Geopolitical uncertainty grips digital health investors

Galen Growth Asia has released its Q3 2019 Asia Pac HealthTech, aka digital health, ecosystem key trends interim report, which provides a checkpoint to bridge our mid-year and full year reports, each one powered by HealthTech Alpha.

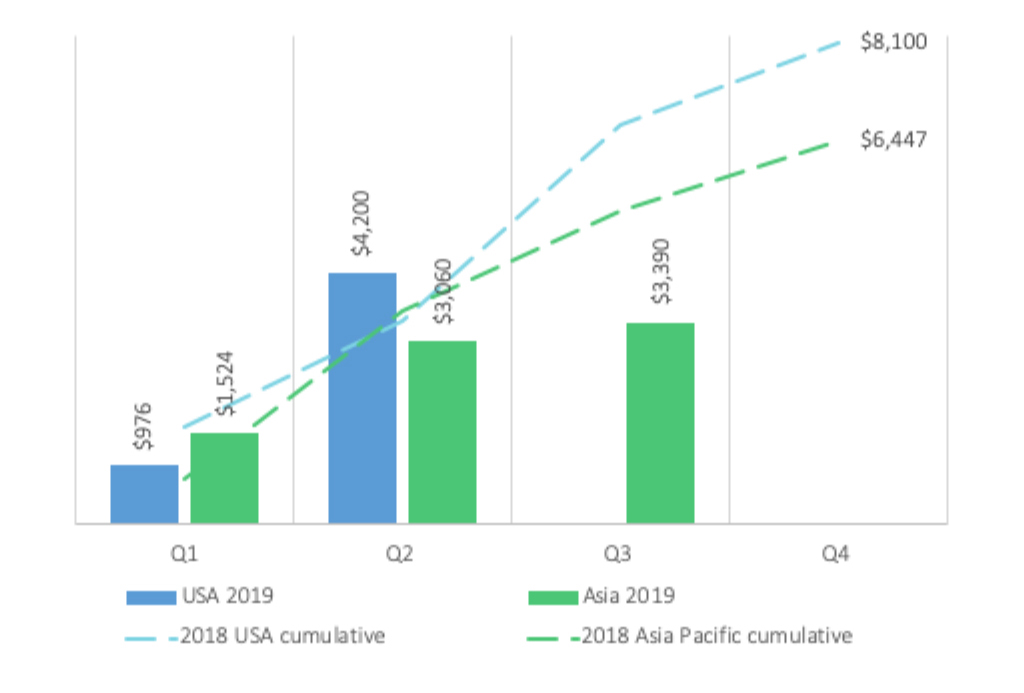

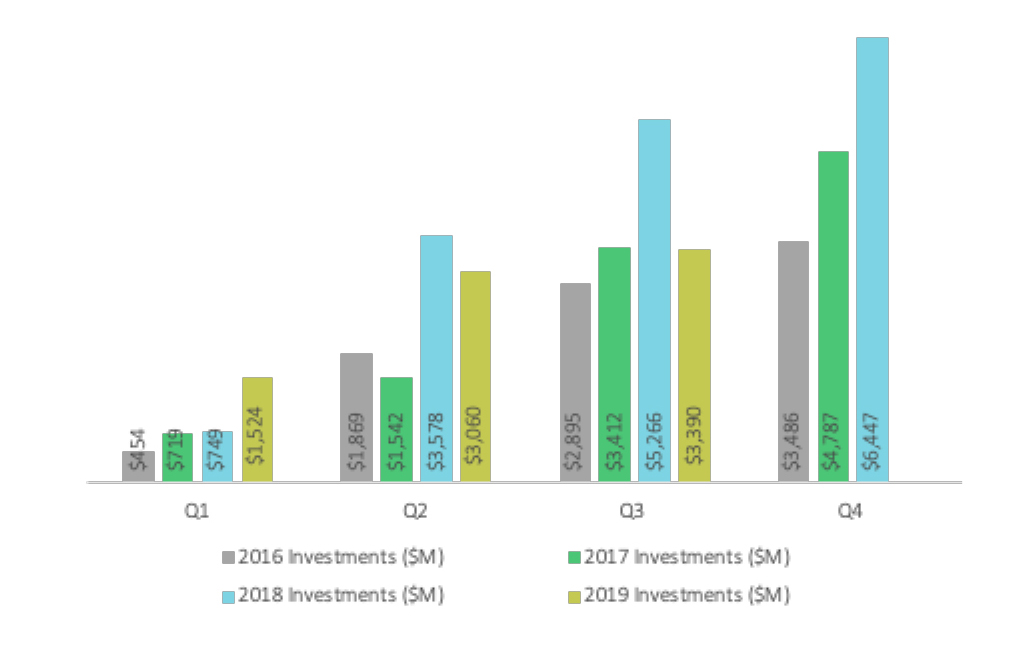

In our H1 2019 funding report, we stated that the Asia Pac HealthTech ecosystem momentum continued unabated closing at the mid-year point at US$3B invested, building on the back of a record breaking 2018 and a superior Q1 2019.

Multiple headwinds combine to challenge investor appetite

The Asia Pac HealthTech ecosystem records its weakest quarter of funding since 2016. With Q3 2019 cumulative deal volume down 40% YoY, the slide was further accentuated by the average deal size falling to US$5.2M from US$18.2M at the end of H1 2019.

The outcome is that total investment in digital health in Asia Pac in Q3 2019 closes at US$330M, down 81% YoY, taking the YTD cumulative to a total of US$3.4B.

The key drivers for this lackluster performance include:

- China: Total funding in Q3 closed at US$213M which is the country’s lowest since 2015. Funding volume is 61% lower compared to Q3 2018;

- India: After a stronger Q2, investment in digital health slumped, closing at US$38M, down 87% vs Q3 2018 with deal count down 45% vs Q3 2018;

- SE Asia: Continuing the trend this year, the region witnessed an uptick of ~US$30M, almost doubling Q3 2018 funding by value, with deal volume down 28% vs Q3 2018;

- NE Asia: This cluster of countries (JP, TW, SKR & HK) closed at US$49M, down 33% vs Q3 2018 with deal count down 6% vs Q3 2018;

- We recorded no mega-deals and no IPOs in Q3 2019 in the region.

Asia Pac vs USA cumulative funding history

