Sandoz bags first-ever biosimilar approval in US

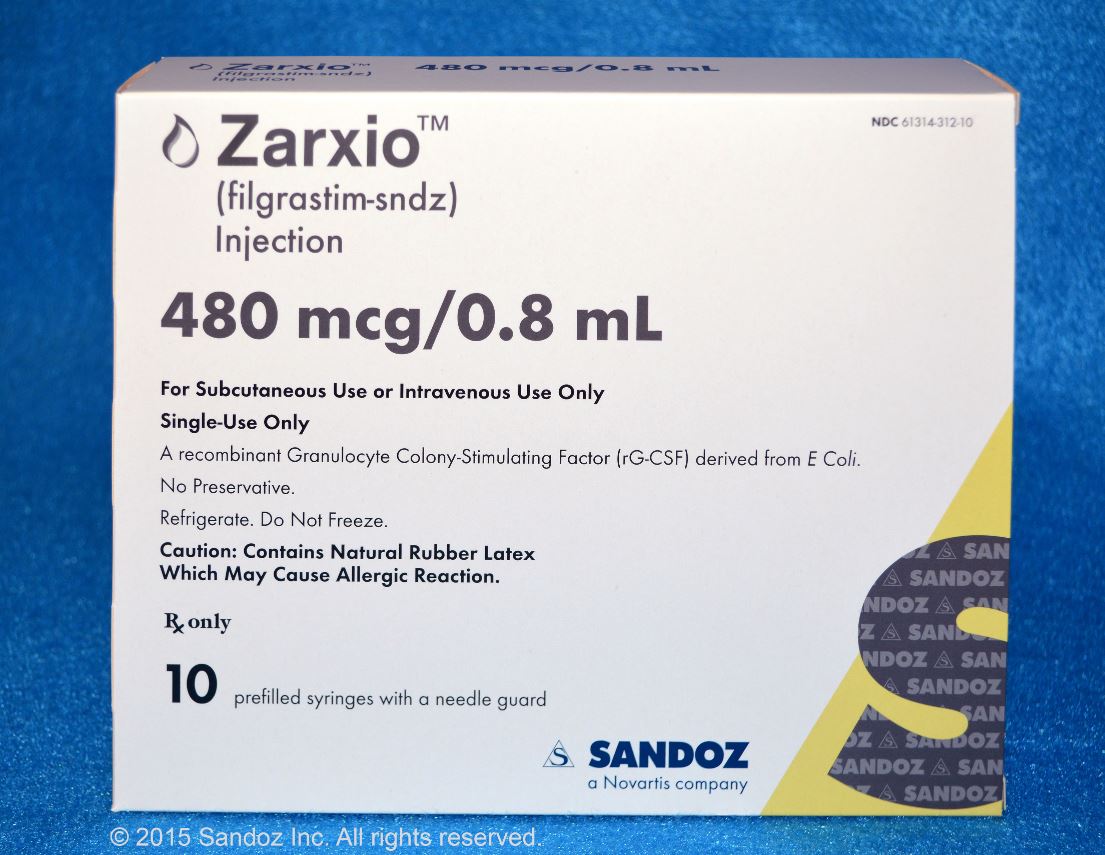

Novartis generics subsidiary Sandoz made history ahead of the weekend after getting approval in the US for Zarxio, the first biosimilar cleared by the FDA.

Zarxio (filgrastim-sndz) is a biosimilar version of Amgen's Neupogen (filgrastim), a drug used to boost white cell counts in patients with chronic neutropenia or those undergoing chemotherapy for cancer or bone marrow transplantation, among other indications.

The biosimilar was recommended for approval by an FDA advisory committee in January but has been on the market outside the US for years, debuting in Europe in 2009.

Neupogen has been a big seller for Amgen since it was first launched in 1991.

The US has taken a long time to develop a regulatory pathway for biosimilars, which finally came to fruition in 2009 with the passage of the Biologics Price Competition and Innovation Act (BPCIA).

As defined by the BPCIA, a biosimilar biologic is a biological product that is highly similar to the reference product, with no clinically meaningful differences between the biological product and the reference product in terms of safety, purity and potency.

Delays in the development of FDA guidance to facilitate the BPCIA pathway prevented biosimilar developers from quickly making use of the new pathway, however, and it was not until last year that Sandoz' application for Zarxio became the first biosimilar (351(k)) application accepted for review by the agency.

The BPCIA also provides for approval of a biosimilar biologic under the higher standard of 'interchangeability', which provides a period of exclusivity on the market for the first drug to meet this goal, although Zarxio has not met the criteria for that status.

An interchangeable product can be substituted for the reference product without the intervention of the health care provider which prescribed the reference product, notes the FDA.

There is already a rival version of filgrastim on the market in the US in the form of Teva's Granix (tbo-filgrastim), although this is not a biosimilar as it was approved with a full clinical dossier via the Biologics Licence Application (BLA) route.

The availability of Granix has already had an impact on Neupogen, with Amgen reporting sales of the drug declined 17 per cent in 2014 to $1.16 billion, although most of the impact was felt in Europe.

Amgen's longer-acting version of the drug – Neulasta (pegfilgrastim) – grew 5 per cent to approach $4.4 billion last year. That product could also be under threat, however, as it is due to lose patent protection in the US in October.

Canada's Apotex filed for approval of a Neulasta biosimilar in December and has also filed for approval of a Neupogen biosimilar that could be on the US market before the end of the year.

Other biosimilars in the FDA's in-tray include Celltrion's application for a version of Johnson & Johnson's arthritis treatment Remicade (infliximab) which was filed in August 2014.

Related article