Digital health financing drops again, but don't worry yet

After a bumper 2021, the fall-off in digital health financing deals that started to appear early this year has continued, with the three month to end of September the lowest funded quarter since the tail end of 2019.

All told, digital health companies raised $2.2 billion from 125 deals in the third quarter, taking the tally for 2022 to $12.6 billion and 458 deals, respectively, according to new figures from Rock Health, which point to a big pullback in late-stage deal financing.

That casts doubt that the total haul for 2022 will reach even half the massive $29.2 billion achieved in 2021, when pandemic-fuelled excitement about digital health was at its height.

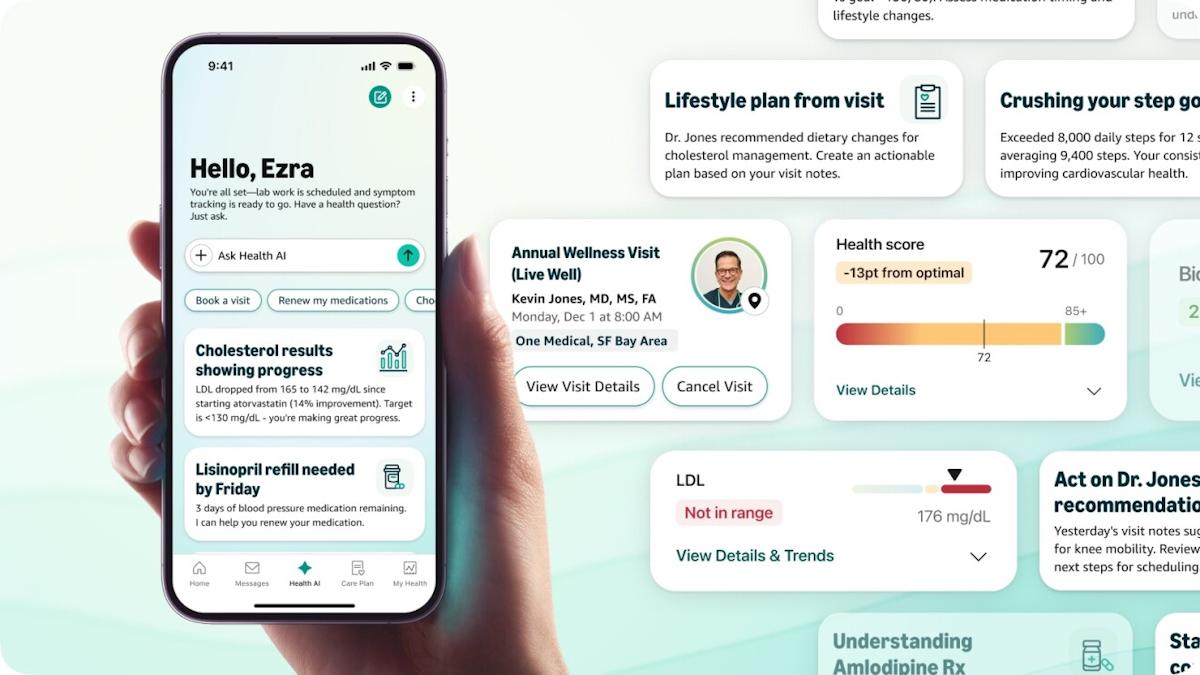

It's not as bleak as it may seem, however, according to Rock Health researcher Mihir Somaiya, who says the quarter included some "standout" activity, including Amazon's $3.9 billion deal to buy One Medical, CVS' $8 billion play for Signify Health, and Akili's public exit via a black-cheque company merger.

"Given the year's choppy venture waters and public market correction, investors are holding back from the market, waiting to strike once things stabilise," writes Somaiya in the update, also pointing out that while it has declined 48% by value, the number of transactions has only dropped 14%.

The reduction in large, late-stage deals comes in part because some were brought forward into 2021 as a result of the financing-friendly climate, while others are happening "behind closed doors via arrangements like round extensions and venture debt," he reckons.

Some, meanwhile, are likely not happening at all, given current sentiment towards the sector, so digital health start-ups "are making do by running leaner businesses", while they wait for an uptick and a stronger IPO market.

As the year enters its last three months, among the trends to note are smaller deal values overall, and a focus on early-stage funding, as investors hunt for complementary businesses to round out portfolios.

The changing appetites can be seen by breaking the deals down into categories. Start-ups focused on helping biopharma and medtech companies carry out R&D have fallen from first to third in the funding rankings, while specialists in nonclinical workflow tools jumped to first place from seventh.

Interest in telehealth seems to be waning, with attention "turning to immersive and decentralized health-tech enablers," according to Somaiya.

Companies focusing on mental health tools continued to lead the table by therapeutic category, although there has been a shift to complex disease states, and oncology care remains strong in second place.

"Q3 represented a clear departure from the COVID-driven digital health financial market," writes Somaiya. "We've seen a gradual return to pre-pandemic asset pricing [and] rational prices promote long-term market health and, if anything, diminish near-term worries."