The future of diagnostics: personal genetic services

With genetic analysis and diagnostic tests now available to many via mail order, how will this trend towards the proactive consumer impact the evolution of health management? Craig Wylie investigates.

The introduction of relatively inexpensive biological assays, particularly around known genetic biomarkers and mutations, is creating a new diagnostics industry. Today, personal genetic services companies, such as 23andMe, can provide inexpensive genetic analyses directly to consumers to help them understand their risk of major genetic-based diseases. We are at the beginning of a new era in which assays and biomarkers are increasingly important in the treatment of cancers, degenerative diseases, and infectious diseases.

The birth of a new industry

New, innovative treatments are very expensive, and often specific to genotypes or markers. Examples include direct-acting antiviral therapies for the treatment of Hepatitis C, OPD1 inhibitors used to treat a variety of cancers, and chimeric antigen receptor T-cell therapy (CAR-T) for the treatment of certain childhood leukaemia and B-cell malignancies. People with these types of diseases, as well as those who want to understand and manage their personal risk of life-threatening diseases, have a better understanding of their own genetic risk profiles and are much more engaged with their treatment profiles than the general population. Today about 14% of the population has been identified as carrying a mutation or marker that puts them, or their children, at an increased risk of developing cancer, type-1 diabetes, cystic fibrosis, multiple sclerosis, arthritis, autism, Parkinson’s disease, or heart disease.

