How cell and gene therapies are transforming pharma deal-making

After decades of clinical research targeting development of more “personalised” medicines, the biotechnology sector is now starting to deliver with the first generation of promising new cell and gene therapies.

Whether the optimism about the impact of these therapies plays out as expected or not, advances in this area of research are also having a significant effect on the pace of deal-making in the life sciences sector.

As many investigational cell and gene therapies continue to advance and demonstrate their clinical and commercial potential, companies including smaller biotechnology firms and larger pharmaceutical companies are positioning themselves for opportunities to acquire assets or develop collaborative relationships to take advantage of these new technologies.

Given that development of cell and gene therapies is still in its nascent stages and uncertainties remain about their long-term potential, some industry insiders have questions about the risks involved and how financial deals related to these drugs should be structured.

To better understand deal-making trends related to cell and gene therapies, we conducted an analysis of recent activity in the sector.

We reviewed more than 30 mergers, acquisitions, and licensing agreements executed between 2016-2019 and compared them to deals that were executed for the previous generation of breakthrough therapies, including monoclonal antibodies (mAbs).

In this analysis, we considered a range of factors including the size of the companies involved, target indications, deal structures, terms such as upfront payments and royalties, and the number and clinical stage of assets included in each deal.

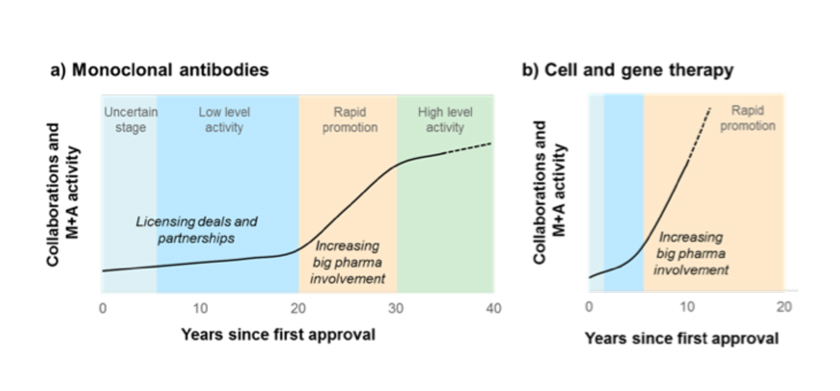

The review shows that overall the pace of deal-making in cell and gene therapy is faster and occurring much earlier in the drug development process compared to deals seen in the past.

More deals and earlier deals

The pace of deals in the cell and gene therapy sector has been building in momentum since the first of these drugs received regulatory approval nearly a decade ago. From 2010-2016 alone, pharmaceutical companies executed more than 50 partnerships and investments to access cell and gene therapies.[1]

Larger companies have often been involved in these deals from the beginning. In 2010, Novartis established a partnership deal with GenVec worth potentially $213M (excluding royalties) for development of adenovirus-based gene therapies. That same year Novartis also formed a strategic alliance with GlaxoSmithKline and the Telethon Institute of Gene Therapy (TIGET) to pursue additional gene therapy research and development.

Unlike deals made decades ago related to mAbs, larger pharmaceutical companies are not waiting for the cell and gene therapy sector to become well established before pursuing partnerships or M&A deals.

With mAbs, financial deals were often characterised by the acquisitions of late-stage and marketed products, significantly reducing levels of risk. Conversely, acquisitions and other deals in the cell and gene therapy space often include entire product pipelines, platform technologies, and manufacturing capabilities with the potential to deliver significant clinical value and commercial potential.

Source: CRA analysis

With growing eagerness to buy into the cell and gene therapy market, the fact that companies are targeting these drugs earlier in the development cycle is also driving them to consider innovative deal structures to reduce risk.

One key difference with respect to cell and gene therapy deals is that most companies prefer to target partnerships and licensing deals rather than mergers or acquisitions, which were more commonly associated with mAbs. This shift may be based in part on the lack of long-term safety and efficacy data associated with many cell and gene therapies, but it also may be a reflection of the unique challenges in development of these drugs.

Despite the risks and unknowns, interest in the sector continues to grow dramatically. Pfizer’s first move into cell and gene therapy, for example, was through a collaboration with Spark Therapeutics regarding clinical development and potential commercialization of its Phase 1/2 gene therapy for treatment of hemophilia B.

Subsequently, Pfizer further expanded its cell and gene therapy portfolio by acquiring Bamboo Therapeutics in 2016, which provided a Phase 1 product and several preclinical stage assets, and by partnering with Vivet Therapeutics in early 2019 on development of a Phase 1/2 drug for treatment of a rare liver disease. The deal with Bamboo Therapeutics is a good example of a company structuring a deal to gain access to several different products or platforms rather than only one asset, which was often the case with mAbs.

Transforming the M&A and licensing landscape

While it took more than 20 years for collaborative activity around mAbs to generate significant interest from Big Pharma and lead to billion-dollar deals, the cell and gene therapy sector has reached this level of activity in less than 10 years.

This may be driven by the claims that these drugs represent innovative platforms and approaches for treatment of many conditions, including rare diseases. As research advances, industry partners recognise the potential for these drugs to represent major standard of care advances in areas where effective treatments are limited, sub-optimal, or non-existent.

As the discovery of promising new cell and gene therapies continues to expand, the emphasis on collaboration and innovative structuring in licensing, partnering, and M&A arrangements is expected to grow rapidly. It will be increasingly essential for participants in early-stage deals to have the expertise and insight necessary to conduct a thorough assessment of the risks and potential benefits of each option in structuring a deal. By working to understand and address any issues, they can better protect their interests over the long term. Companies that do not develop this capability to assess deals quickly and precisely risk being left behind.

About the authors

Lev Gerlovin is a vice president in the Life Sciences Practice at CRA. He has more than 12 years of experience in life sciences strategy consulting, focused on commercial and market access strategies.

Pascale Diesel previously served as a vice president in the Life Sciences Practice at CRA from July 2017 through December 2019. Dr Diesel has worked in global development, marketing, planning, and business development and has more than a decade of strategic consulting experience focusing on portfolio optimisation and valuation.

The views expressed herein are the authors’ and not those of Charles River Associates (CRA) or any of the organisations with which the authors are affiliated.

[1] Kong X., Wan J., Hu H., Su S., Hu, Y., Evolving patterns in a collaboration network of global R&D on monoclonal antibodies, mAB’s, 2017, 9,7, 1041-1051.