UK biotech Mereo gears up for key brittle bone drug data

UK biotech Mereo BioPharma is hoping the coming months will transform its fortunes as it prepares for potentially pivotal data for a brittle bone disease drug.

Mereo is developing setrusumab for osteogenesis imperfecta (OI), and an interim analysis from the ASTEROID study may provide data that could form the basis of a filing with regulators, one of several potential drugs that the biotech hopes will catch the eye of big pharma looking for a development project.

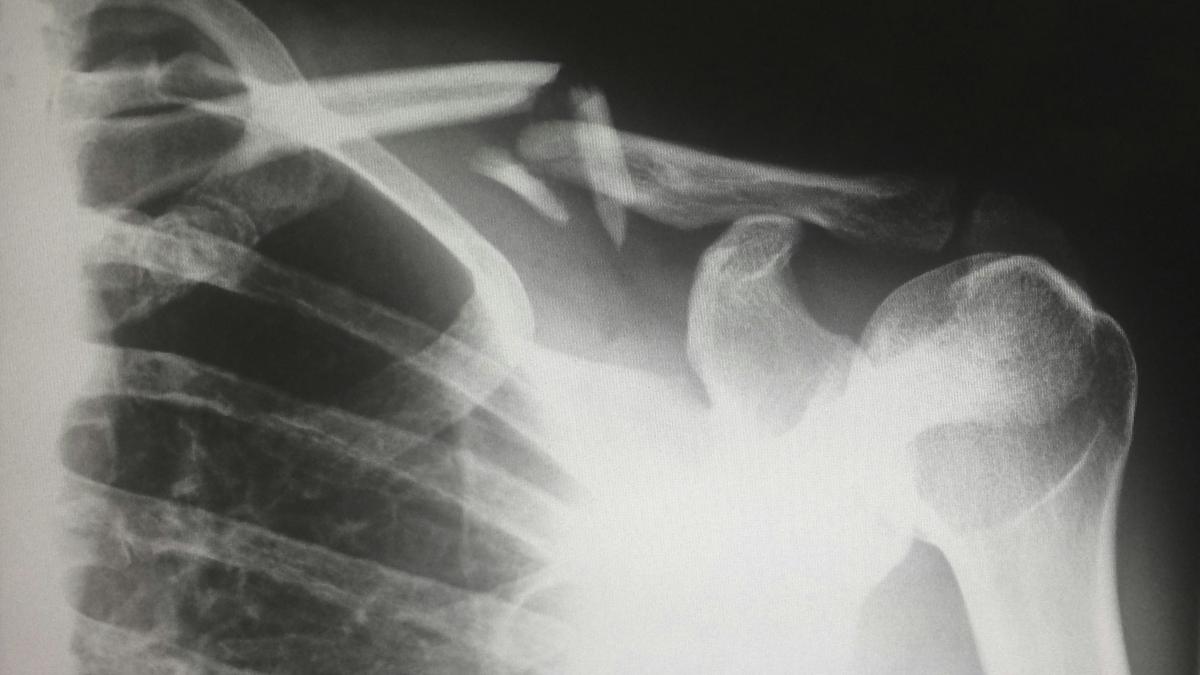

OI is a catch-all term for a group of rare diseases that lead to bones that fracture and break easily, as well as other symptoms such as breathing problems and short stature.

The analysis from the open label arm of the study, where patients will receive the highest dose, could provide an “early insight” into activity of the drug after six months of treatment, broker Cantor Fitzgerald said in a note.

While regulators will likely require data gathered at a 12-month cut-off, the interim analysis will “de-risk” the drug if things go well, ahead of a final read-out due later this year, management told pharmaphorum.

