Market access for new oncology products in Europe

As our oncology focus month continues, Jim Furniss and Chris Teale discuss the market access environment for new oncology products in Europe, including sales comparisons with the US and their thoughts on the future.

What do we mean by market access?

Essentially, market access is about:

• Considering the implications your product may have on the wider healthcare market

• Understanding the impact the changing healthcare market will have on your product

• Developing a positive healthcare environment which supports uptake of your product

• Communicating the 'value' of your product to the range of customers who influence uptake

Strategically, market access is about developing and packaging data in the right way, for the right customer at the right time. In a changing environment, aligning your product with a moving target is challenging and only by understanding the needs of all stakeholders involved in the adoption, positioning and funding of your product will you be able to develop messages that improve its chances of success.

What is special about market access in oncology?

Oncology is an emotionally thought-provoking sector and remains a serious scientific and medical challenge. It is a rapidly evolving environment with many new products. It is also a therapy area that is characterised by high prices and high treatment costs – posing a significant financial burden for payers.

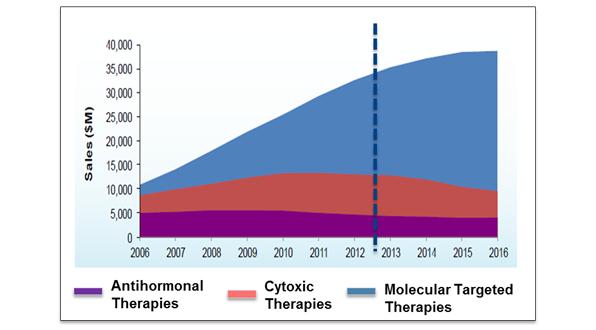

How cancer is viewed and treated as a disease has changed over time as figure 1 shows.

Figure 1: How cancer is viewed and treated changes over time

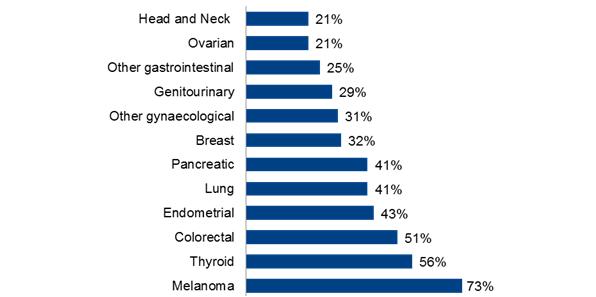

This move towards personalised healthcare in oncology is dramatic and data suggests 50% of pharmaceutical manufacturers are integrating personalised medicine into their product development to aid product differentiation and market access1. The market size of molecular targeted therapies is predicted to continue to grow reaching $40 billion by 2016 (see figure 2), driven by our increasing understanding of the genetic basis of many cancers and the large patient populations, which can be targeted (see figure 3).

Figure 2: Previous and predicted growth rate in the global sales of molecular targeted therapies2

Figure 3 Percentage of patients with tumours driven by certain genetic mutations3

However, these bold forecasts need to be interpreted carefully in terms of the payer and market access challenges they will bring.

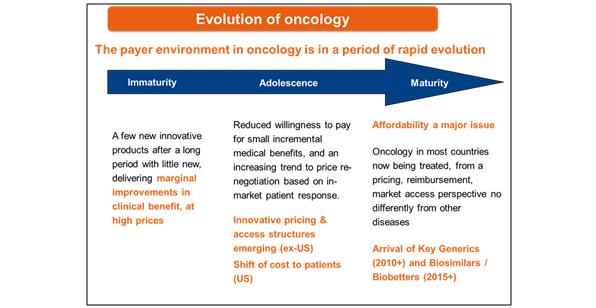

The payer environment for oncology has evolved over time with oncology in most countries now being treated by payers no differently from other diseases, as figure 4 shows:

Figure 4: How the payer environment for oncology has changed over time

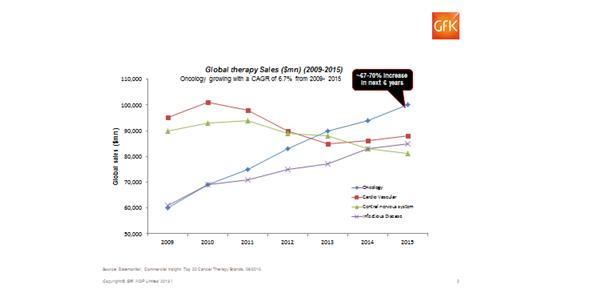

Oncology is increasingly becoming a key issue for payers. Compared to other major disease areas such as cardiovascular, central nervous system, and infection, growth in this sector has been strongest. This, although positive for companies developing and marketing oncology products, is a headache for payers.

Figure 5: Global oncology therapy sales between 2009 and today, plus the forecast for the next few years

Payers are increasingly concerned about budget impact of oncology products. Advances in cancer treatment are outstripping available financial resources creating politically difficult questions regarding priorities in healthcare budgets.

