Merck bets on Inspirna’s colorectal cancer drug ompenaclid

Germany’s Merck KGaA is paying $45 million upfront for rights to a potentially first-in-class drug for colorectal cancer (CRC) being developed by New York biotech Inspirna.

The agreement gives Merck exclusive ex-US rights to ompenaclid – an oral inhibitor of the creatine transport channel SLC6A8 – as well as options to co-develop and co-promote the drug in the US and follow-on SLC6a8 candidates.

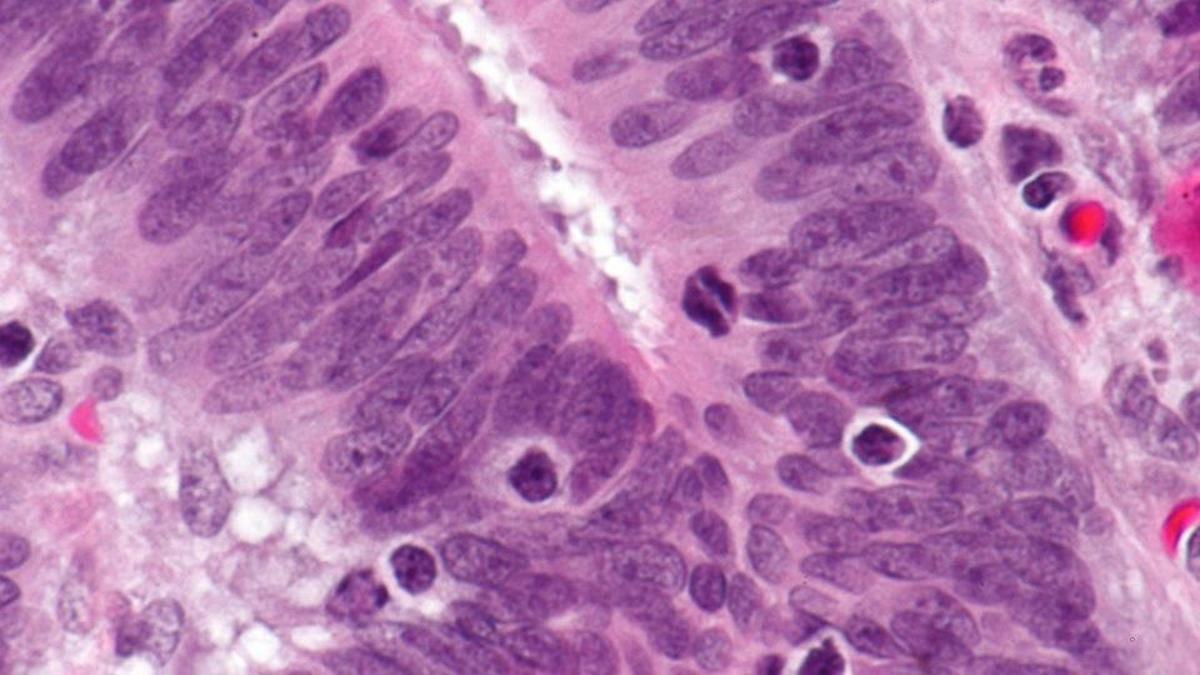

Ompenaclid (RGX-202) is in phase 2 testing as a second-line therapy for RAS-mutated advanced or metastatic CRC, a patient population that has seen little in the way of treatment innovation in recent years.

Phase 1b/2 data reported at the ESMO cancer congress last October suggested that the combination of the drug and standard second-line therapy with FOLFIRI chemotherapy and bevacizumab has the potential to improve outcomes, without adding to its toxicity burden.

The drug achieved an overall response rate of 37% – 11 partial responses out of the 41 patients treated – with median progress-free survival (PFS) of 10.2 months and median overall survival of 19.1 months, which Inspirna said exceeded what would be expected with FOLFIRI/bevacizumab alone.

Since then, it has started a 50-patient phase 2 trial comparing ompenaclid to placebo given on top of FOLFIRI/bevacizumab in second-line RAS-mutant advanced or metastatic CRC, with results due in 2026, according to the clinicaltrials.gov listing for the study.

Advanced metastatic CRC has a desultory five-year survival rate of around 14%, with a median duration of survival of three years or so, and the 40% to 45% of patients whose tumours are RAS-mutated typically fare less well and are less likely to respond to other second-line options like Merck’s own EGFR-targeting antibody Erbitux (cetuximab).

This year marks the 20th anniversary of the introduction of Erbitux, which is sold by Eli Lilly in the US. The drug remains a major earner for Merck, with sales still running in excess of €1 billion a year, despite losing patent protection several years ago. It has proved difficult to develop biosimilars of the antibody due to its structural complexity.

“With our expertise in the treatment of CRC, and based on the encouraging early data for ompenaclid, this agreement with Inspirna offers the opportunity to advance a potential new first-in-class therapy that may improve outcomes for patients,” remarked Victoria Zazulina, head of cancer drug development at Merck.

Along with Erbitux and now ompenaclid, Merck is also developing M9140, a CEACAM5-targeting antibody-drug conjugate with an exatecan payload that is in an ongoing phase 1a/b study in patients with mCRC.

The Inspirna deal comes shortly after Merck suffered a major late-stage pipeline blow with the failure of multiple sclerosis candidate evobrutinib in two phase 3 trials.

Merck acknowledged at an R&D update last year that it had a pressing need to bolster its pipeline, particularly through external ‘bolt-on’ partnership deals, and get drugs through development and onto the market more quickly. It set a target of launching a new product every 18 months.