Operations can create competitive advantage in emerging markets

Operating models that work for developed markets won't necessarily succeed in emerging markets. Involving operations in emerging market strategy can avoid fragmented and misdirected investment, which often thwarts growth goals, Vitaly Glozman discusses.

Biopharmaceutical companies increasingly look to emerging markets for new revenue as profit margins in developed markets shrink. Yet uncertainty, operating risks, and country-specific challenges often thwart these efforts. Without market-appropriate operating models, companies often fail to achieve and sustain their growth goals in emerging markets.

A starting point: make the operations organization an equal partner in developing emerging markets strategy. To build competitive advantage, operations should partner with the commercial organization to identify and evaluate new markets, decide how and when to enter, and choose the types of strategic investments to pursue to enable market aspirations.

The many faces of emerging market strategies and operating models

A recent study analyzed the emerging market strategies, portfolio, target countries, and operating models of 15 leading biopharmaceutical companies. The study also assessed the growth potential and market access of developing countries, including the BRICs (Brazil, Russia, India, China) and select countries in EMEA (Europe, Middle East, Africa), South America, and Southeast Asia.

Among the key findings of the study was that most companies operate in emerging markets by extending the mindset gained from success in developed markets. When it comes to deploying investments, companies tend to give highest priority to the near-term objectives of market entry and revenue generation rather than balancing country-specific objectives with regional or global goals. These approaches typically don't provide efficiency and scale, and companies can end up with a fragmented operating network capable of only meeting individual country objectives.

"Without market-appropriate operating models, companies often fail to achieve and sustain their growth goals in emerging markets."

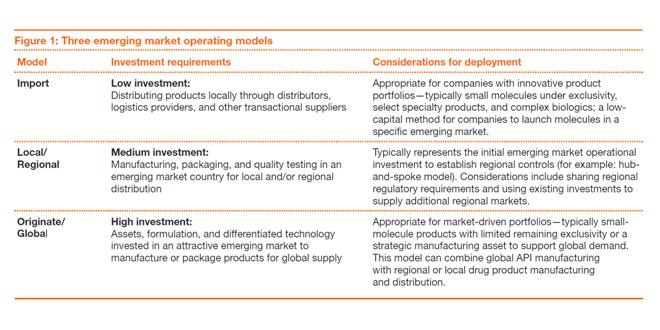

Choosing the right operating models: import, local / regional, and originate / global, can turn this scenario around. Each has different investment requirements and considerations for deployment (Figure 1).

The right operating model depends on a company's product portfolio and markets of interest. By considering these two dimensions, operations can map a direction for emerging markets strategy that balances market opportunity with operational risks and required investments.

Each of the operating models described above requires different levels of assets, ownership, financial control, governance, and technology. As companies move from innovation- to market-driven strategy, they should consider reconfiguring their operating models to address the challenges of increasing operational investment (number of assets and ownership stake) and complexity.

As companies increasingly engage in emerging markets business, they can develop the right operating models to make the most of their investments and balance risk. The right models will help them avoid over-investing in less attractive markets or under-investing in high-potential markets.

Developing the right approach for success in emerging markets

To succeed in emerging markets requires different thinking. Biopharmaceutical companies should quickly realize that established approaches for developed markets won't necessarily succeed in emerging markets. They may want to consider the following recommendations:

• Make operations an equal partner in developing emerging market strategy. In developed markets, operations typically follows the lead of the commercial organization. But operational success and corresponding risks can make or break emerging market aspirations. In developing markets, operations therefore should proactively partner with commercial and other functions to achieve near- and long-term business objectives.

• Consider an organizational focus on emerging market operations. Excelling in emerging markets requires dedicated focus. A separate cross-functional team should manage emerging market strategy, investment, planning, and execution. While emerging market operational resources should have the appropriate level of autonomy and decision-making rights, they should tightly integrate with other core emerging market functions, including regulatory, compliance, and commercial.

"...most companies operate in emerging markets by extending the mindset gained from success in developed markets."

One leading player in emerging markets started by developing a separate business division integrating commercial, R&D, and operations focusing purely on emerging markets. More of these singular focuses are likely to appear as emerging markets begin to take off and as companies realize they need to "up their game" to survive local competition.

• Take on non-traditional roles. A company can build competitive advantage by taking on roles that are not traditionally required or prioritized in established markets. Competitive differentiators include technology transfer, health agencies advocacy, partner management, regulatory launch capability, and value-added customer service.

For example, an international biopharmaceutical company with more than half its revenue coming from emerging markets found itself with an inflexible supply chain structured for mature markets. Long lead times in getting products to customers were common in emerging markets. To solve this problem, the company established a partnership with a vendor to set up regional packaging and distribution hubs in three emerging market countries. The regional hub model not only allowed the company to better respond to customer needs but also offered opportunities to use these capabilities for the mature, developed markets.

Along with cost-conscious manufacturing expertise, operations will benefit from a "regulatory factory," a function that can significantly accelerate product registrations. With a sharpened focus on the regulatory process, operations can improve product launch timing and build scale quickly in emerging markets. A leading biotech company that implemented this type of regulatory center in emerging markets obtained an 11-fold increase in capacity.

• Plan for future emerging markets now. Companies already established in emerging markets appear to be leading the way in expanding to Africa and other developing economies. Companies just entering emerging markets might want to consider these less-developed regions in their long-term planning and near-term decisions because they could become critical emerging market hubs. Waiting will let the competition move ahead.

Emerging markets will continue to offer growth potential for biopharmaceutical companies during the next decade. Companies that involve operations in upfront strategy planning, operating model design and execution will be among the most successful in achieving growth goals and global reach.

References

1. Emerging markets growth: The critical role of operations in driving competitive advantage, March 2013. www.pwc.com/us/en/health-industries/publications/pharmaceutical-operations-emerging-market-growth.jhtml.

About the author:

Vitaly Glozman is a principal in PwC's Pharmaceuticals and Life Sciences Industry Group. He can be reached at vitaly.v.glozman@us.pwc.com.

© 2013 PwC. All rights reserved. "PwC" and "PwC US" refer to PricewaterhouseCoopers LLP, a Delaware limited liability partnership, which is a member firm of PricewaterhouseCoopers International Limited, each member firm of which is a separate legal entity. This document is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

What do you think it takes to succeed in an emerging market?