Roche bolsters diagnostics with $295m LumiraDx deal

A flurry of mergers and acquisitions in the pharma space at the end of 2023 ended with a $295 million deal by Roche to buy a point-of-care diagnostics platform from LumiraDx, which recently went into administration.

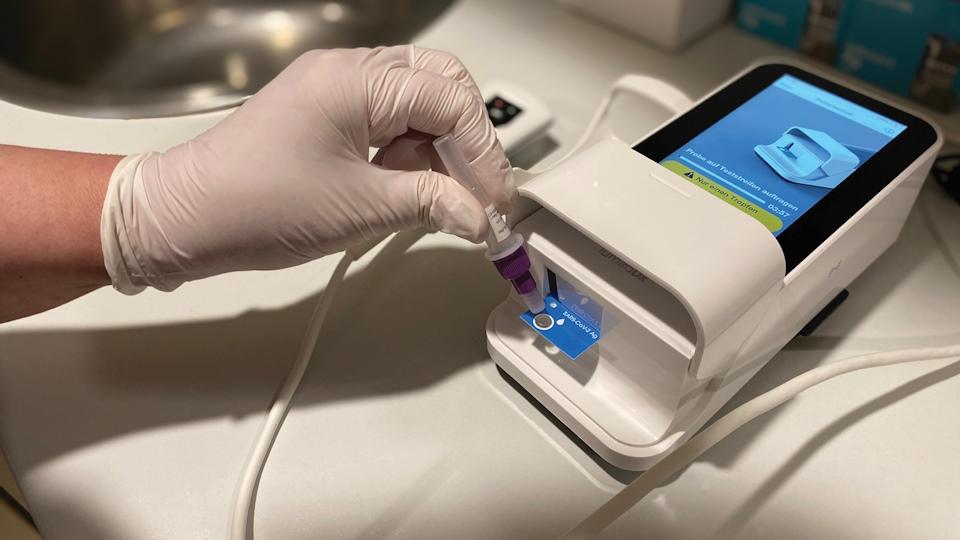

Roche is buying “select parts” of the London, UK-based LumiraDx group – which has developed a microfluidics-based diagnostics platform that allows multiple tests to be run on a single-use device – as part of an agreement with the administrators tasked with liquidating the company.

If all goes according to plan, Roche will pay $295 million on the closing of the deal, with another commitment of up to $55 million in funding that will be used to keep the point-of-care diagnostics business operating in the meantime.

LumiraDx was founded in 2014 to develop its platform, which combines a small, portable instrument with microfluidic test strips, and rose to some prominence during the COVID-19 pandemic with its rapid development of SARS-CoV-2 diagnostics.

Since then, it has expanded the range of tests available for the platform to include diagnostics for other infectious diseases, as well as coagulation disorders, cardiovascular disease, and diabetes, finding customers in laboratories, urgent care facilities, physician offices, pharmacies, schools, and workplaces. A year ago, it won a $14.2 million award from the Bill & Melinda Gates Foundation for further development of a point-of-care diagnostic for tuberculosis (TB).

Earlier this year, however, LumiraDx announced plans to lay off around 40% of its workforce after seeing a sharp reduction in demand for its COVID testing that left it with excess manufacturing capacity and inventory as it also struggled to service debts of around $350 million. Revenues have hovered at around $20 million a quarter since then, from a height of $420 million in full-year 2021.

In the intervening months, senior directors have left the company, including chief executive and chair Ron Zwanziger, chief technology officer David Scott, and chief scientist Jerry McAleer, with founder and general counsel Veronique Ameye stepping in as interim CEO.

It was also faced with de-listing from the Nasdaq after its shares traded below $1 for more than 30 business days and was residing in penny-share territory when it went into administration.

Roche’s move has rescued the technology, and the Swiss diagnostics giant said it will “enable us to transform testing at the point of care.”

“LumiraDx has developed a highly versatile platform that delivers strong performance across multiple disease areas and technologies,” commented Matt Sause, CEO of Roche Diagnostics.

“We believe this will enable better patient access to timely results in decentralised healthcare settings worldwide.”

The deal is expected to close in the middle of 2024.