Getting back to sales force effectiveness basics

In this article, Marty Nicholas provides us with three quick-win, pharma-specific Sales Force Effectiveness strategies that drive an immediate lift in sales performance.

Introduction

To many sales leaders, the end of the blockbuster drug era, rise of generics, and new ensuing margin pressures have come to represent the death of Sales Force Effectiveness (SFE). In response, many organisations have gravitated towards quick-fix solutions in the hope of reviving the sales success of yesteryear. These responses have ranged from efficiency-focused remedies like simply downsizing field forces, through to acquiring flavour-of-the-month digital point solutions.

Whilst all of these strategies and initiatives contribute in some way to enhancing engagement, maintaining relevance, or cutting costs; high performing sales organisations have responded by recognising the significant upside opportunity in elevating the focus on core principles of SFE to address business challenges that persist across economic and product lifecycles. As a multifactorial concept that spans organisational enablers, management disciplines and frontline behaviours; high performing pharma companies are those that not only do the right things, but also do these things right.

Below we run through three immediately-actionable opportunities that represent a return to core SFE fundamentals that drive more predictive and repeatable performance.

Opportunity #1: Understand what really defines sales performance

The lack of doctor prescribing data makes On-Target Performance (OTP) a less useful outcome-based KPI for pharma than for other industries. Since underlying product demand is highly predictable within pharma, a singular focus on OTP as your sole KPI offers little insight beyond simply validating the effectiveness of your company's abilities to forecast. Where this issue is addressed by using alternative, input and activity-biased compensatory data sources, an environment of goal diffusion results, leaving pharma sales reps unclear on what their ultimate goals and measures of success actually are.

High-performing pharma organisations have responded by evaluating financial performance across two dimensions. In addition to considering just current performance with OTP metrics, they also consider performance trajectory to determine whether overall sales performance is improving or declining. The typical metric used here is Compound Annual Growth Rate (CAGR). Introducing CAGR as a proxy for performance trajectory illuminates the performance variability otherwise hidden within pharma when only OTP is considered. Assessing performance in this way enables you to categorise sales people as being either above or below target, and with performance that's either improving or declining. This enables you to you gain visibility over who your true high performers actually are, and then analyse and understand what they are doing differently from the core.

Using the right metrics to correctly define sales performance is imperative, given the breadth of decision-making and business implications that flow from accurately defining sales performance.

Call to Action:

1. Build a sales culture that elevates Compound Annual Growth Rate (CAGR) to being a joint KPI that stands alongside On Target Performance (OTP)

2. Integrate consideration of your reps' performance trajectory into performance management processes and BAU (Business As Usual) coaching conversations

3. Utilise Compound Annual Growth Rate as a key mechanism for identifying performance variance across your teams and reward, recognise and incentivise appropriately

Opportunity #2: Optimise the call coverage model

High performing sales organisations operationalise their call coverage models off a clearly defined plan that begins with clarity on customer segmentation and targeting. These companies execute a call coverage model that reflects the company's defined Health Care Professional (HCP) segmentation and targeting process.

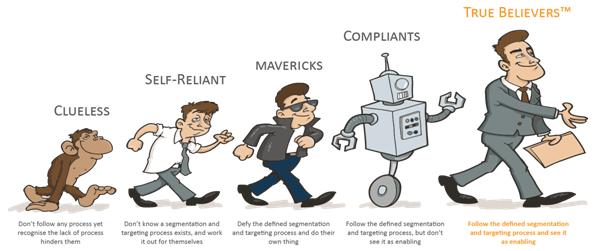

This however, does not always play out as intended, with varying levels of adherence to both the process and belief in its ultimate utility. Building an army of True Believers™ - those that follow the defined segmentation and targeting process and see it as enabling - is your path of least resistance to guaranteeing predictable, repeatable and sustainable performance.

Figure 2: The five tribes of segmentation and targeting process adherence within all sales teams

As an industry, pharma has more True Believers™ than the high-performing External Benchmark (62% vs. 56%) - on the face of it, a great situation. However, pharma also have twice the number of 'Mavericks' (20% vs. 10%) and a 15% 'Compliant' population. This means that over one third of pharma reps and managers do not fundamentally see their segmentation and targeting methodology as enabling.

"...over one third of pharma reps and managers do not fundamentally see their segmentation and targeting methodology as enabling."

Across any industry, prioritisation of customers fundamentally comes down to three principal questions: Are they big? Do we want them? Can we win them? When it comes to growing market share, high performing pharma reps will prioritise the upside potential and probability of conversion with HCPs within their territories. When it comes to defending market share, they shift their priorities to the size of the opportunity being defended, coupled with the HCP's prescribing predisposition towards their company's drugs.