Were we simply witnessing the ecosystem pausing for breath before returning to the race or are the growing number of headwinds causing significant concern for investors with respect to both exit routes and access to deal flow?

Context: Headwinds

For the past 12 months, observers of this ecosystem and Asia Pac macro-trends have not helped but notice the brewing storm of headwinds influencing the region, and more particularly investors’ strategies. Principal ones would include (not exhaustive):

- The US/China trade war which will likely bite harder with ratcheting tariffs and regulations:

- The threat of a ban on China companies listing in the US, raising questions on potential exit routes for investors;

- The potential of limits imposed on US investors to their portfolio flows into China assets.

- The global HealthTech IPO sluggish performance. A Galen Growth Asia ongoing study of 20 pure play HealthTech startups listed in the US, Europe and Asia reveals an average decline in share price value of 7% in Q3 2019;

Despite claims to the contrary by investors, corporations and startups in the region, in Galen Growth Asia’s sentiment surveys conducted in late 2018 and more recently at this year’s mid-year point, investors have clearly taken their foot off the investment peddle.

All these variables considered; we believe that 2019 is highly unlikely to exceed 2018. Galen Growth Asia forecasts a Full Year 2019 closing at ~US$4.5B across an estimated 300 deals, some US$2B shy of 2018, matching 2017.

Show me the money!

Total investment in digital health in Asia Pac in Q3 2019 closed at US$3.4B, down 39% compared to Q3 2018 (not allowing for the 8 mega-deals in Q3 2018) whilst the total number of deals is virtually flat with a dip of ~6%, resulting in a significant reduction in average deal size thus indicating a favouring of earlier stage deals.

