New NICE Advice service

Leela Barham digs into what’s publicly available on the success of NICE Advice just as the institute launched a refreshed offer to life sciences companies. She argues that evidence of the difference it makes is needed more than the PR spin.

Refreshed offer

On 6th November 2023, NICE launched its new refreshed offer for providing advice to life sciences companies. The original NICE scientific advice service was one of the first offered to companies by a health technology assessment (HTA) agency and was launched in 2009.

Companies have to pay a charge for the majority of advice services, although, how much isn’t stated and NICE only describes it as “a flexible service customised to meet your needs and budget.” That's not all that is confidential, with NICE not revealing which companies, for which products, advice has been given, let alone what the advice was.

Just as before, companies can get scientific advice from NICE alone, with the UK regulator, the MHRA, as well as with the Canadian HTA agency, CADTH. The offer is still the same to get advice on health economic models (previously known as PRIMA) and for the option to use NICE’s evidence gap analysis tool, META.

There are also options to meet for an hour to get insights on routes to access and the relevant NICE process (a NICE surgery), get a therapeutic landscape summary, including discussion with NICE experts, as well as a system engagement meeting where NICE plus others who matter will meet with the company for two to three hours. The system engagement meeting was known before as a safe harbour meeting. There are education opportunities, too, some free and others charged for.

From the internal side, the real differences emerge; NICE has brought together the in-house teams that were previously separate. Now, staffers work together from what was previously the nice scientific advice team, the Office for Market Access (OMA) team, as well as the international team. That’s according to the minutes of the July 2023 NICE board meeting. The international team has ebbed and flowed and hasn’t appeared as a line item in NICE’s annual report in recent years.

However, perhaps another difference is the heavy PR influence on the website write-up. Companies can “make lasting connections and hear different perspectives and solutions that act as a springboard to achieving your market access goals”, through system engagement for example. Can NICE Advice live up to that?

Key performance indicators

NICE will undoubtedly have key performance indicators for their advice offer. Exactly what those are isn’t clear from the public domain sources; the most recently available integrated performance report presented at the September 2023 board meeting mentions only the financial position of NICE’s advice offer. (It is worth remembering that NICE has been changing what and how it reports, in the past more detail being typically covered in routine board reporting; perhaps less is more to the board members themselves, but less obvious is whether this has an impact on transparency, as there are now lots of different separate places to check for relevant information.)

As of July 2023, the old-style NICE Scientific Advice service was in a deficit of £137,000. The report notes that the team had a strong end to the 2022/23 financial year, with a surplus of £409,000. Driving the current financial year’s deficit was a mix of postponed or cancelled advice slots in the first quarter of 2023/24. That position is predicted to change and break-even is anticipated by the end of 2023.

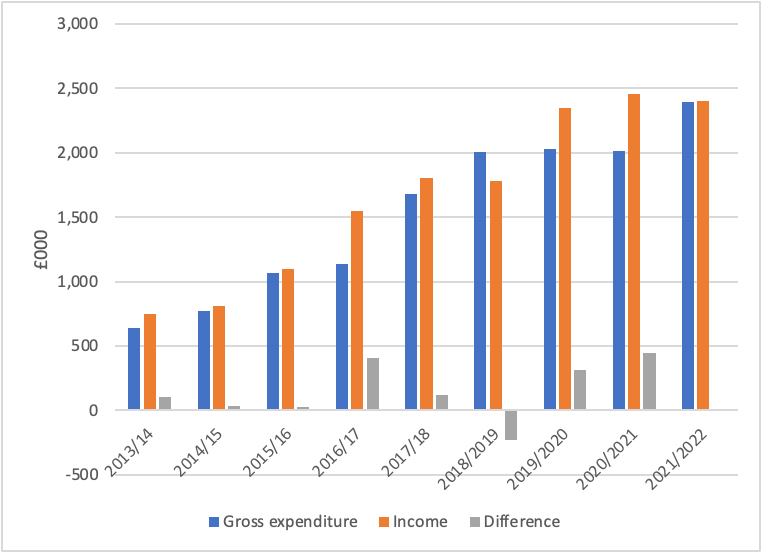

To put the financials into perspective, NICE advice services have typically fared better in the past, with surpluses more common than deficits (Figure 1). Companies have been willing to pay for advice. It’s not clear though if more of them are, if it’s repeat business, or if the fees have changed that have led to the rising income over time. That’s because these details aren’t made publicly available. It’s clear that, on the metric of ensuring break-even (or better), NICE has been successful in delivering the service. Growing income should also be seen as a big success.

