Eli Lilly lost over 10% of market value in Q1. Among the reasons Global Data analysts listed “the inability to strike major new deals, the poor performance of struggling divisions, revenue dependence on a small number of drugs in their portfolio, collapsed sales of top drugs and the loss of patent exclusivity”.

But there were also some success stories lower down the order - CSL’s market cap grew by around 10% based on strong results in 2017. Vertex sustained its impressive growth by gaining 22nd position at the end of Q1 driven by positive results from its clinical studies and a growing portfolio of cystic fibrosis drugs.

Geography

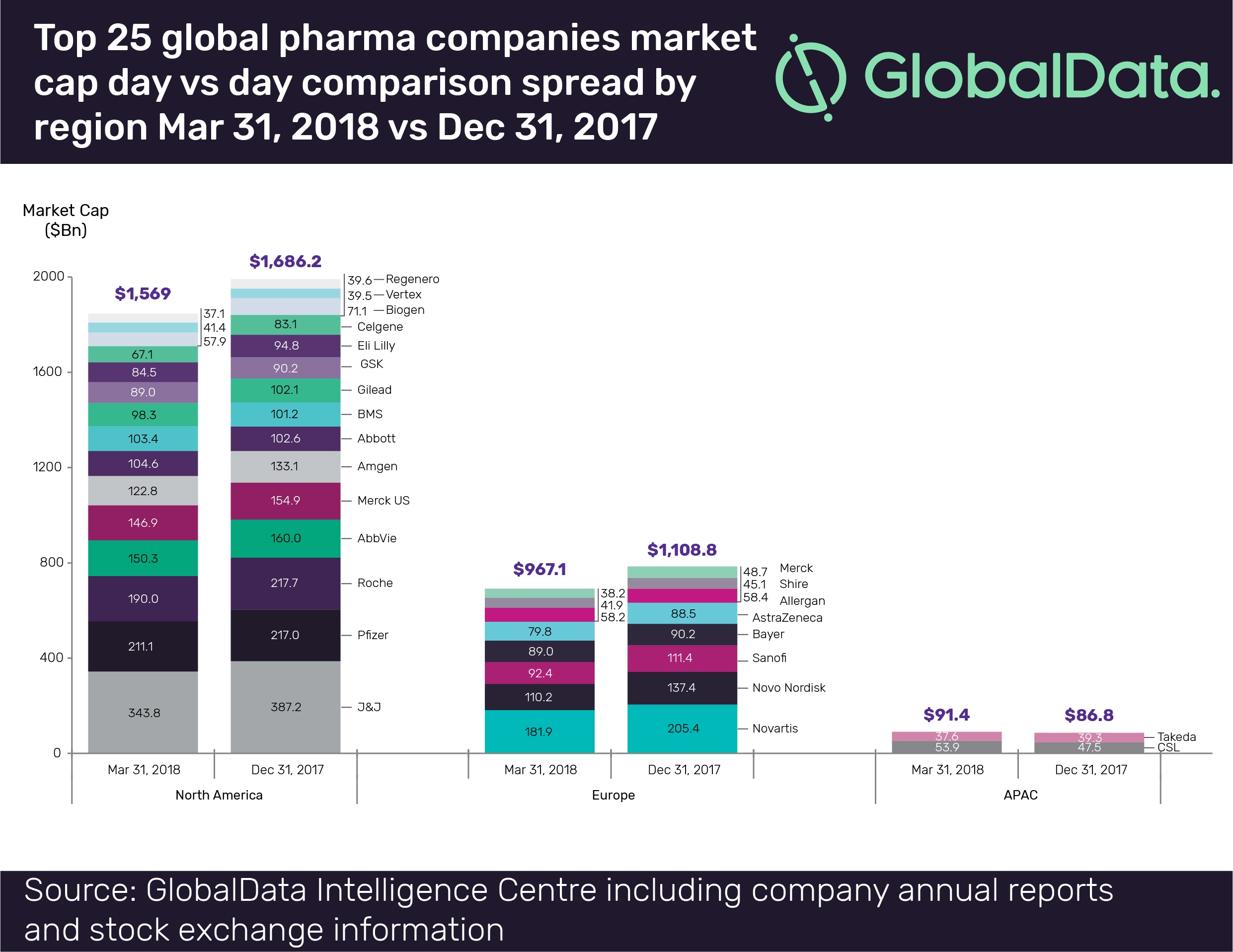

Looking at the same data from a geographical point of view, North American and European companies’ values fell by 6.9% and 12.8% respectively in the first four months of 2018. Analysts suggested this was down to uncertainty caused by Brexit and protectionist measures introduced by the Trump administration.

In North America, 10 pharmaceutical companies have shown decrease in their market cap for reasons including generic competition to key drugs following the loss of their patent exclusivity, and clinical trial failures

On the other side of the world, Asia Pacific headquartered companies Takeda and CSL managed to grow its market cap value in the first quarter.

The quarter witnessed a flurry of transactions and acquisitions, including Takeda’s proposed $64 billion acquisition of Shire, and GSK’s $13 billion agreement to buy Novartis’s stake in their consumer-health joint venture.

There was also Merck’s $4.2 billion intended divestiture of its over-the-counter unit to P&G; Sanofi’s planned divestiture of its European generic-drug business to Advent International Corp; Novartis’ $8.7 billion acquisition agreement with AveXis, Inc and Sanofi’s planned acquisition of Ablynx for €3.9 billion.

While markets are uncertain about what to expect from Amazon, the top 20 is likely to change again next year with Takeda’s merger with Shire. The merger of these two lower-order companies will create a company that will likely be in the top 15 – although this of course depends on how the increasingly likely merger proceeds.

And with doubts over the potential of many of Shire’s rare disease drugs, it remains to be seen whether the merged company will push forward up the charts or languish in the lower order in the coming years.

GlobalData’s Top 25:

| J&J | 343bn |

| Pfizer | 211bn |

| Roche | 190bn |

| Novartis | 182bn |

| AbbVie | 150bn |

| Merck & Co | 147bn |

| Amgen | 123bn |

| Novo Nordisk | 110bn |

| Abbott Laboratories | 105bn |

| Bristol-Myers Squibb | 103bn |

| Gilead | 98.3bn |

| Sanofi | 92.4bn |

| GlaxoSmithKline | 89bn |

| Bayer | 89bn |

| Eli Lilly | 84.5bn |

| AstraZeneca | 80bn |

| Celgene | 67.1bn |

| Allergan | 58.2bn |

| Biogen | 57.9bn |

| CSL | 53.9bn |

| Shire | 41.9bn |

| Vertex | 41.4bn |

| Merck KGaA | 38.2bn |

| Takeda | 37.6bn |

| Regeneron | 37.1bn |

Source: Top 25 GlobalPharmaceutical Companies analysis by Market Cap (for Q1 2018) report published by Global Data.