Trump tax reform uncertainty puts biotech M&A on hold

The biotech M&A spree predicted at the beginning of 2017 has failed to materialise, according to a new analysis by Bloomberg.

There have just been $11.5 billion in takeovers this year – and although this could all change with one deal, commentators are blaming uncertainty over US tax policy for the M&A malaise.

Biotech M&A topped $30 billion for two consecutive years in 2015 and 2016, driven by some big deals such as Pfizer’s $14 billion purchase of Medivation.

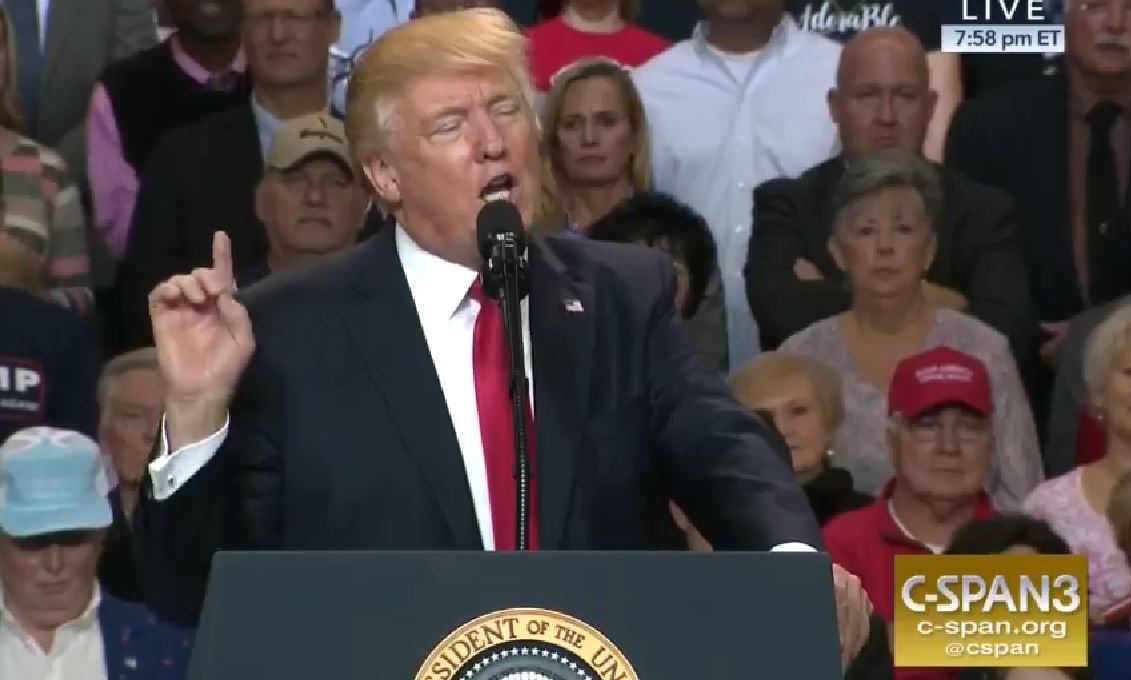

In its commentary on the figures, Bloomberg said that the cause of the problem is the lack of action from president Donald Trump on tax reform.

While everyone waits for the president act on reforms promised in the run-up to his election, pharma and biotech firms are delaying decisions on M&A.

This year had been predicted to be a vintage one for pharma M&A as many large companies seek to enrich their pipelines via acquisition.

And although things got off to a good start with Takeda’s $5.2 billion acquisition of Ariad in January, there has been little action since then.

Bloomberg’s analysis also seems to discount Johnson & Johnson’s $30 billion acquisition of Actelion, which went through in June.

Although some would class Actelion as a biotech, it was perhaps too large, with products approved of its own, to be considered a biotech.

The suggestion is that there are a group of companies that are ripe for a takeover – Tesaro and Kite Pharma being prime examples.

Tesaro has its PARP inhibitor Zejula (niraparib) already approved in ovarian cancer, while Kite is closing in on US approval for its revolutionary CAR-T blood cancer therapy.

US biotechs Clovis and Puma also have PARP inhibitors approved and have also been touted as potential acquisition targets.

Diminishing hopes

The US corporate tax rate is currently 35%, far higher than almost all developed economies.

Pfizer's chief executive Ian Read is one of the loudest of big pharma CEOs in his calls for corporate tax reform. He says his company won't be spending until there is greater clarity about tax reform.

In an article written for Forbes entitled: "The Future of American Innovation Rests on a Competitive US Tax Policy", Read said this high tax rate was deterring investment in the US.

In April, Trump promised to slash the rate from 35% to 15% to bring it into line with many other developed countries, and promised to do this whether or not it added to federal budget deficit.

Herein lies the problem for Trump: while tax cuts are supported by 'fiscally conservative' Republicans in Congress, many also prioritise cutting back federal deficits and spending. This means a radical cut will be opposed by many Republicans, making it difficult for Trump to win over his own party.

Many experts believe that Trump could still achieve a cut to the 35% rate, but forecast that it won't be cut beyond a 25-28% level.

However, Trump's still declining popularity in Congress and in the electorate, will make the task much harder. Add to that growing doubts about Trump White House's ability to drive forward its own agenda, and significant progress before the end of 2017 looks increasingly unlikely.

Against this background, big pharma looks set to sit tight unless a very attractive M&A proposition emerges.