Oxford BioMedica signs $100m CAR-T deal with Novartis

Oxford BioMedica has signed a deal worth up to $100m with Novartis to supply modified viruses used to generate its CAR-T therapies.

The deal represents a major financial boost for the UK biotech firm, which provides bioprocessing services for third parties as well as advancing its own gene and cell therapies.

Novartis' CTL019 could be the first groundbreaking CAR-T to gain approval later this year, but will rely on a complex manufacturing process - and any problems in this area could delay approval or subsequent availability for patients.

The deal covers lentiviral vectors used to generate CTL019, which could be approved by the FDA within months, and other undisclosed Chimeric Antigen Receptor T-cell products.

While the FDA is reviewing CTL019 for relapsed and refractory acute lymphoblastic leukaemia (ALL) in paediatric and young adult patients, Novartis is building manufacturing capacity in anticipation of a launch later this year.

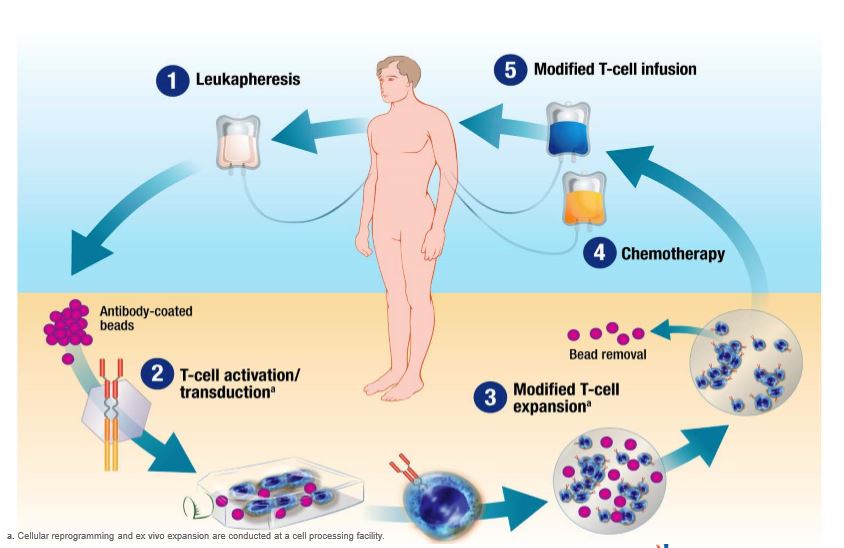

CAR-T therapies work by harvesting a patient’s own T-cells and genetically altering them with a lentiviral vector so they target receptors on the surface of cancer cells.

Oxford Biomedica and Novartis have already been collaborating since 2014 and the expanded agreement includes $10 million upfront plus undisclosed performance incentives and fees for bioprocessing and development services.

The deal lasts three years, extendable to five years if both companies agree to.

As previously agreed, Oxford BioMedia will receive undisclosed royalties on potential future sales of Novartis’ CAR-T products.

John Dawson, chief executive of Oxford Biomedica, said the new deal would strengthen his firm's balance sheet immediately and support its continued growth over the next three years.

"Oxford BioMedica is recognised as a world leader in the field of lentiviral vectors and we are delighted to be supporting Novartis and patients with commercial supply of the lentiviral vector used to generate CTL019.”

Novartis filed CTL019, also known as tisagenlecleucel, with the FDA at the end of March, giving it a narrow lead over Kite Pharma and its CAR-T therapy axicabtagene ciloleucel, formerly known as KTE-019.

CAR-T therapies could revolutionise treatment of haematological cancers – CTL019 produced complete remission in 82% (41 out of 50) patients at three months after infusion in a phase 2 trial.

But this has to be balanced against significant side effects, as the therapy can cause the immune system to go into overdrive and begin attacking a patient’s own body.

So far, there have been no deaths on trials involving Novartis’ CAR-T, but there has been a patient death in a trial of Kite’s KTE-C19, which the FDA is reviewing in advanced non-Hodgkin lymphoma.

Evaluate Pharma predicts peak sales for Novartis’ drug approaching $4.7 billion, while Kite’s rival could generate sales of $7.9 billion.