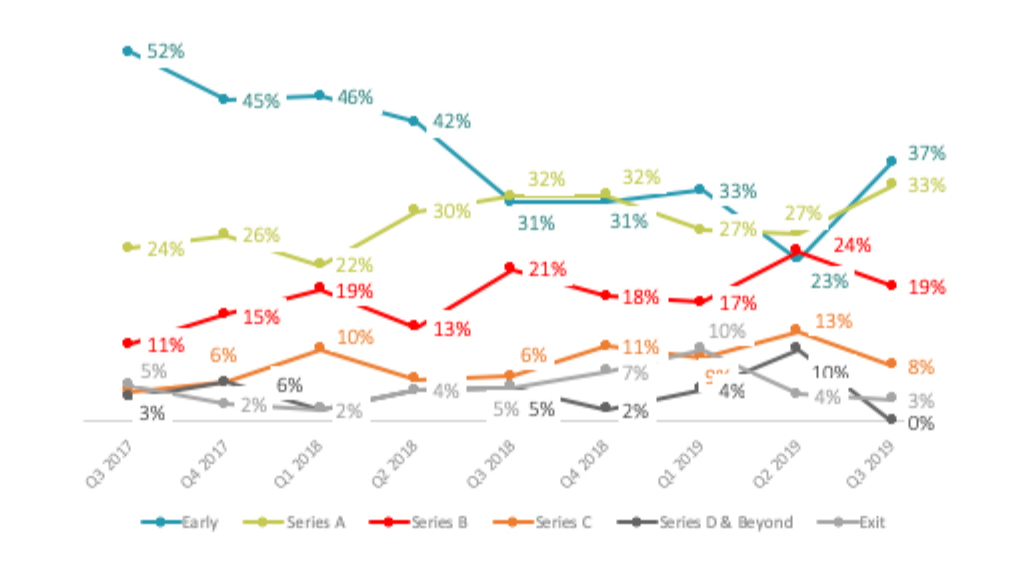

Reversing a downward trend for the past eight quarters, Early stage deal volumes grew to 37% in Q3 2019 up from 23% in Q2 2019.

Conversely, both Growth and Late stage deal volumes shrunk in Q3 2019 from 60% and 3% respectively, down from a total share of 77% in Q2 1019. The lack of any mega-deals (deal exceeding US$100M) was no doubt a major driver!

Closer scrutiny of the funding allocation by stage across Q3 deals to better understand the dislocation between total funding and total deal volume reveals that 25% of deal volume went to Series A deals compared with only 9% in H1 2019.

Indeed, as previously stated, Early stage deal volume share reversed an eight-quarter trend of erosion in Q3 2019 recording 37% of a total deal volume, closely followed by Series A deals which also recorded an uptick to grab 33% of total deal volume.

In contrast, all Series B, C & D (and beyond) deal volume all experienced a downward trend.

Asia HealthTech deal volume by investment stage

As we suggested in our 2019 mid-year report, are we witnessing Growth stage investors moving up the maturity pipeline in search of deal flow, having saturated the available Growth stage deal flow over the past 12 months?

China and India plummet leaving the rest of Asia to thrive

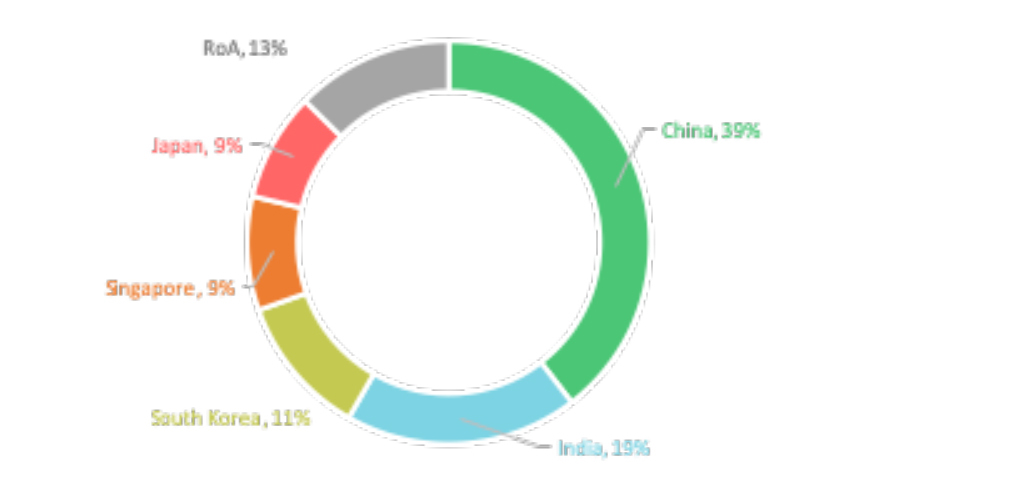

China vs India vs Rest of Asia by deal volume share

China

At the 2019 mid-year point, with 77% of total Asia Pac HealthTech funding by value (down from 89% in H1 2018), dollars to VC-backed ventures in China YTD remained flat at 76% by value share, down 43% by absolute value over the same period.

