Celgene hit by FDA rejection of MS drug filing

Celgene paid $7.2 billion to acquire Receptos and its multiple sclerosis hopeful ozanimod in 2015 – but it has hit a major setback after the FDA refused to accept its dossier.

The New Jersey-based pharma said it had received a Refusal to File (RTF) letter from the FDA for ozanimod, an oral pill that the company hopes will allow it to build a significant presence outside of cancer, where most of its sales are based.

The FDA informed the company that the nonclinical and clinical pharmacology sections in the filing were insufficient for a complete review.

Celgene said it will seek immediate guidance and a meeting with the FDA to find the additional information required to refile.

The company had hoped for US approval for ozanimod by the end of the year, but this is now unlikely, and the announcement sent shares down by 7%, the lowest they have been for four years.

In failing to provide sufficient detail in its pharmacology sections, the rejection seems to highlights an apparent major oversight by Celgene.

This adds to its woes elsewhere in the business. Last autumn it decided to axe development of its gene silencing drug, mongersen, a drug it was developing for Crohn’s disease following a phase 3 trial failure.

Celgene had paid $710 up front for the drug, developed by a little-known Irish biotech, Nogra Pharma, and had tipped it to produce peak annual sales in the region of $5 billion.

[caption id="attachment_32971" align="alignnone" width="112"] Mark Alles[/caption]

Mark Alles[/caption]

CEO Mark Alles told pharmaphorum in an interview in 2016 that the bidding process for mongersen was “one of the most competitive” he had ever seen, and was pleased that the company had “won the molecule”.

Ozanimod is similarly important for the company, which forecasts it could bring in peak annual sales of between $4-6 billion.

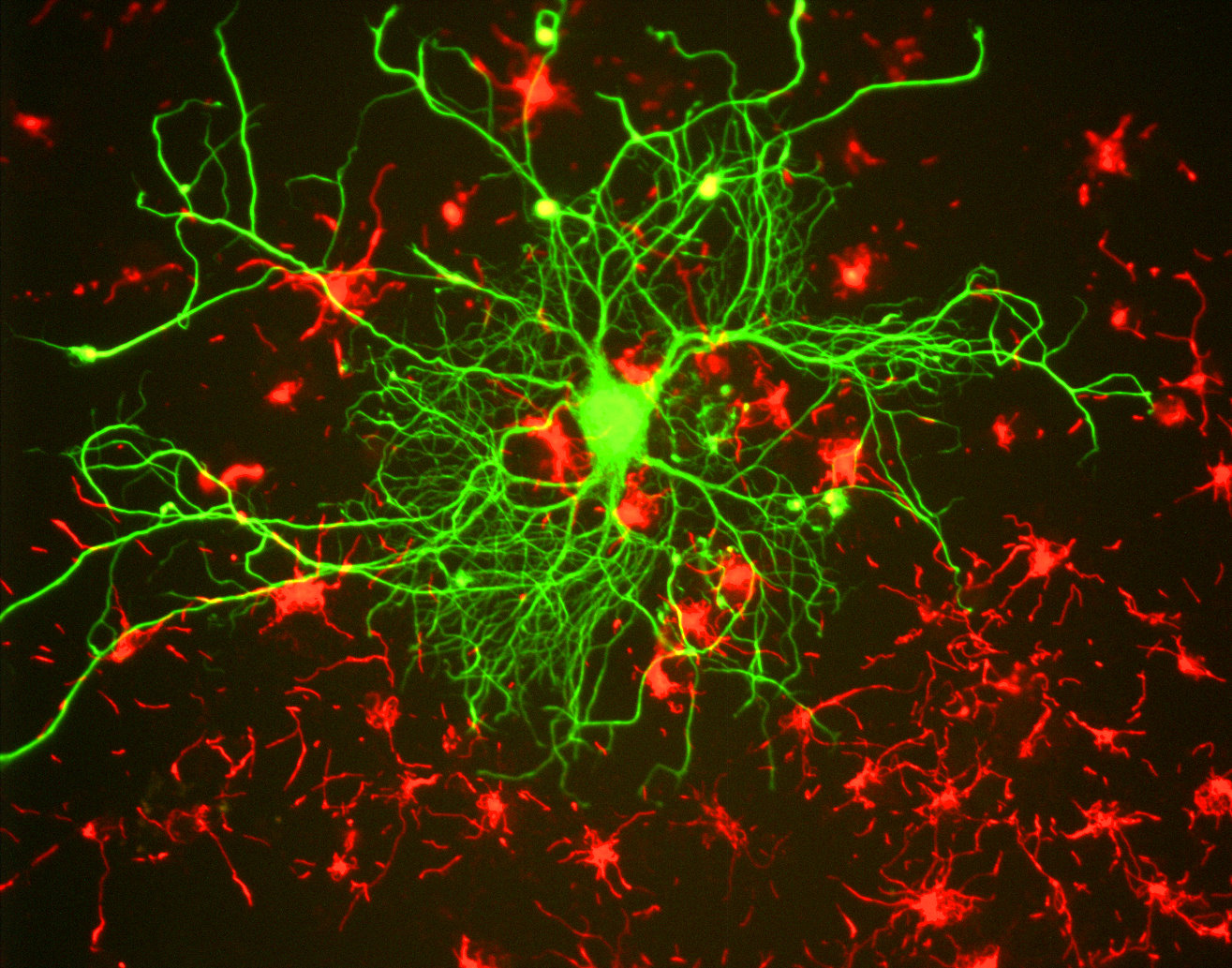

Celgene hopes ozanimod will compete with other MS pills such as Merck KGaA’s Mavenclad, Biogen’s Tecfidera, and Novartis’ Gilenya, providing a more convenient alternative to injected medicines that have been the standard of care for many years.

It’s worth noting that unlike mongersen, ozanimod cleared the phase hurdle of phase 3 trials by outperforming Biogen’s injected MS drug Avonex at reducing yearly relapse rates and MRI brain lesions.

But while the RTF letter is an embarrassing and costly setback, the drug still looks fundamentally sounds thanks to its phase 3 SUNBEAM and RADIANCE studies that form the basis of the filing.

Celgene has stressed there is no need for any new pivotal trials, though further non-pivotal studies may be required, and is currently re-evaluating its likely timelines.