J&J abandons work with Genmab on Darzalex successor

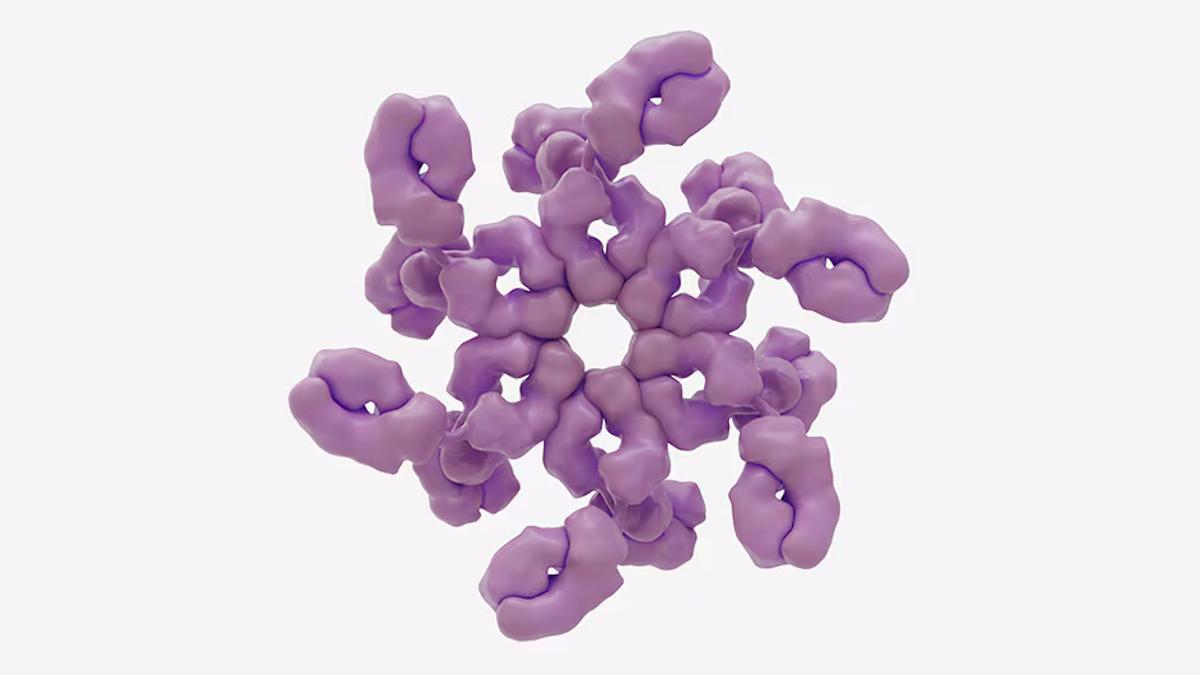

HexaBody is Genmab’s proprietary antibody platform designed to generate potent therapeutics by inducing antibody hexamer formation after target binding at the cell surface.

Genmab is facing increased pressure to deliver on its in-house pipeline after its partner Johnson & Johnson backed out of a much-anticipated project.

The two companies worked together on blood cancer blockbuster Darzalex (daratumumab) – a CD38-targeting antibody which brought in almost $12 billion in sales worldwide last year – but J&J has decided it is no longer interested in pursuing the development of follow-up HexaBody-CD38 (GEN3014).

It won't take up an option on the drug, cutting off Genmab from a source of future revenues, despite what the Danish biotech said was "robust clinical efficacy" in trials.

Under the terms of their original agreement for the drug in 2019, Genmab could continue to develop and market HexaBody-CD38 for Darzalex-resistant patients, and certain other indications, but in its update, said: "Following a thorough evaluation of the data, the market landscape, and…rigorous portfolio prioritisation, Genmab will not pursue further clinical development of HexaBody-CD38."

As its name suggests, the new drug was created using Genmab's Hexabody technology, which enhances the effect of the 'tail' of the Y-shaped antibody molecule in order to improve its potency and efficacy.

One reason for J&J's decision could be the strong performance of a newer subcutaneously administered formulation of daratumumab, Darzalex Faspro, which has been driving the franchise's sales growth.

A head-to-head trial of HexaBody-CD38 versus Darzalex Faspro revealed an overall response rate (ORR) of 55% and 52%, respectively, with Genmab pointing to "deeper responses" with the new drug and a manageable safety profile.

Genmab chief executive Jan van de Winkel said that the company was "disappointed" by J&J's exit from the alliance.

Still, he stressed that the strength of other programmes – including AbbVie-partnered Epkinly (epcoritamab) for non-Hodgkin lymphoma and phase 3 candidates Rina-S (rinatabart sesutecan) for ovarian cancer and acasunlimab for non-small cell lung cancer (NSCLC) – makes him "confident in the potential of our existing pipeline."

He also said that the clinical data with HexaBody-CD38 was a validation of the technology platform, and the company's focus now will be to maximise the potential of its commercial medicines, accelerating its in-house pipeline, and pursuing "focused business development and M&A opportunities."

Shares in Genmab have lost around 8% of their value since J&J's decision to exit the alliance was announced. The company said it did not expect it to have any impact on its financial guidance.