MSD buys Modifi for $1.3bn to boost oncology pipeline

MSD has acquired Yale University spinout Modifi Biosciences, claiming ownership of a potential new class of therapeutics for difficult-to-treat brain tumours, including glioblastomas.

Under the terms of the deal, MSD (known as Merck & Co in the US and Canada) is paying $30 million upfront for Modifi, with up to $1.4 billion in milestone payments tied to the development of its drug candidates, which target cancer cells lacking expression of a DNA repair protein called O6-methylguanine methyl transferase (MGMT).

Approximately half of glioblastomas and more than two-thirds of grade II and III glioma tumours are deficient in MGMT.

Modifi was only formed in 2021 and its drug candidates are still in preclinical development, but the science behind them has been featured in the journal Science and the biotech's researchers have shown they have activity across a number of tumour models, including patient-derived xenograft glioma models and other cancers with DNA repair defects.

"DNA repair defects are a frequent hallmark of tumour cells and a major cause of resistance to cancer therapy," commented Dr David Weinstock, head of discovery oncology at Merck Research Laboratories.

"The talented Modifi Biosciences team has developed an innovative approach that we believe has potential for treating some of the most refractory cancer types," he added.

The New Haven, Connecticut-based start-up has been hoping to show that its drug candidates have potential in glioblastoma multiforme (GBM), the most common type of glioma, which is highly aggressive and in desperate need of new treatment strategies.

At the moment, most GBM patients are treated with temozolomide chemotherapy, but resistance develops in more than half of them, often through the MGMT pathway.

"We designed our small molecules to have the ability to uniquely overcome clinical resistance mechanisms that have been known for decades, but until now have been non-actionable," said Seth Herzon, who co-founded Modifi alongside fellow Yale researchers Ranjit Bindra and Kingson Lin and HighScape Capital's Kevin Rakin.

The agreement is one of a series of pipeline-boosting deals that MSD has signed to offset a fall-off in revenues from its $25 billion blockbuster Keytruda (pembrolizumab) that is expected to occur when it loses patent protection, expected around the end of the decade. It has also chalked up some disappointing trial results with LAG-3 and TIGIT immuno-oncology programmes.

Other recent examples in the cancer arena include a $1.3 billion deal with Curon that added a bispecific drug for B-cell diseases in August and its licensing of three antibody-drug conjugate (ADC) therapies from Daiichi Sankyo for $4 billion upfront in October last year.

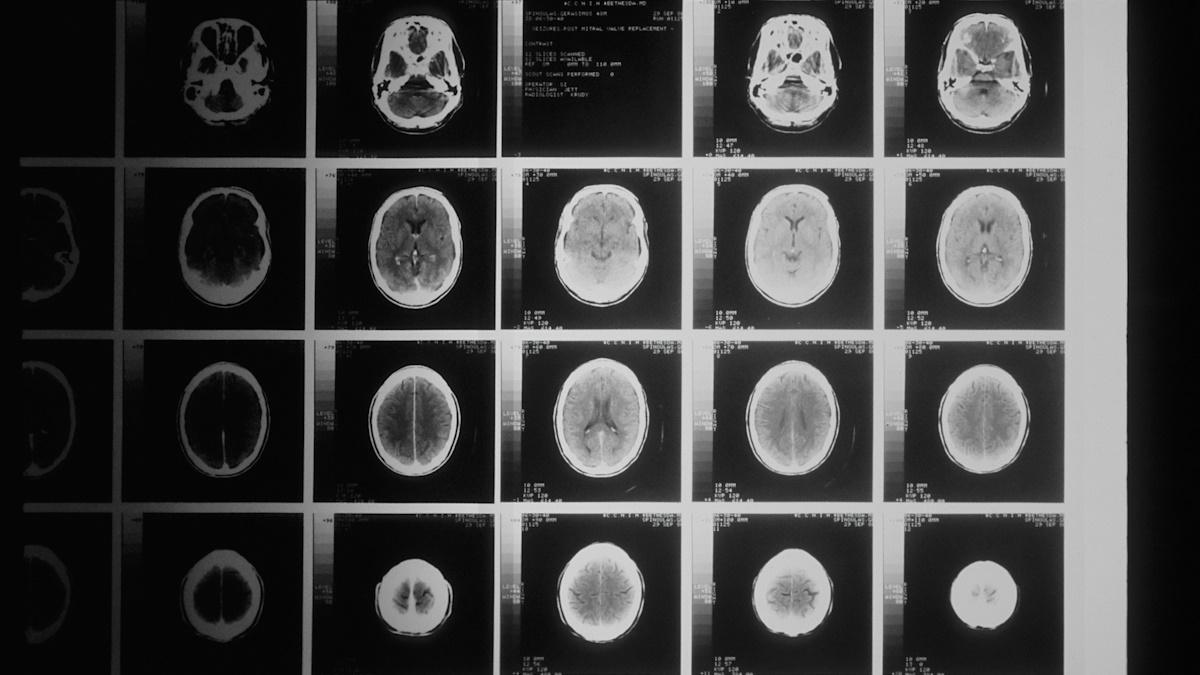

Photo by National Cancer Institute on Unsplash