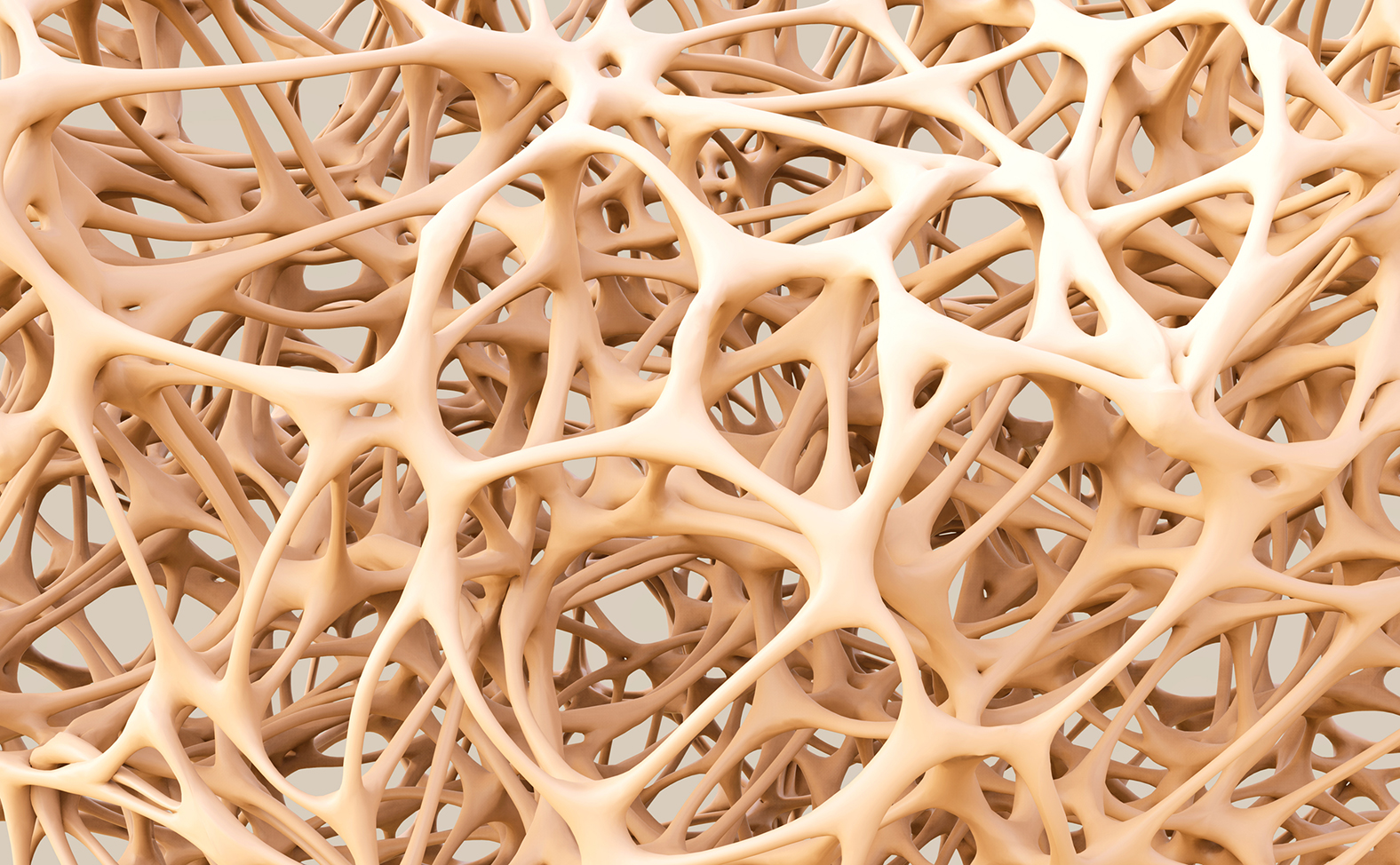

Also working in Mereo’s favour according to Cantor is the prior approval of UCB/Amgen’s Evenity (romosozumab) in osteoporosis, which also works by inhibiting sclerostin.

This protein inhibits bone growth in healthy people, but can be pharmaceutically “turned off” to encourage bone development in conditions such as osteoporosis and OI.

Regulators have already said the drug holds promise: in Europe it has been given Priority Medicine (PRIME) status, indicating that the former Novartis antibody has the potential to be an important therapy choice in OI.

Setrusumab was picked by Mereo’s management from around 20 drug candidates that the big Swiss pharma considered surplus to requirements in 2015.

In return for three molecules, Novartis took a 15% stake in Mereo in the transaction, and the antibody came with the added bonus of some early stage trial data from around 14 patients that suggested it could be used in OI.

The plan now is to either use data from the mid-stage trial to get a conditional approval from European regulators, which should be followed fairly quickly with confirmatory data from a larger phase 3 paediatric fracture trial, which would be the largest ever study conducted in OI and could be under way by next year.

“If data is strong in adults we could look to get conditional approval next year,” CEO Denise Scots-Knight told pharmaphorum in an interview.

Mereo also has backups: the company bought cancer biotech OncoMed at the end of 2018 for around $57 million and with that came anti-TIGIT (T-cell immunoreceptor with Ig and ITIM domains) drug etigilimab, which is being developed in partnership with Celgene.

Celgene has an option to further develop that drug, although this could be affected by the merger with Bristol-Myers Squibb as the latter has its own anti-TIGIT programme.

Celgene has already walked away from further development of another OncoMed drug in Mereo's pipeline, navicixizumab, but Scots-Knight is optimistic that another partner could be found if BMS/Celgene decides against partnering over etigilimab.

“If we get it back we would expect to be able to partner it again,” she said.

Also in the pipeline is alvelestat, licensed in from AstraZeneca, which is in phase 2 development for the rare disease alpha-1 antitrypsin deficiency, with further data due around the end of the year.

Scots-Knight added: “The odds are we are going to partner one of these programmes in the near future.”

With its 15% share Novartis has normal voting rights and no controlling interest, meaning that it will be treated like any other company when it comes to partnering proposals.

The biotech still had around £27.5 million in cash at the end of 2018 despite the OncoMed acquisition.

And after cutting R&D costs in another rare disease Scots-Knight said an acquisition in respiratory, bone, or endocrine disease areas where the company has expertise could be possible within the next 18 months.