Roche’s Tecentriq flunks triple-negative breast cancer trial

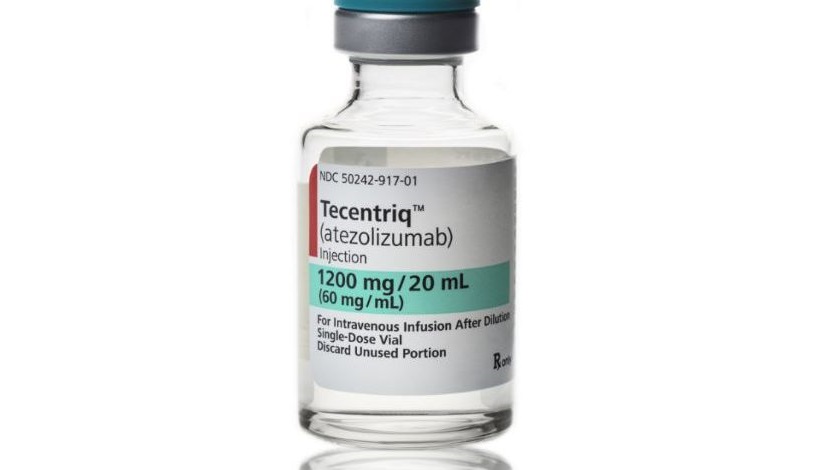

Roche’s hopes of extending the use of its PD-L1 inhibitor Tecentriq in triple-negative breast cancer (TNBC) have been dashed by a late-stage trial failure looking at the drug in combination with chemotherapy.

Adding Tecentriq to treatment with paclitaxel as a first-line treatment for TNBC patients whose tumours expressed the biomarker PD-L1 did not lengthen the time it took for the cancer to progress, when compared to paclitaxel plus placebo.

Moreover, there was a trend towards worse overall survival with Roche’s drug in the IMpassion131 study, although the company says the data on this are still immature and statistically underpowered.

TNBC is so called because it lacks the biomarkers that other targeted therapies can latch on to. It is more aggressive than other types of breast cancer, accounting for 15-20% of cases but causing 25% of deaths.

Tecentriq was the first drug among checkpoint inhibitors to get approval in TNBC, although rivals are circling, notably Merck & Co / MSD’s Keytruda (pembrolizumab).

“Today’s results underscore the need to better understand the cancer and immune system interactions, including the chemotherapy backbone and associated regimens,” said Roche’s chief medical officer Levi Garraway.

Roche’s drug is already licensed in more than 70 countries as a front-line treatment for PD-L1-positive forms of TNBC in a regimen with Bristol-Myers Squibb’s Abraxane (nab-paclitaxel) – a form of paclitaxel bound to the blood protein albumin to improve its delivery side effects – based on the IMpassion130 trial.

Tecentriq has had the frontline TNBC immunotherapy market to itself since it was approved last year, but is facing direct competition from Keytruda (pembrolizumab) in the wake of the KEYNOTE-355 trial reported in May.

That study showed Merck’s drug plus chemo reduced the risk of disease progression or death by 35% compared to chemo alone in PD-L1-positive TNBC, and will form the basis of regulatory filings later this year.

There’s little doubt that the arrival of Keytruda on the TNBC market would have an impact on Roche’s ambitions in this area, given the drug is the top-selling PD-1/PD-L1 inhibitor.

Failure in IMpassion131 puts a brake on growth in an indication that Roche has suggested could be worth $1 billion in sales on its own for Tecentriq, which brought in around $2 billion for Roche last year across its approved uses in TNBC, bladder and various forms of lung cancer.

It’s not all been bad news for Tecentriq of late, however. In June, Roche scored a major win for Tecentriq as a pre-surgery (neoadjuvant) therapy for TNBC patients – regardless of their PD-L1 status – on the back of the IMpassion031 trial, and is in the build-up to regulatory filings in this indication.

That would open up a much larger eligible patient population for the drug and extend its use into the 60% of TNBC patients with low PD-L1 expression levels. Merck is lurking in the wings in the neoadjuvant setting too though, thanks to the results of KEYNOTE-522 reported last year.

So far, none of the PD-1/PD-L1 inhibitors have been approved for neoadjuvant or adjuvant (post-surgery) use in any form of cancer.