Simple, affordable tests gain FDA approval

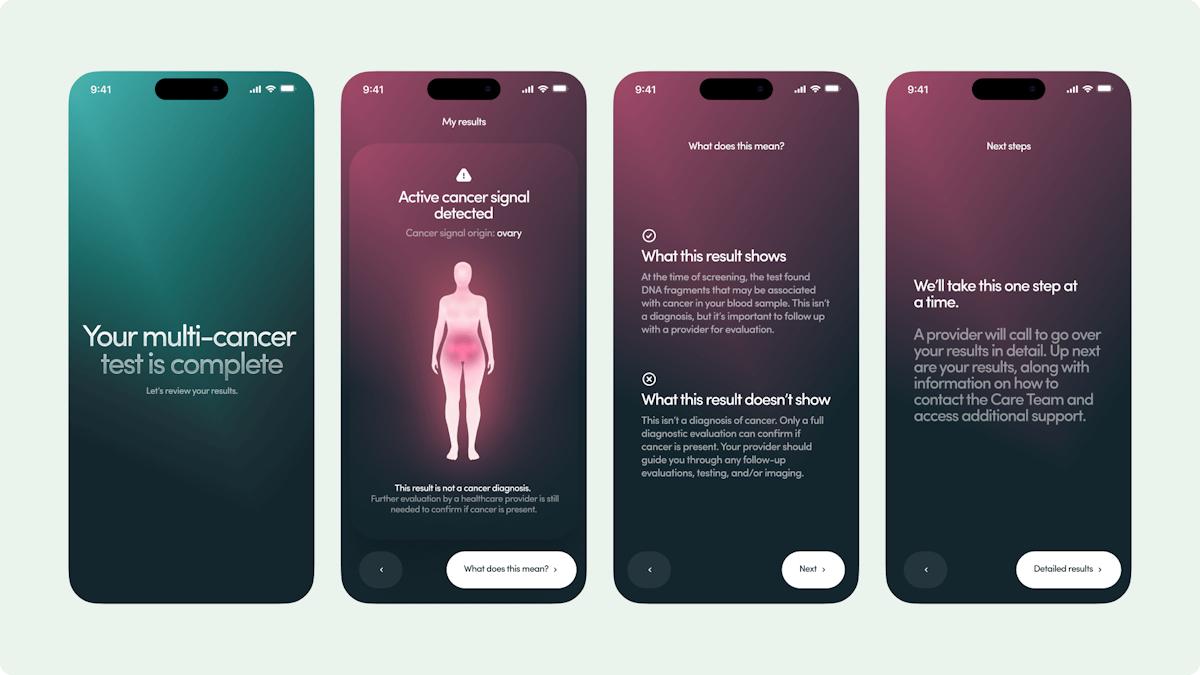

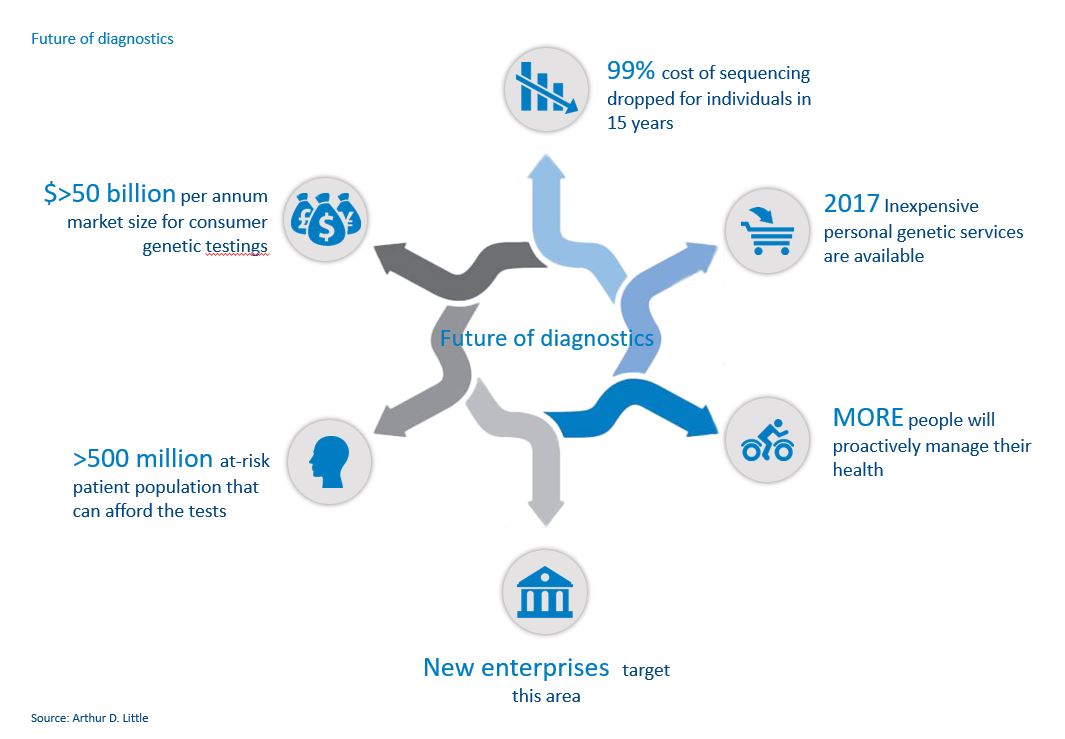

Previously, most genetic and diagnostic interactions involved visits to local clinics and laboratories. Today, simple tests – often available via mail order – are becoming more mainstream by providing services as diverse as identifying ethnic origins and determining the risk of hereditary diseases such as breast cancer. Genetic analysis has moved from the domain of the healthcare practitioner to that of the consumer, and new enterprises are already targeting this area, such as GRAIL and Elypta.

Early in 2017, the US FDA approved the direct marketing of 23andMe’s Genetic Health Risk tests to consumers for multiple diseases or conditions, thus setting the precedent and blueprint for other companies to navigate the FDA’s regulatory landscape. This provides opportunities for other companies to use the 'predicate device' pathway to reduce approval times for their own products and services.

However, the FDA is also starting to take a more active role to ensure that the claims of the sellers are accurate and verified, especially with tests sold as 'kits'. This increasing involvement is expected to instil more confidence into consumers and contribute to market growth, but there are still challenges outside the direct-to-consumer space. The FDA has issued guidance[1] that clarifies the regulatory pathway and, although now clear, it is not simple. For example, pharmaceutical manufacturers will need to register two licences in parallel: one for the diagnostic and another for the therapeutic product.

