Can rare diseases be a viable option for the pharma industry?

In this article, Christopher Ehinger questions whether rare diseases are a viable option for the pharma industry. He looks at the total number of approvals and orphan drug designations in the US since the Orphan Drug Act of 1983 and the factors driving pharma to invest its research and development budgets into discovering orphan drugs.

Background

Rare diseases are a large, complex and heterogeneous group of conditions with a few common similarities affecting a small proportion of the people in a population. In Europe, a rare disease would be defined as a disease that affects 1 individual in 2,000, whereas in the USA, a disease affecting less than 200,000 individuals is considered a rare disease. There are 6,000 to 8,000 identified known rare diseases depending on the definition used, and fewer than 500 have treatments. The aetiology for these known rare diseases is linked to genetics in approximately 80% of the cases. Children make up 75% of all identified cases with 30% of those never reaching their fifth birthday1.

However, the term rare disease is a misnomer, since the conditions affect a collective total of 350 million patients worldwide, with 3.5 million in the UK. This equates to 1 in 17 people developing a rare disease at some point in their lives.1 This represents a huge untapped potential for pharma companies, an opportunity for growth, and a pathway to a solid and sustainable business model. Linked with the current stagnation in traditional pharmaceutical markets, companies are feeling the pressures to look beyond their current offerings and seek out new patient populations within a niche market area. Moving into rare diseases will provide an opportunity for big pharma to diversify and begin to move away from developing drugs for the mass market indications. These niche areas are highly sought after due to the potential for companies to gain the first mover advantage and the ability to establish themselves as the market leaders.

Case for investment

With only a limited number of the population affected by a rare disease, the justification for investing substantial funds for clinical studies by the pharmaceutical industry has always been a challenge and a real barrier to innovation. With the introduction of the Orphan Drug Act (ODA) for the USA in 1983, this has allowed a level of exclusivity in the terms of 7 years and tax incentives for the first products brought to market for a specific orphan indication. This has been the catalysts for recent R&D investment with the development of over 200 new products – a 20 fold increase from the period before the introduction of the act.

Total orphan designations and approvals – USA market2

EU has enacted similar legislation, Regulation (EC) No 141/2000, in which pharmaceuticals developed to treat rare diseases are referred to as "orphan medicinal products". Orphan drug status granted by the European Commission gives marketing exclusivity in the EU for 10 years after approval.

Market research with many of the industry leaders involved with the development of orphan drugs has indicated the main influential drivers to pursuing an orphan drug approval as3:

Figure 2: Factors driving orphan drug R&D

Of all the drivers mentioned, the market exclusivity, limiting the competition and approval of another version of the same orphan drug, is the most powerful incentive to drug developers4.

"...making orphan drugs available for treating rare diseases throws up a completely different set of challenges..."

A different perspective to commercialisation

Unlike other main stream pharmaceutical products that are developed to address larger disease populations with treatment expected in a primary or secondary care setting, making orphan drugs available for treating rare diseases throws up a completely different set of challenges that are not addressed in the current pharmaceutical development setup and distribution model. The necessary infrastructure, understanding of orphan drugs and skill set required for success are not currently well represented at most pharmaceutical companies.

Difficult to diagnose rare conditions

One of the fundamental challenges for any disease not seen regularly by clinicians, is patients not being diagnosed due to a limited awareness of what to look for with these more obscure diseases and their associated symptoms. In many cases, there is a lack of clear diagnostic guidelines and tests available for the majority of these rare diseases, making it difficult for clinicians to identify the potential patients and make a definitive diagnosis. Although some of these patients will have clearly defined symptoms, the majority will fit in a grey area where even specialist hospital consultants will struggle to identify these patients. In the example of Adenosine deaminase (ADA) deficiency, with an epidemiology of only 1 patient in 230,000 births for the UK market, many of the leading paediatric consultants may potentially see only one of these patients during their entire working career.5 This infrequent appearance of these diseases will mean that many of the patients will go undiagnosed and will miss out on potentially lifesaving treatment.

"...there is a lack of clear diagnostic guidelines and tests available for the majority of these rare diseases..."

To improve the diagnostic rate, a potential solution could be the addition of these rare diseases to a national screening panel for all newborns. The USA and some of the EU countries have started expanding their screening criteria to include some rare diseases that impact in the first few years of life. This could only be possible if an in-vitro marker exists for the disease, which would be highly unlikely for any condition that doesn't have a treatment currently in use.

Limited number of patients

The treatment for many of these rare diseases will occur in highly specialised tertiary care hospitals involving interactions with a limited number of renowned clinicians with expertise in the disease area. This will most likely force a re-alignment of any promotional efforts towards established patient advocacy groups for the disease. who will have a more intimate relationship with the patient, family and clinicians.

