RNA therapy firm Avidity files $400m placement

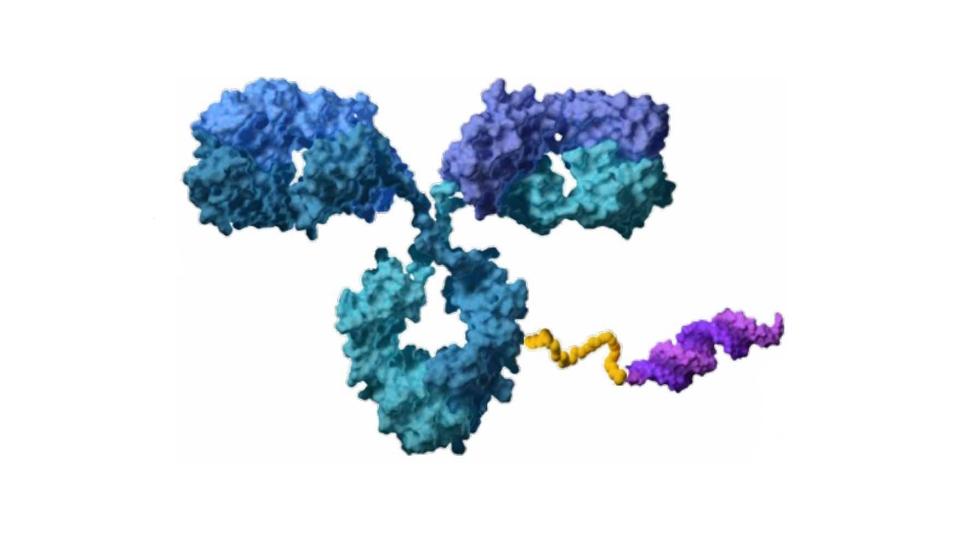

Avidity Biosciences has filed a private placement worth around $400 million, seeking a cash infusion to help advance its pipeline of clinical-stage candidates that combine antibodies with RNA oligonucleotides.

The filing comes as the San Diego-based biotech is preparing to start a phase 3 clinical trials programme for its lead antibody oligonucleotide conjugate (AOC) – AOC 1001 for myotonic dystrophy type 1 (DM1) – within the next few months.

DM1 (formerly known as Steinert disease) is caused by a defect in the DMPK gene on chromosome 19 and is a form of muscular dystrophy, leading to weakness and loss of function in voluntary muscles, as well as cardiac and respiratory problems as the disease progresses.

There is currently no disease-modifying therapy, and treatment involves muscle relaxants, braces and wheelchairs for disability, pacemakers and other measures to support the cardiac and respiratory systems, and pain relief.

AOC 1001 was shown in the phase 1/2 MARINA trial to achieve improvements in myotonia (when muscles are unable to relax after contraction), muscle strength, and mobility over six months. Avidity has scheduled an investor briefing later today to present data from an open-label extension (OLE) to that study that is following patients for up to two years.

Chief executive Sarah Boyce has said that 2024 will be a “transformative year” for Avidity, as it starts the phase 3 programme for AOC 1001, reports data with two other clinical-stage candidates in facioscapulohumeral muscular dystrophy (FSHD) and Duchenne muscular dystrophy (DMD), and advances other programmes towards human testing.

It is an ambitious programme, and the $400 million placement will provide a boost to Avidity’s already-strong cash position of around $595 million at the end of 2023, which the company said was already sufficient to fund operations through to the end of next year. The new cash runway will last until the latter half of 2026.

Avidity reported initial clinical results for DMD treatment AOC 1044 in December, showing that the AOC could be delivered to muscle and achieved the desired effect of ‘skipping’ exon 44 mutations in the dystrophin gene. Preliminary efficacy data from the phase 1/2 EXPLORE44 study is due later this year.

The biotech is also preparing for the first data readout from its FORTITUDE phase 1/2 study of AOC 1020 in FSHD.

“We know how important these potential new treatments are for the patient community and are working diligently to bring these much-needed therapies to people living with rare diseases,” said Boyce.

The private placement is for more than 15 million common shares at an asking price of $16.50. Avidity’s share price is currently above $20, more than twice its value at the start of the year and valuing the company at around $1.6 billion.