Early stage funding: how to improve odds of success

In this new serial of articles, Jean-Louis Roux Dit Buisson shares with us his experience in selecting projects for future investments and proposes solutions to improve odds of success in early stage funding.

The increasing number of young and bright people getting higher education, compounded by the fact that money available for investments grows proportionally to the development of the economy, and by a radical change in mentalities, especially in traditional Europe, have resulted in a number of new and potentially interesting projects looking for funding.

A great proportion is initially developed in Universities, until a prototype and / or a patent are constructed or issued. Then everybody wants to become an entrepreneur and make it big in the pharma industry.

Few realize that funding an early stage company with Venture Capital Funds requires the attention of talented young MBAs overwhelmed by the flux of funding dossiers.

So most entrepreneurs-to-be fail not because their idea or project is wrong, but because of a few attitudes that can be easily corrected with proper professional coaching:

1. Introversion

In my experience, as VP in charge of M&As and counsellor to VC funds, I have too many a time witnessed people whose essential motivation was to prove to their peers how good they were and how clever their technology. As Einstein said, "Human mind is keen on techniques and methods, but blind to aim and value".

A lot of reviewed projects pretend to be "disruptive" and then propose value drivers based on "costs", essentially. In our experience, this reflects that most teams have not done their job in understanding the equation between their invention, which is not yet an innovation, and the wild world into which it will have to fit.

As in high tech product sales, the technology and its features lead the way, while the markets, the customers and the perceived risks will open the door to board-room discussions.

2. Forgetting about the audience

Before knocking at the door of a VC and sending a 100-page document in small print, one ought to ask oneself: "What is it that this person wants to see in my project, today and for the future?"

"...in the initial phase of contact, 68% of respondents said that projects fail due to poor presentation of the unmet needs..."

I ran a survey amongst VCs, which I use in my teaching classes. It showed that in the initial phase of contact, 68% of respondents said that projects fail due to poor presentation of the unmet needs, and unsatisfying description of the opportunity.

What the same respondents want to see and be able to assess in the description of the opportunity are the unmet need (68% of rejections), the competitive advantage (57%) and the customer benefit (45%).

In other words, if you don't address the issues of customer benefit and product positioning early in the discussion process you have little chance to be heard or followed.

3. Forgetting about customers and whole product concept

In line with the previous statements, very few entrepreneurs-to-be project the use of their technology in its environment. This leads to wrong segment definition, ill-positioning and limitation to offering a device when the environment calls for a global solution, an approach that can be improved by applying the "whole product concept" methodology of thought and design.

4. Focusing on costs

Interestingly enough, the vast majority of high tech entrepreneurs tend to sell their project idea on the basis of a cost advantage, and most of the draft business models they propose detail how good they will be at lowering overall costs.

In our judgement, next to being close to science-fiction projections in most cases, these bright minds devaluate, erase and offset all other benefits linked to the thinking and the efforts that lead to a new and potentially innovative technology.

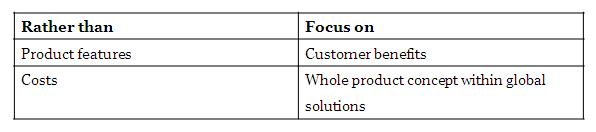

These deadly shortcomings can be easily overcome with professional assistance that will help the young entrepreneur to focus its attention and team efforts on customer benefits rather than on product features, and on global solutions rather than simple metrics like costs.

By using these guidelines, the initial communication tools such as a one-minute pitch and short presentation will be dramatically improved, raising the odds of being invited to a full 20-minute presentation, and successfully moving into the boardroom.

In my next article, I shall discuss how to improve value negotiation outcomes, which happens to be low in the initial priorities of VCs.

Part 2 of this article can be viewed here

About the author:

Jean-Louis Roux Dit Buisson is a Professor of Entrepreneurship at the Grenoble Management School in France. He is founder of Foro Ventures, a company dedicated to provide assistance and interim management for top-line growth projects and turn-arounds.

Jean-Louis is specialized in high technology sectors (such as Bio Pharma, Medtech). He has an MSc from MIT and an MBA from INSEAD and can be reached at jl@forotech.ch.

How can you improve the odds of success in early stage funding?