A payer’s perspective on value-based contracting (VBC)

What payer wouldn’t want to ensure that they pay for value when buying drugs? If the emerging trend in the US towards value-based contracting (VBC) continues many more may be able to do so.

VBC deals see payers only pay when drugs meet agreed outcomes, getting a payback when they don’t, and Massachusetts-based not-for-profit health services company Harvard Pilgrim is seen as a trail blazer for striking VBCs in the US.

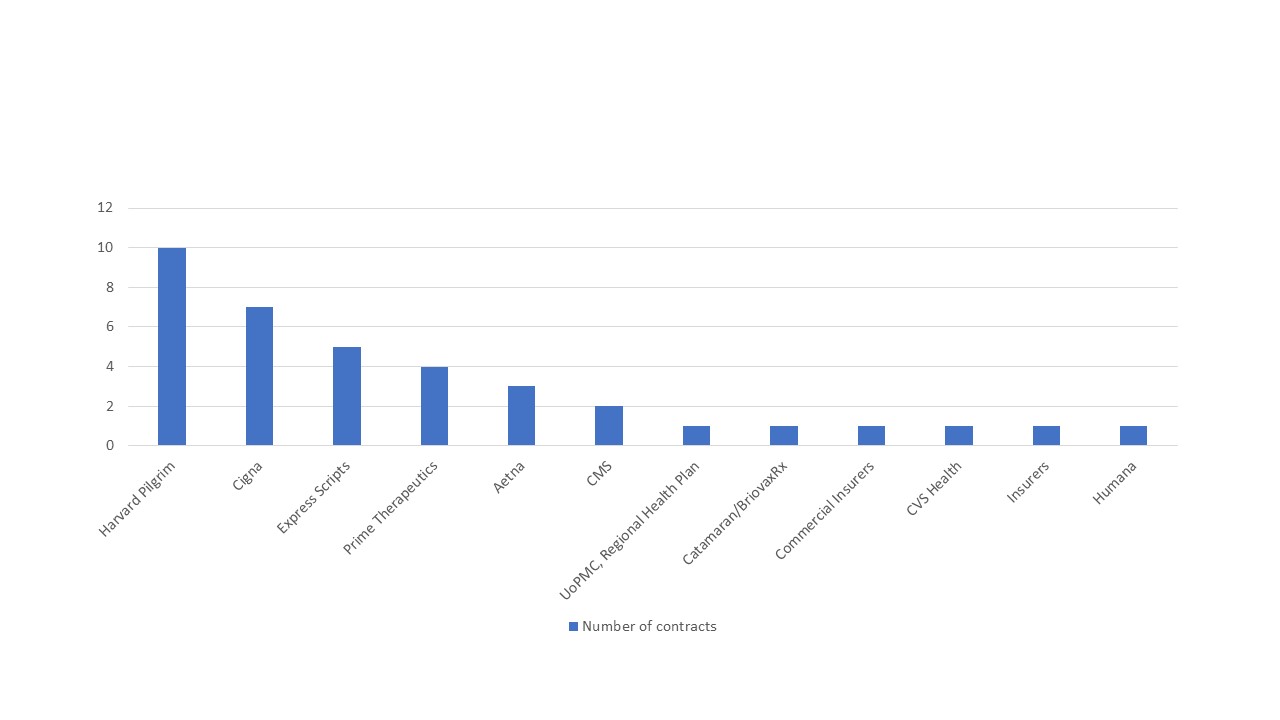

Those tracking this trend at Stisali put them ahead of other US payers in striking the deals with pharma companies (figure 1), with 15 VBCs in place according to a rare glimpse of spend Harvard Pilgrim published on the 24 August 2018.

Figure 1: US payers and published outcome-based innovative contracts, 2014-2018

Source: Data from Stisali. See stisali.com for further information.