At the close of Q3 2019, China’s total deal volume YTD accounted for 39% of all deals in Asia, down from 47% in Q3 2018.

The weakening in the domestic economy and a deteriorating external environment, including both a global slowdown, and the US-China trade tensions, have no doubt played a role in China's deceleration.

This will be a key topic of the Galen Growth Asia HealthTech Summit 2019 on 13-14-15 November in Singapore.

India

After a glimmer of hope in Q2 2019 where we saw the India HealthTech ecosystem regain momentum, it experienced a hard landing witnessing its total deal value slump to 87% for the same period. Total deal volume share shrunk to 19% down from 23% in Q3 2018.

India is facing a sharp economic downturn and severe loss of business confidence. Investors alarm over the economic condition is not merely a reflection of a slowdown in GDP growth but also the poor quality of growth. Private sector investment, the mainstay of sustainable growth is at a 15-year low. In other words, there is almost no investment in new projects by the private sector.

SE Asia

SE Asia, which doubled its total funding in H1 2019 compared to the same period last year, continued to be a net winner of the aforementioned trade war.

During Q3 2019, we witnessed a continuation of SE Asia’s momentum accounting for 12% of all deals, up by 1% when compared to the same period last year.

Singapore deal volume is up ~2% for the same period in 2018, now accounting for 9% of all deals.

Other

Of specific interest and on Galen Growth Asia’s watch list, South Korea is up from 4% in Q3 2018 to 11% in Q3 2019 and Japan up by 2% and now accounting for 9% of all Asia Pac ecosystem deals.

Solution category attractiveness

HealthTech Alpha classifies each HealthTech venture by its primary solution which we monitor continuously as this does evolve / pivot. Our taxonomy includes 15 distinct clusters (underpinned for further granularity by a total of 42 categories). We track both $ value and volume for each super category to better understand the attractiveness of each.

By the end of mid-year 2019, the Online Marketplace and Medical Diagnostics categories had continued to maintain their top 3 leadership positions by deal value, with Health Management Solutions leapfrogging them into the lead, driven by China mega-deals.

2019’s third quarter saw Online Marketplace regaining pole position closing US$555M across 20 deals, closely followed by Health Management Solutions with US$493M across 29 deals and Medical Diagnostics at US$450M across 35 deals. Overall, they account for ~45% of total funding deployed. Both Wellness and Health InsurTech remain amongst the top six most attractive solution categories which overall represent ~67% of total funding deployed in Q3 2019.

Deal value category share (Q3 2019 YTD cumulative)

Noteworthy deals

With no mega deals in Q3 2019 (deals exceeding the value of US$100M in size), we consider a shortlist of noteworthy funding rounds to better understand the type of deal driving the top 6 solution categories.

| Primary Cluster > HealthTech Category | Funding Size & Stage | Principal Investor | |

|---|---|---|---|

| Synyi (森亿智能) (CH) |

Health Management Solutions > EHR / EMR | US$36.0M Series C |

Tencent Holdings |

| Halodoc (IND) | Online Marketplace > Consumer Marketplace | est. US$20.0M Series C1 | Bill & Melinda Gates Foundation |

| Lemon Healthcare ((레몬헬스케어) (SK) |

Health InsurTech>Health Claim Management | US$8.5M Series B | Korea Development Bank |

| Yunhu Health (云呼科技) (CH) |

Medical Diagnostics > Genomics Related Diagnosis | US$31.0M Pre-B |

ZWC Ventures, CCV |

| Neurospace (ニューロスペース) (JP) |

Wellness > Wellness Apps | US$1.6M Series A1 |

SOMPO Holdings |

| Meddo (IN) |

Health Services Search > Medical Concierge | US$3.0M Pre-A |

growX Ventures |

Synyi.ai (森亿智能), a China venture founded in 2016, is a developer of big data-driven AI applications for medical research, healthcare, and patient services. The company has developed a semantic analysis system that is able to standardise and analyse the unstructured records kept by many Chinese hospitals. The medical data management company uses its machine learning and natural language processing technology to collect, model and analyse large-scale medical data.