When it comes to whether customers think it’s worth it, it’s less clear. The 2020/21 NICE annual report is the only one that revealed the number of NICE scientific advice projects delivered: 84 that year. With an income of £2.458m, the average cost comes out at around £29,000. Is that good value for money? Probably, although only the companies will know.

Figure 1: Gross expenditure and income from NICE scientific advice services, 2013/14 to 2021/22

Source: NICE annual reports. Note the 2012/13 annual report does not separately identify gross expenditure and income for NICE scientific advice, it is combined with NICE International.

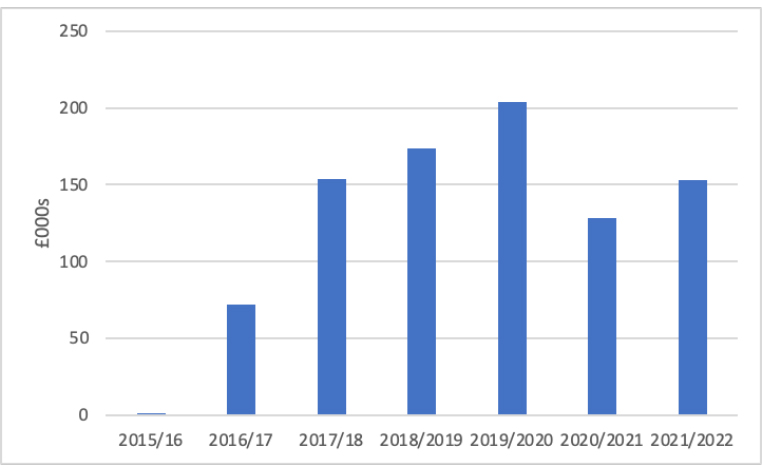

Income from OMA has been more variable and far less than that for scientific advice (Figure 2).

Figure 2: Income from OMA, 2015/16 to 2021/22

Source: NICE annual reports. NICE annual reports do not identify gross expenditure only income for OMA. OMA was launched in 2015.

Impact of advice

There are two quotes from companies – Organon and Gilead Sciences - who have used NICE advice services in the past to tempt companies to take up the opportunities. There’s also a case study from the Organon experience.

For an organisation that is all about evidence, two quotes and a case study can be charitably described as light on detail. Especially when there is evidence of the difference getting advice can make.

Analysis by NICE staffers has found that products from companies who have sought advice between April 2020 and May 2023 had faster publication of guidance than those who had not, a median of 109 days earlier. Not only that, but the products were more likely to achieve a higher clinical-added value than those that did not. Similar evidence was presented to ISPOR in 2020. There could be yet more evidence out there of the difference it makes, too (if you’ve seen some, let me know, especially on the difference it makes to the NICE recommendation).

Debatable, but since the ‘customers’ for NICE Advice will include health economists and other experts in evidence, showing them the evidence could well make it more enticing for them to take up the offer. What company wouldn’t want to get a faster and ‘better’ recommendation from NICE by hearing from them directly, especially if it’s value for money to do so? That presumes that they will be submitting to NICE though, something that not every company is doing these days.

Competitive reality

NICE is competing with other sources of advice. That includes with other HTA agencies, since staffers at companies may not be able to convince the powers that be that they should have the budget to meet with them all, they may not have enough in-house resources to do so in any case. There are also opportunities to meet with the European regulator and European HTA agencies at the same time.

Then, there are the many consultancies that offer much the same services, some of which will have former NICE staffers and/or those who have worked for NHS England, a key payor in the NHS in England.

Some deep technical experts have never actually held a staff position at NICE – those working at the evidence review groups who provide their independent view of company submissions and have worked on NICE methods and processes, too – that can provide advice. Many of those experts also work at, or with, consultancies.

Companies might not need to hear from today’s NICE staffers and, in any case, there is a separation between those companies who meet with NICE Advice and those who make decisions and come up with NICE recommendations.

It's this competitive reality that means NICE should set out the difference it makes to get NICE Advice. It needs to do this to ensure that it’s a continued success because, even though it’s not about profit, NICE does need to cover its costs. And it seems that’s getting harder to do.