Astellas adds to cell therapy drive with Poseida deal

Astellas has added another programme to its growing cell therapy pipeline via an agreement with Poseida on an off-the-shelf CAR-T therapy for solid tumours.

The Japanese pharma is paying $50 million upfront for an option on P-MUC1C-ALLO1, an allogeneic CAR-T still in early-stage clinical development, which includes $25 million to buy an 8.8% stake in San Diego-based Poseida. It also gets an observer seat on the US biotech's board and a say in any change in control of the company.

The deal is a fillip for Poseida, still dealing with the loss of a wide-ranging alliance with Takeda in June focused on the development of up to eight gene therapies, which was agreed in 2021 with a potential value of around $3.6 billion if all objectives were met.

That alliance came to an end after Takeda said it was stopping all work on adeno-associated virus (AAV) gene therapies, and Poseida is hoping to find a new partner for at least some of the programmes whilst deciding if it can take any forward on its own.

P-MUC1C-ALLO1 targets solid tumours derived from epithelial cells, including breast and ovarian cancers, and is currently in a phase 1 clinical trial with results expected later this year. However, due to changes in dosing, there will be a limited amount of data available until 2024, said Poseida.

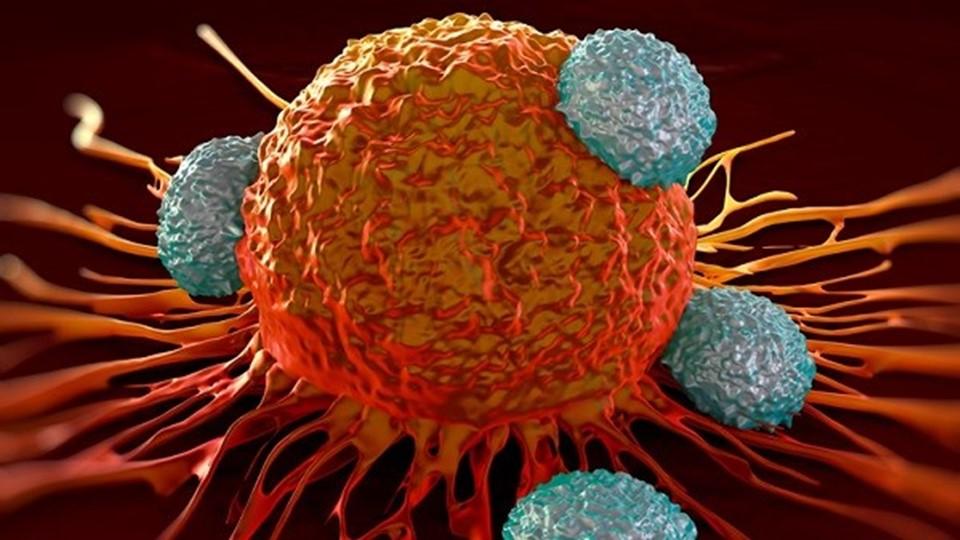

The biotech says its platform can generate off-the-shelf therapies that do not require the complicated production schedules of those that rely on harvesting cells from patients and could also extend the use of CAR-T into solid tumours, which so far have only been effective in haematological cancers.

Astellas, meanwhile, has made cell therapy a key part of its R&D strategy, particularly in the area of immuno-oncology, where it is also working on oncolytic viruses, bispecific immune cell engagers, and small-molecule drugs.

The Poseida agreement comes amid a series of other deals by the Japanese pharma aimed at building its cell therapy pipeline, including the $665 million takeover of Xyphos Biosciences to claim rights to its cell therapy development platform, along with alliances with Mogrify for hearing loss and Minovia for diseases caused by mitochondrial dysfunction.

It also signed an $898 million partnership Adaptimmune on allogeneic T-cell therapies for cancer in 2020, but that was recently disbanded.

"We are focused on reinvigorating the immune system's ability to discover, disarm, and destroy cancers in more patients," said Adam Pearson, Astellas' chief strategy officer.

"We believe that this investment fits strategically with our long-term vision of expanding our capability in immuno-oncology," he added.