In July, Synyi announced the completion of a new round of US$36M (approximately RMB 250M) Series C round of funding from Tencent Holdings and Sinopharm Capital.

Halodoc, founded in 2016, an Indonesia-based digital healthcare platform, and the winner of Galen Growth Asia’s 2018 Most Innovative HealthTech Startup, connects customers in Indonesia to over 20,000 licensed doctors in the country for live consultations via its mobile app and website. Services also include fast delivery of medication as well as lab tests.

In July 2019, Halodoc secured funding in a Series B+ round from strategic investors including the Bill and Melinda Gates Foundation, Allianz X, and Prudential. Galen Growth Asia estimates this round to be in the region of US$20M. This round follows closely after the March 2019 Series B raise of US$65M.

LemonCare, a South Korea venture founded in 2017, is a customized patient-focused service platform for medical facilities that manages everything from making appointments to submitting medical insurance claims and transferring e-prescriptions.

In July 2019, LemonCare has raised US$8.5M (approx. ₩10B), co-led by Korea Development Bank, Shinhan Investment and Shinhan Capital.

Yunhu Health (云呼易检), a China venture founded in 2017, developed a mobile genetic testing platform which provides testing services for pregnancy, neonatal and male factor infertility services. Yunhu Health also provides medical concierge services including appointment scheduling and medical claims and general information.

In September 2019, Yunhu Health raised US$31M (approx. RMB 220M) from ZWC Ventures, CCV and BioTrack Capital.

Neurospace (ニューロスペース) , a Japan venture founded in 2013, focuses a Sleep Analysis Platform utilizing AI and IoT technology. Since its launch the company has developed a sleep improvement program called Sommnie focused on corporate health management.

After raising a Series A round in April 2019, Neurospace has announced a partnership with capital injection of US$1.6M (approx. ¥170M) with SOMPO Holdings in July.

Meddo , an India venture founded in 2018, partners with doctors to provide comprehensive one stop care for patients, providing all health needs under same roof – starting with consultations, nutrition, lifestyle, cutting-edge lab testing and other health services.

In September, Meddo disclosed a US$3M raise led by SRI Capital with participation from growX Ventures, LetsVenture and angel investors.

Helpful notes

This is the Galen Growth Asia Q3 2019 YTD Asia HealthTech Investment Landscape interim report, which is an update to our comprehensive go-to-reference half year reports. These can be downloaded for free at: https://www.galengrowth.asia/research/

About GGA

Galen Growth Asia (GGA) is the leading market intelligence, analytics and advisory firm in Asia Pac serving Fortune 500 companies and global investors, exclusively HealthTech focused. Founded in late 2015 by HealthTech innovators, GGA, operates at the epicentre of HealthTech innovation, aka digital health, in Asia Pac, currently a US$80+B startup ecosystem.

GGA has built a portfolio of solutions which enables it to be the catalyst of direct collaboration between enterprises, startups and investors to accelerate the timeline to ROI of their digital health strategy.

GGA has recently opened its European office to respond to the growing demand and needs of its continuously expanding client base of healthcare incumbents, new entrants and investors.

For further information, visit us at: www.galengrowth.asia or write to us at: info@galengrowth.asia

Important information

This update is provided for informational purposes only and was prepared in good faith on the basis of public information available at the time of publication without independent verification. Galen Growth Asia does not guarantee or warrant the reliability or completeness of the data nor its usefulness in achieving any particular purposes. Numbers will be updated from to time to reflect information identified after the event. Galen Growth Asia shall not be liable for any loss, damage, cost or expense incurred by reason of any persons use or reliance on this update. This update is a proprietary aggregation of publicly available and undisclosed data and shall not be forwarded or reproduced without the prior written consent of Galen Growth Asia.