With such few patients being diagnosed with the rare disease each year, it will be difficult for pharmaceutical companies to get a handle on the expected number of patients that may require treatment in a specific country. A deviation of only 1 or 2 patients will have an acute impact on any clinical trial plans, commercial forecasts, health outcomes study or pricing strategy.

It will also be vital to develop a good epidemiology assessment for the disease which reflects clearly the potential eligible patient population defined by disease and co-morbid conditions within the market. This could be difficult over a 10-15 year time frame and a more longitudinal view over more years will be required. An example of this would be Gaucher's disease, which has 3 specific sub-types of patients requiring dynamic modeling of the data from patient registries over a 60 year time span, to yield some reliable patient numbers6.

Pricing and reimbursement

By addressing only a small group of patients, the price of treatment for many orphan drugs has been significant in offsetting the cost required to develop the drug. In an evolving price sensitive landscape within the healthcare industry towards controlling costs and value base assessments, these expectations are pushing against what is expected by the payors.

"It will also be vital to develop a good epidemiology assessment for the disease..."

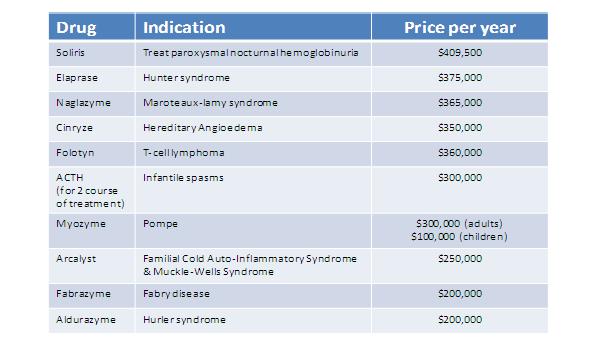

Most expensive treatments in the USA7

Figure 3: Chart showing the most expensive treatments in the United States

In an environment where a successful Health Technology Assessment (HTA), showing substantial benefit over the current standard of care, will become a requirement for any new drug approval post 2014, orphan drugs for rare diseases will find it almost impossible to compete. With limited outcomes data and a significant price point for treatment of a small cohort of patients, the results will never be favourable in this environment for the orphan drug treatment

Outlook

As opportunities continue to diminish in disease areas addressing the mass market of patients, the pharma industry will be encouraged to look at rare diseases as an opportunity to establish themselves in areas within healthcare with limited treatment options, and huge clinical unmet needs. With a significantly reduced investment profile for product development and marketing expenditure, the emergence of orphan drugs, to provide treatment for rare diseases, could bring on a new age of pharmaceutical companies that will be smaller in size, requiring less resources and having a very focused product portfolio and strategic intent. The nature of rare disease with its limited patient populations will also encourage a much closer alignment between clinical trials, patient advocacy groups and the end user clinician, who will most likely be the key opinion leader for the treatment and the disease area.

References

2. Department of Health & Human Services, Office of Inspector General, The Orphan Drug Act – Implementation and Impact, May 2001

3. 36 Biotech / Pharmaceutical companies and 37 patient advocacy groups interviewed by Department of Health & Human Services, Office of Inspector General

4. The Orphan Drug Act – Implementation and Impact

5. Epiomic Patient Segmentation Database, Primary Immunodeficiency Category, Epiomic.com

6. Epiomic Patient Segmentation Database, Metabolic Disorders Category, Gaucher Disease sub-type 1,2,3, Epiomic.com with 60 years historical data

7. Harvard Health publications, February 9, 2012

About the author:

Christopher Ehinger has over 14 years of pharmaceutical experience in various commercial roles in therapeutic, diagnostic and medical device businesses. This includes experience in blue-chip organizations such as SmithKline Beecham, GlaxoSmithKline, Amersham Health & GE Healthcare where he was the Global Marketing Director for the Oncology and Neurology disease franchises.

He is currently the Managing Director for Black Swan Analysis, a unique fully integrated analysis practice founded in 2007. The company develops novel patient related healthcare databases which are made available via the web to the pharmaceutical and healthcare professionals on a subscription basis. Their current offering includes the Epiomic™ Patient Segmentation database that provides a robust, evidence-based source of patient populations that go beyond basic prevalence or incidence rates, to include essential conditions and patient attributes for each disease. It covers a comprehensive range of over 125 of the most prominent diseases, including over 2,500 unique patient sub-populations, displaying many of the clinically critical attributes and co-morbid conditions seen in these patients.

Black Swan Analysis Ltd., Moorbridge Court, 29-41 Moorbridge Road, Maidenhead, Berkshire SL6 8LT

+44 (0)1628 621790

christopher.ehinger@blackswan-analysis.co.uk

Can rare diseases be a viable option for the pharma industry?