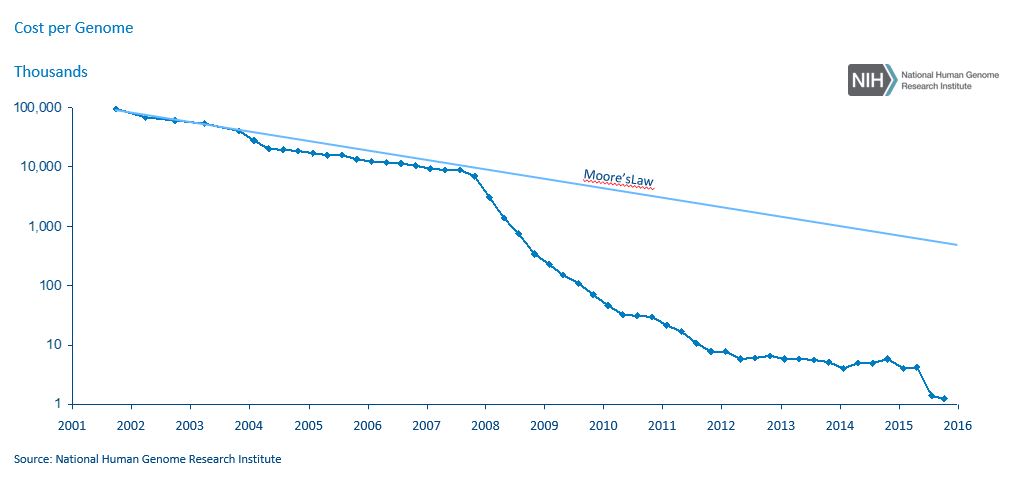

With the technological advancements led by these consumer-orientated companies, it is becoming less and less expensive for consumers to have genetic analyses. The cost of sequencing a genome has dropped 99% in 15 years, according to the National Institutes of Health. This is entirely in line with Moore’s Law and suggests further significant reductions are likely, with an assay that costs $100 in 2017 dropping to $1 in 2026. 23andMe now charges $99 for an ancestry test and $199 for a combined health and ancestry test, while Color Genomics charges $249 for its hereditary-cancer and high-cholesterol tests.

Because of these price reductions, some payers and healthcare providers have started referring patients to these consumer-orientated services, even though not all payers currently reimburse for them. This is a classic disruption model, and established vendors will need to navigate a market that is changing dramatically around them. For example, Quest Diagnostics has responded by launching a service that allows consumers to initiate certain medical tests without a physician’s order.

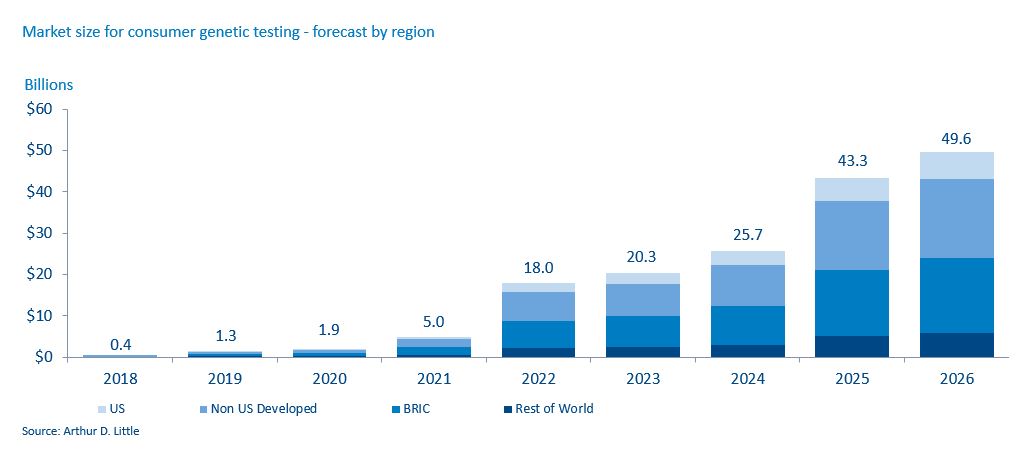

Development of the diagnostics market

Every part of the market will be affected by the increase in need for, and availability of, genetic testing. Manufacturers will have to develop diagnostics strategies, and consumers will progressively take ownership of their own genomes. For example, diagnostics companies sit in the space between pharmaceutical and medical-device organisations; much of their work is wet chemistry but, at the same time, their products are lab equipment, chemical assays and medical devices. They have an opportunity to set a strategy that embraces the consumer, not just the laboratory or healthcare provider.

It is likely that there will be continued introduction of new assays going beyond mutation-based biomarkers to actionable biomarkers for an increasing number of conditions, especially those associated with reproductive health, oncology, transplant medicine, and forensics. Also, a new, consumer-orientated industry will develop that will help individuals know and manage their risks. The patient population will increasingly look to proactively manage its risks, moving from one-off analysis to continual monitoring to manage their health and existing conditions.

Reference:

[1] FDA publication, Principles for Codevelopment of an In Vitro Companion Diagnostic Device with a Therapeutic Product, July 2016

About the author:

Craig Wylie is a Partner at Arthur D. Little, focused on the life sciences industry and specialising in operational improvement, plus transformational and innovative change of the regulated business functions in the pharmaceutical industry.