Call to Action:

1. Build your army of True Believers™ by ensuring that the call coverage model activated by your sales teams reflects the call coverage plan that correctly prioritises HCPs against the right segmentation and targeting criteria

2. Ensure your call coverage plan remains the dynamic and adaptive tool it is intended to be – ruthlessly disqualify HCPs based on the probability of success determined throughout the sales quarters and reflect this back in future call coverage and frequency of visits

3. Prioritise the upside potential and probability of conversion to grow market share. To defend market share, prioritise the size and attractiveness of the opportunity.

Opportunity #3: Fix broken linear sales models

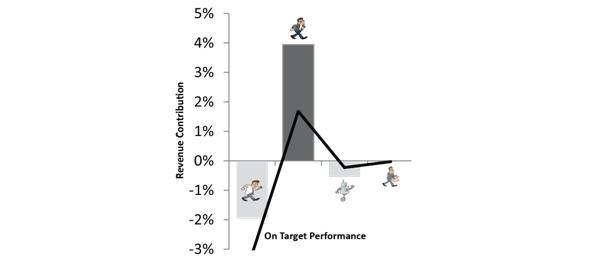

Whilst a small number of Maverick sales people (those who defy the defined sales process and do their own thing) provide a healthy agitation across any organisation, too large a number of these folk indicate there is something materially wrong with the defined sales model, or signal negative perceptions of its utility. Within Pharma, this problem is compounded even further: not only are there more Mavericks (more than 2.5 times the External Benchmark), but their revenue contribution also materially exceeds that of any other tribe by a minimum of 4%. These Mavericks are also the tribe most likely to hit their targets.

Figure 3: Mavericks' revenue contribution and OTP materially exceed that of any other sales tribe's

Understanding what your high-performing Mavericks are doing is the first step to building your army of high-performing True Believers™. Once you understand what your high performing Mavericks are actually doing differently, you're able to get everybody on board to then systematise, replicate and embed their success.

"...high-performers employ a range of long-call, influencing, educating and closing tactics that enable them to differentiate themselves from their competitors."

High-performing Mavericks have been quick to shift away from traditional and linear 'selling-focused' models towards more fluid and buyer-centric sales models. Within sales calls, we know that high-performers employ a range of long-call, influencing, educating and closing tactics that enable them to differentiate themselves from their competitors. For example, when dealing with HCPs that predominantly prescribe competitor products, high performing reps ask twice the number of questions to understand historic prescribing habits and rationale, as well as perceptions of product efficacy.

Call to Action:

1. Identify the mix of sales people across each of the five tribes within your organisation

2. Determine where amongst these tribes your high performers are concentrated

3. Diagnose what this is telling you about the effectiveness of your organisation-wide sales model

Conclusion

Shrewd pharma companies have quickly recognised that SFE is far from dead. They understand that there are no silver-bullet shortcuts to meeting the current pressures of the day. It involves viewing your sales engine holistically – as an ecosystem of component parts, which work interdependently to impact sales results. They perceive industry shifts as the opportune moment to return to basics and make sure the house is in order.

Whilst there are fundamental and universal principles that hold true across all industries, sales force effectiveness and performance improvement initiatives such as those above represent quick-win, high-impact and immediately-actionable SFE priorities that have proven timely and relevant for benchmarked pharma companies. High performing pharma companies know that returning to core SFE priorities like these is what's actually required to move the needle.

In times of uncertainty, it is those that return to these universal, enduring and proven basics that will not only survive the tides of uncertainty, but prosper amidst the headwinds of unprecedented industry challenges.

About the author:

Marty Nicholas established Blackdot in 2001 & has been instrumental in building Blackdot's blue-chip clients across Asia-Pacific, North America and Europe; working across core industry verticals such as Pharma, Financial Services, FMCG, Transport & Logistics, IT & Telecommunications. He has driven large-scale sales transformations as well as countless continuous improvement engagements spanning Blackdot's benchmarking, consulting, capability and advisory services.

Marty possess rich experience in improving the effectiveness and efficiency of sales organisations; their leaders, managers and frontline field forces. Marty works with clients to enable their organisations through developing strategy, optimising their operating models, and improving their people, processes and use of technology. He has rich experience in assisting organisations refocus the frontline sales effort onto high-yielding activities through embedding effective management disciplines, as well as building a critical mass of sales people exhibiting the behaviours that will drive more consistent out-performance.

To arrange a discussion with Marty on ways in which you're able to improve your sales effectiveness and efficiency, he may be contacted at enquiries@theblackdot.com.au.

Should pharma revert to traditional sales models?