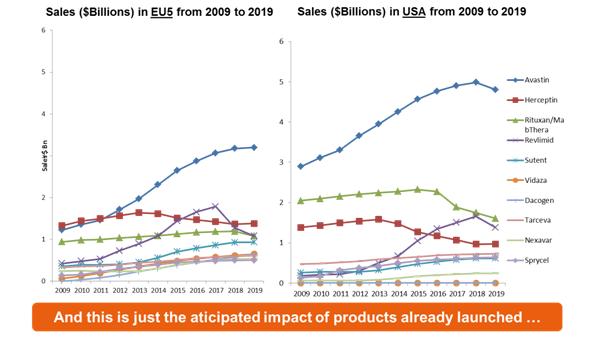

Figure 6: Sales of oncology treatments in Europe compared with the US

This challenge for payers has prompted political responses. For example looking at the UK:

A range of measures have been introduced to improve access to cancer treatment in England, acting on a recognition that NHS patients were being denied life-extending treatments which are routinely available in other countries and that, within England, there were variations in access which were undermining public confidence in the NHS.

The measures introduced by successive governments include:

• The introduction of new 'end‐of‐life' flexibilities for use by the National Institute for Health and Clinical Excellence (NICE) in assessing whether drugs which extend life at the end of life are cost‐effective

• The implementation of directions to commissioners setting out a more structured approach they should follow in order to assess so‐called 'exceptional case' requests for treatment (IFRs)

• The clarification of when and in what circumstances NHS patients can purchase additional private treatment to 'top up' their NHS care

• The encouragement of greater flexibility for manufacturers in setting prices for their medicines

• The introduction of a Cancer Drugs Fund to enable clinicians to prescribe the treatments which they feel will most benefit their patients, even if these treatments have not been routinely available on the NHS

But market access "solutions" themselves often lead to new "issues". For example, the Cancer Drugs Fund has led to disparities between the nations of the UK:

Scotland

• There are now 23 cancer treatments which are not routinely available in Scotland which may be available in England through the Cancer Drugs Fund

• As a result, people in Scotland are now more than three times less likely to gain access to a cancer drug which is not routinely available than people in England

• If the same approval rate occurred in Scotland as does in England, then 248 cancer patients in Scotland would gain access to life extending treatment instead of 74 – an increase of 174.

Wales

• There are now 24 cancer treatments which are not routinely available in Wales which may be available in England through the Cancer Drugs Fund

• People in Wales are now more than five times less likely to gain access to a cancer drug which is not routinely available than people in England

• If the same approval rate occurred in Wales as does in England, then 159 cancer patients in Wales would gain access to life extending treatment instead of 31 – an increase of 128.

The Cancer Drugs Fund will be eliminated with the introduction of Value-based Pricing in 2014, at which point new politically and payer driven solutions to address affordability and access will be required.

"...market access "solutions" themselves often lead to new "issues"."

The future of market access in oncology

With new product availability and future demand in oncology producing growth in cost outstripping affordability, new and innovative solutions will need to be explored. These will include, but will certainly not be limited to:

• Conditional reimbursement, or coverage with evidence determination (i.e. retain early access while creating longer term data e.g. overall survival)

• Conditional pricing, with adjustments based on outcomes

• Risk sharing reimbursement schemes

• Pharmaceutical companies as payers / insurers

References

1. Tufts CSDD Impact Report. Centre for the study of medicine development, Tufts University December 2010.

2. Datamonitor forecasts and MIDAS Sales Data, IMS Health, 2007

3. Wall Street Journal Copyright 2011 by DOW JONES & COMPANY, INC.

About the authors:

The above topics are just some of those that were addressed in GfK Bridgehead's most recent course on market access for new oncology products which was held in London in March 2013.

Jim Furniss, BA (Hons), Senior Vice President

Jim has a health policy background gained during 24 years in the UK Department of Health. As head of the Pharmaceutical Industry Branch, Jim was responsible for the operation of the UK Pharmaceutical Price Regulation Scheme (1991-1997) and drug budgets in the UK.

Jim gained experience in pharmaceutical price regulation across Europe as a leading member of the European Commission's Pharmaceutical Pricing Transparency Committee.

Jim led the pharmaceutical policy and drug price reimbursement practice at Cambridge Pharma Consultancy for five years, before joining GfK Bridgehead in 2002.

Chris Teale, BSc (Hons), MORS, MSIB, Principal Consultant

Chris joined GfK Bridgehead in 2011 bringing with him extensive practical and academic experience within the pharmaceutical industry, across both Marketing and R&D, over a 30 year career.

He has held a number of leadership positions at both Global and European level, having previously been Director of Global Pricing and Market Access (Oncology) at Astra Zeneca; Director Health Economics, Pricing, Reimbursement and Access at Allergan; Commercial Planning Manager at Fisons, and Portfolio Planning Manager at Ciba-Geigy in Switzerland.

Prior to working in the pharmaceutical industry, he worked in the Operational Research (OR) Executive of the NCB. His interest in OR continues, and he is currently Chairman of the East Midlands Operational Research Group.

For further details of GfK Bridgehead's oncology strategic market access services and courses, please contact Jim (jim.furniss@gfk.com) or Chris (chris.teale@gfk.com)

What does the future look like for market access in oncology?