Illumina eyeing future of Grail as EU shoots down merger

The EU has blocked the merger of Illumina and Grail, saying the deal would stifle innovation in blood-based diagnostics for cancer diagnostics, just days after a bid by the US authorities to do likewise was blocked in the courts.

The European Commission said in a statement this afternoon that Illumina had not provided enough assurances to address its concerns that the $7.1 billion merger would squeeze other players in the liquid biopsy category out of the market.

The DNA sequencing company said afterwards that it has started a strategic review of the Grail business – suggesting it could be divested – although it also said it is reviewing the order and intends to appeal.

While Illumina completed the takeover of Grail last September, it has maintained the business as a separate subsidiary company while it waits for the outcome of antitrust reviews in the US and Europe.

Now, the door to full integration has been slammed shut by EU authorities, which remain convinced that the merger would be anticompetitive.

"In a race with other companies, Grail is developing a blood-based early cancer detection test. If successful, these tests will revolutionise our fight against cancer and help to save millions of lives," said Margrethe Vestager, who is in charge of competition policy at the Commission.

https://twitter.com/vestager/status/1567117299324260352

"Illumina is currently the only credible supplier of a technology allowing to develop and process these tests," she added. "With this transaction, Illumina would have an incentive to cut off Grail's rivals from accessing its technology, or otherwise disadvantage them."

Not so, insists Illumina. Its general counsel, Charles Dadswell said that Grail's technology "would be more available, more affordable, and more accessible – saving lives and lowering healthcare costs" – if Grail stays within its fold.

Illumina would accelerate the commercial entry of Grail's Galleri diagnostic platform into the EU at scale "by at least five years, saving tens of thousands of lives in the EU and billions of euros in healthcare costs," claimed the company.

Last week, a judge in the US ruled in favour of Illumina in a dispute with the Federal Trade Commission (FTC), which has objected to the merger on similar grounds to the EU and also says it plans to appeal.

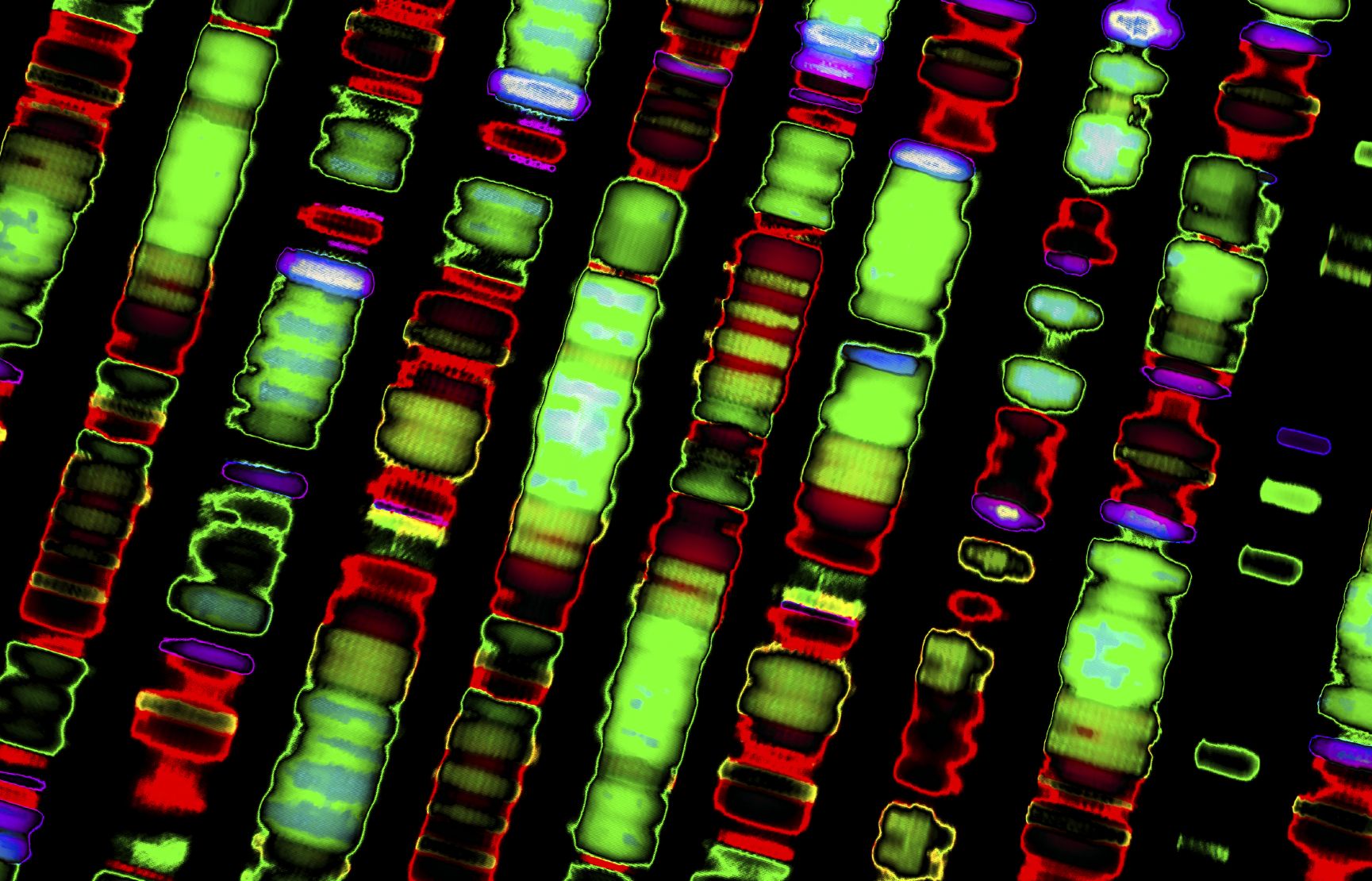

Illumina equipment is used to analyse DNA in blood samples, and – as the dominant player in this category – the FTC was concerned that it could squeeze other liquid biopsy developers out of the emerging market.

The company has said it would guarantee access to its sequencing services for existing clinical oncology customers, and also reduce its prices.

Illumina earlier tried to argue that the EU had no jurisdiction over the merger, but a court in Luxembourg ruled in the Commission's favour and said its review could go ahead.