Strategies in RA: blockbusters, orals, and biosimilars in the US

The future RA market will be dominated by how innovative orals and biosimilars interact with existing stakeholders, particularly whether they will be able to unseat the blockbuster market leaders, in our musculoskeletal disorder themed month Kristina Harter discusses.

Current market overview:

Since the 2002 launch of Humira, many products have entered the rheumatoid arthritis (RA) market, but the majority of sales still belongs to the big three anti-TNFs (Enbrel, Humira and Remicade). Even recent head-to-head trials by other branded products haven't been able to unseat them: Actemra showed superiority against Humira and Orencia showed non-inferiority against Humira. While it is yet to be seen if a recent study showing the non-inferiority of a triple generic regimen to Enbrel1 will impact utilization, an accompanying editorial expressed doubts that it would have a significant impact due to entrenched prescribing practices. Clinical preference and guidelines, combined with favorable placement on a majority of plans have solidified Enbrel, Humira and Remicade's position as three of the top ten best-selling drugs in the US2.

The launch of Xeljanz early this year made it the first of perhaps multiple oral medications approved for RA. Because of their new patient-friendly administration and novel method of action, the new orals are differentiated from existing therapies3. However, to become preferred products, orals will need to either convince payers to have an additional preferred agent or unseat another product on formularies.

Looking forward, the largest market event looming over the RA space is the entry of biosimilars. Starting with rituximab in 2015 and followed by adalimumab and infliximab, biosimilars could dramatically shake up product choice. RA is one of the biggest drug expenditures, so payers are looking for tools that will help them control rising costs. However, the market leaders can be expected to aggressively defend their share using their substantial market experience.

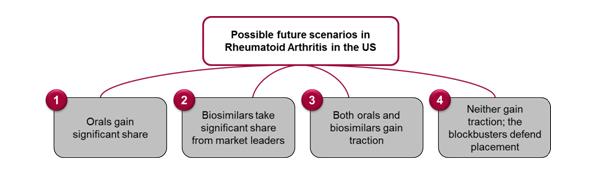

The future of the RA market will be dominated by how orals and biosimilars fare against the blockbusters. There are four scenarios of how the entrances will play out, as well as potential strategies that would help each of the players influence the market in their favor.

Four scenarios of how orals and biosimilars will shape the US RA market (in no particular order):

1. Orals gain significant traction

Physicians will need to consider the trade-off between the orals' clinical profiles and the value of oral administration. It's yet to be determined how much value prescribers will perceive in oral administration. Additionally, physicians still lack real-world experience with Xeljanz, which was "associated with serious safety concerns" according to an FDA pre-approval report.4,5

Oral administration has advantages in both costs of administration and patient convenience, but its effect on compliance is unclear, since it requires more frequent dosing. Without real-world compliance data to sway them, payers will most likely wait and watch uptake before considering changing their preferred medications. Therefore for payers, without physician pull, making an oral agent preferred probably does not make sense either clinically or financially. Because of these factors, orals need to generate substantial demand in the market so that their contracting offers will appear competitive to existing therapies.

2. Biosimilars take significant share from market leaders

Payers, under pressure to control spiraling costs in RA, are eagerly awaiting the entry of biosimilars, which are expected to come in at a significant discount to branded products (estimates between 20-30%). However, payers typically are less aggressive when it comes to switching existing patients. So, while payers can save money by putting new patients on a biosimilar, such a policy could risk all the rebate dollars from their existing patients on the branded agent. Payers will have to make a trade-off between savings on new patients and higher costs for existing patients.

Physicians have real-world clinical experience with the incumbents. Many stakeholders worry time in the market will expose unforeseen side-effects or less-than-anticipated efficacy with biosimilars, as they do for any new biologic. Additional questions surround the interchangeability of the biosimilars and their originator products. Many experts believe that interchangeability will be difficult to obtain and most likely only as a second step following biosimilarity and in-market studies. In the absence of interchangeability, biosimilars need to show clinical non-inferiority and then beat the branded products on net price. Then, as the manufacturer of Omnitrope, the first biosimilar launched in many markets, unfortunately learned, biosimilars also need to drive share to their products using a comprehensive strategy including marketing campaigns, reimbursement support programs, and injection devices. If biosimilar manufacturers can accomplish that while beating the branded products on price, payers will gladly push significant utilization to biosimilars.

3. Both orals and biosimilars gain traction and significant share in RA

Orals and biosimilars face an uphill battle against the RA blockbusters. Not only must they differentiate from the blockbusters, they also must contend with each other. But, if the manufacturers of orals are successful at differentiating on value and the biosimilars on price, it is likely that both classes gain share and at least partially unseat the big three in RA.

4. Enbrel, Humira, and Remicade successfully defend their placement in RA

Enbrel, Humira, and Remicade have significant leverage to defend their share. With physicians backing them, many plans prefer one or multiple anti-TNFs for use in biologic-naïve patients, often requiring step-throughs before a patient may try another mechanism of action. AbbVie and Amgen have been proactive, reportedly providing attractive contracts to protect their placement. Since they both have the volume, even a smaller rebate has the potential to provide large cost-savings to individual plans.

In order to protect their share, the blockbusters need to continue their active contracting. Another way manufacturers can maintain their value story is by providing clinical evidence for their products, possibly grounded in long-term data from thousands of patients that other products can't hope to match for years. If the manufacturers remain proactive in their defense of both placement and utilization, the continued strength of Humira, Enbrel, and Remicade based on clinical preference and volume cannot be underestimated.

Strategies moving forward:

While physicians make the final prescription decision, payers and their coverage have a moderating influence when there are many similar options. With the move toward tighter management and higher out-of-pocket costs, that influence will only increase. Payers are influenced by product pricing and contracting to varying degrees, but if a product can win widespread physician support and utilization based on its clinical merits, US plans will provide it with favorable access. Without prescribers' support, payers are going to be very reluctant to prefer a new product, requiring overall rebates that will be unrealistic for a product that doesn't have the share to compete with the RA blockbusters. For future success in an increasingly crowded RA indication, market players must consistently communicate a unique and convincing value proposition to both physicians and payers.

References

1. O'Dell, et al. "Therapies for Active Rheumatoid Arthritis after Methotrexate Failure"; N Engl J Med, 2013 Jun 11. Bathon JM, McMahon DJ. "Making Rational Treatment Decisions in Rheumatoid Arthritis When Methotrexate Fails"; N Engl J Med, 2013 Jun 11.

2. Drugs.com, "U.S. Pharmaceutical Sales – 2012".

3. Bloomberg Health Finance Brief- Key Catalysts, February 11, 2013.

4. FDA Arthritis Advisory Committee Meeting, May 9, 2012.

5. Forbes, "Pfizer's Key Drug Walks a Tightrope", April 22, 2011. Bloomberg, "Pfizer Arthritis Pill Raises Safety Concerns, FDA Staff Says", May 7, 2012.

About the author:

Kristina Harter is a consultant in the Life Sciences Division of Simon-Kucher & Partners, the world's leading pricing consulting firm. She is based in the firm's New York office where she focuses on product development and market access strategies across a range of indications, including specialty care, oncology and orphan diseases. Prior to joining SKP, she spent time researching stem-cell and cancer cell signaling and development, as well as working at a patent law firm. Kristina graduated from University of Pennsylvania magna cum laude with a BSE in Bioengineering.

How can RA treatments gain prescriber's support?