Baxter will sell biopharma unit to investors for $4.25bn

Baxter has reached an agreement to sell its contract development and manufacturing organisation (CDMO) business to a pair of private equity companies, raising $4.25 billion in cash that will be used to pay down its hefty debt.

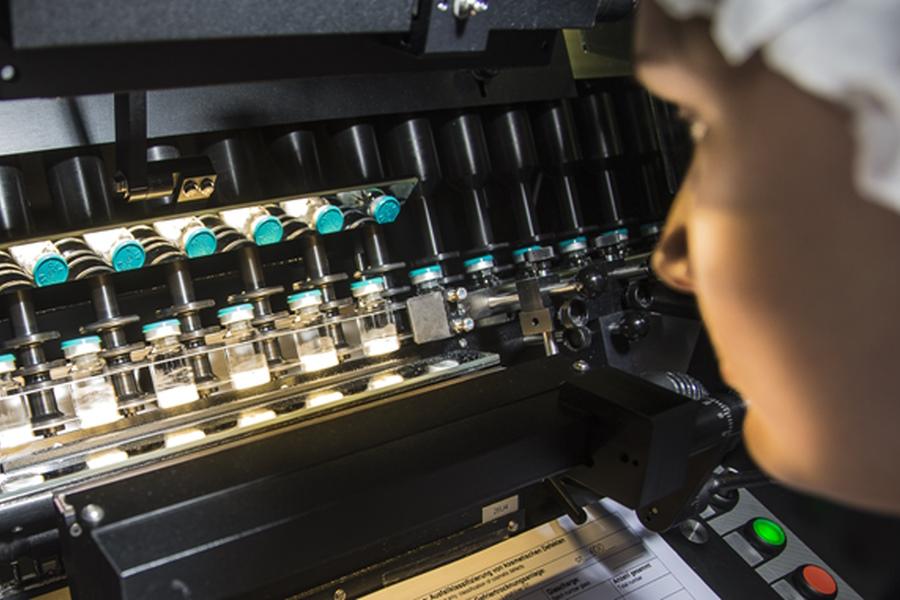

The sale to Advent International and Warburg Pincus comes amid rumours that Celltrion and Thermo Fisher were also interested in acquiring the BioPharma Solutions (BPS) business, which provides sterile contract manufacturing solutions, parenteral delivery systems, and other support services to the pharma and biotech industries.

Baxter ended 2022 with almost $17 billion in debt, following its $10.5 billion takeover of medical device and hospital equipment manufacturer Hillrom at the end of 2021. It ended last the year with a valuation of around $19 billion.

The company has made debt repayment a priority, with the sale of BioPharma Solutions central to that effort, along with the proposed spin-off of its $5 billion kidney care operations – spanning dialysis machines and related supplies and services – into a separate company.

It expects to make around $3.4 billion net from the BPS sale, which is due to complete in the second half of the year, and will all go towards lowering its debt.

The deal will result in dilution of approximately $0.10 to the company’s earnings per share when it closes, slightly offset by lower interest payments, which have been well over $100 million for the last couple of quarters.

Once the CDMO sale and kidney care deals complete, Baxter will focus on drug delivery, clinical nutrition, pharmaceuticals, and hospital equipment, including patient support and surgical systems.

The sale of BPS – which has annual revenues of around $600 million from activities across a spectrum from clinical research to commercial deployment – includes manufacturing facilities and around approximately 1,700 employees in Bloomington, Indiana, and Halle, Germany, said Baxter in a statement.

The company’s chief executive, Joe Almeida, said that the two private equity firms are highly experienced at helping healthcare companies develop and grow: “I am confident that, under their stewardship, BPS will continue to build on its leadership position, foster world-class talent, invest in new capabilities and capacity, and provide leading-edge, high-quality solutions for its clients.”

On Baxter’s first-quarter results call, Almeida said the sale of BPS would open up “opportunity for Baxter for future reinvestment, and even stock share buybacks and other opportunities.”

He also said that the spin-off of the kidney care business was “well underway” and will create a standalone company with 2022 sales of approximately $4.5 billion and upwards of a million patients across more than 70 countries. The company is expecting to complete the process by July 2024.