A year on: pandemic driven trends in HCP engagement

IQVIA’s John Procter explores why the industry should be paying attention to the changing HCP customer experience in the wake of COVID-19.

This article appears in full in this month's Deep Dive digital magazine on Market Access. Here is a preview:

As we reach the end of the first quarter of 2021, our customers continue to be challenged by the question of what they need to do to be successful whilst the uncertainty induced by pandemic disruption continues. Data from across the globe is increasingly giving clues as to the likely answer.

Managing effectively during this period of uncertainty, both in terms of what is done and the way it is done, will likely set the trajectory for post pandemic performance. So, those companies who for example make a better job of introducing multi-channel HCP interactions in terms of volume delivered and perceived value to the HCP will have an advantage when it comes to deploying these channels in the re-imagined salesforce of the post-pandemic future.

They will have the practical experience and customer insights necessary to build successful future strategies. More importantly, successful companies will also pay equal attention to the customer experience.

The current state of promotional activity volumes

Promotional activity volumes have recovered somewhat compared to a year ago but in most countries are still well below those pre-pandemic. Spain and the US are the only countries yet to see recovery to where they were a year ago, whilst Germany and Japan have actually increased to levels above where they were pre-pandemic. More granular data from the US demonstrates a wide variation across specialities, with oncology particularly lagging behind in total promotional activity.

The proportion of promotional activity conducted via channels other than face to face has fluctuated across the year to fill some of the gap. In Spain, other channels went from 12% of total activity in January 2020, to 94% in May and back to 62% in March 2021. Italy has seen a larger fluctuation, from 9% to 96% and back to 28% in March 2021. Meanwhile in the UK there has been virtually no change across the last 12 months, with other channels running around 95% of total promotional volume. Interestingly, the two countries showing growth in total promotional volume in March 2021 compared to pre-pandemic levels – Germany and Japan – have both experienced growth in already large non-personal interaction volumes. In Germany use of postal and email has grown to 82% of total promotional activity and in Japan automated e-detailing has risen to 61% of the total.

Face to face activity levels have continued to recover across most countries, with the notable exception of the UK. The strongest recoveries have been seen in China, Brazil and Italy, with the latter coming close to the activity level pre-pandemic. In the US we continue to see significant variation across specialities with overall activity levels at 52% of their pre-pandemic levels.

Delivering success in 2021 and beyond

Learning from the experience of 2020 and its impact on healthcare systems around the globe, my colleague Sarah Rickwood has written about nine themes that will drive change in our industry in 2021 and beyond. Two of these are particularly pertinent to discussion of promotional channels and how to successfully practical deployment of resources.

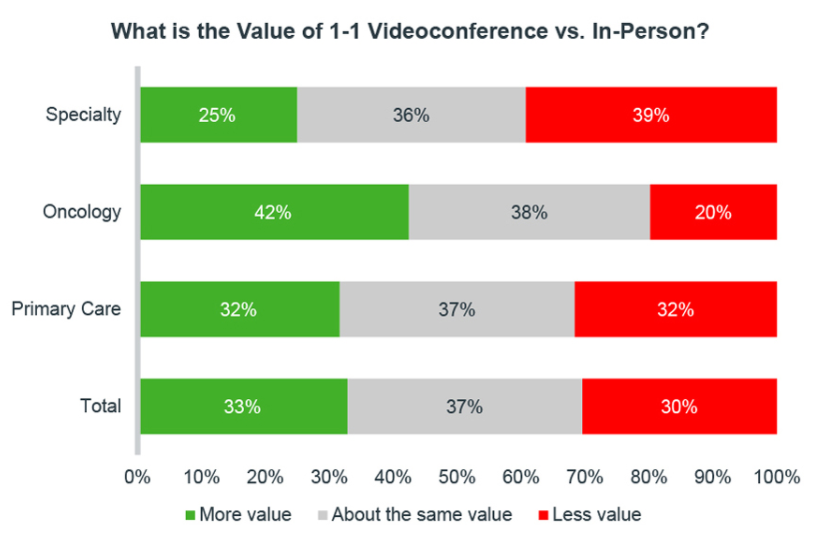

The first is a focus on customer engagement impact. We have consistently seen from HCP feedback that they have become more favourable to the use of remote engagements by pharma company representatives as their experience of their use has grown. In addition, the increased use of telehealth for patient consultations during the pandemic has further helped drive acceptance of online interactions in healthcare. Recent research conducted by IQVIA in the US demonstrates how perceptions have evolved since the beginning of 2020, when video enabled activity represented less than 1% of total promotional volume. Now, around a third of HCPs view videoconference interaction with pharma representatives as more valuable than face to face meetings, and most expect their use to remain high due to factors such as convenience and policy changes in hospitals.

The second relevant theme concerns the non-COVID patient backlog that healthcare systems around the world will be facing for some time ahead and the associated impact on prescribing dynamics. As an example, in the US it is estimated that over one billion diagnostic visits were lost in 2020 and as many as 300 million will be lost in 20211, contributing to a projected reduction in prescription volumes of over 100 million in the first six months of the year. As well as creating significant opportunities for pharma to be active in helping to address this backlog, through initiatives such as supporting the use of telehealth, facilitating patient pathway changes or increasing the efficiency of diagnostic activity, it almost certainly will add to the access challenge. HCPs are likely to be overstretched and under-resourced in many key specialities, reducing the opportunities for, and likely duration of, promotional interactions.

As our industry grapples with managing uncertainty whilst re-imagining promotional models in the post pandemic world I believe paying attention to the HCP customer experience is as important, if not more important, as thinking about the practicalities of channel mix.

Smart use of the channel mix will be the differentiating factor. Paying attention to the changing way that HCPs want to receive information, segmenting approaches to recognise the differing needs of different specialties, of those comfortable using telehealth in everyday practice versus those who are not and making sure face to face visits are optimised for the right objective all become part of that smart approach.

• Read the full article in pharmaphorum's Deep Dive digital magazine