Details of the deals are sparse, with confidentiality of exactly what is being paid and according to what circumstance being a common feature of the contracts, but what is known about the Harvard Pilgrim deals illustrates a diverse set of contracts across different therapy areas, from gene therapies to diabetes treatments with the outcomes just as diverse (figure 2).

Figure 2: Timeline of Harvard Pilgrim VBCs in the public domain

It’s possible to review a timelines of some of Harvard Pilgrim’s VBCs, based on the public announcements it has made:

June 2016 – Value-based contract with Eli Lilly for Trulicity (dulaglutide) used in the management of type 2 diabetes. Lilly will be paid less if fewer patients reach a HbA1c measure of less than 8% in comparison to other patients taking other GLP-1 receptor agonists. Lilly also secured preferred status on the Harvard Pilgrim formulary.

June 2016 – Pay-for-performance agreement with Novartis for Entresto (sacubitril/valsartan), used in heart failure. Novartis will be paid less if patients on Entresto don’t have a pre-agreed reduction in hospitalisations for congestive heart failure.

February 2017 – Value-based contract with Eli Lilly for the once-daily self-injection of Forteo (teriparatide (rDNA origin) injection) to treat osteoporosis in those who are at high risk for broken bones or fractures. When patients don’t take Forteo as prescribed – once a day for a maximum of two years - Lilly will be paid less.

February 2017 – Outcomes-based agreement with Amgen for the biologic Enbrel (etanercept), to treat moderate to severe rheumatoid arthritis. Under the two-year contract, six criteria will be used in an effectiveness algorithm to assess performance. The criteria include patient compliance, switching or adding drugs, dose escalation and steroid interventions. When the score comes in below a pre-agreed level, Amgen will get paid less. Patients will be tracked on their adherence to Enbrel.

May 2017 – Money-back guarantee agreement with Amgen for Repatha (evolocumab), one of the PCSK9 inhibitors, used to lower LDL cholesterol in patients whose levels aren’t controlled by current treatment options. Harvard Pilgrim won’t pay for Repatha if the patient is hospitalised for a heart attack or stroke after taking Repatha for six months or more and maintaining an appropriate level of compliance.

May 2017 – Outcomes-based agreements with AstraZeneca for Brilinta (ticagrelor) and Bydurean (exenatide extended-release) to treat acute coronary disease and type II diabetes respectively. For Brilinta, Harvard Pilgrim and AstraZeneca agreed to a three-year contract that includes measuring the reduction in hospitalisations for acute coronary syndrome compared to outcomes for patients on another therapy. For Bydureon, HbA1c levels of patients on treatment will be measured with an evaluation of the ability of patients who adhere to Bydureon to get to a pre-determined HbA1c goal. AstraZeneca will get paid less for their drugs if performance isn’t in line with the agreements.

January 2018 – Outcomes-based agreement with Spark Therapeutics for one-time gene therapy Luxturna (voretigene neparvovec-rzyl) to treat a particular form of retinal dystrophy, an inherited form of blindness. Full-field light sensitivity threshold testing scores compared to a baseline measure will inform just how much Spark Therapeutics gets paid, measured at 30-90 days and again at 30 months. The deal also allows Harvard Pilgrim to buy directly, cutting out the margin of the middle man.

April 2018 – Outcomes-based agreement with AstraZeneca for Symbicort (budesonide/formoterol fumarate dihydrate) to treat asthma and chronic obstructive pulmonary disease (COPD). If patient outcomes aren’t in line with the clinical trial results or if symptoms worsen or more medical interventions are needed above pre-agreed thresholds, AstraZeneca will be paid less.

Countering increased drug spending with VBCs

Someone with a bird’s eye view of VBC deals is Eric Schultz, who joined Harvard Pilgrim back in 2010 and during his tenure there has been part of the executive team that has seen Harvard Pilgrim reach trailblazer status for VBCs. So just what made Harvard Pilgrim want to try out the VBC approach? Schultz points to the need to tackle what is seen as unstainable rises in drug spend.

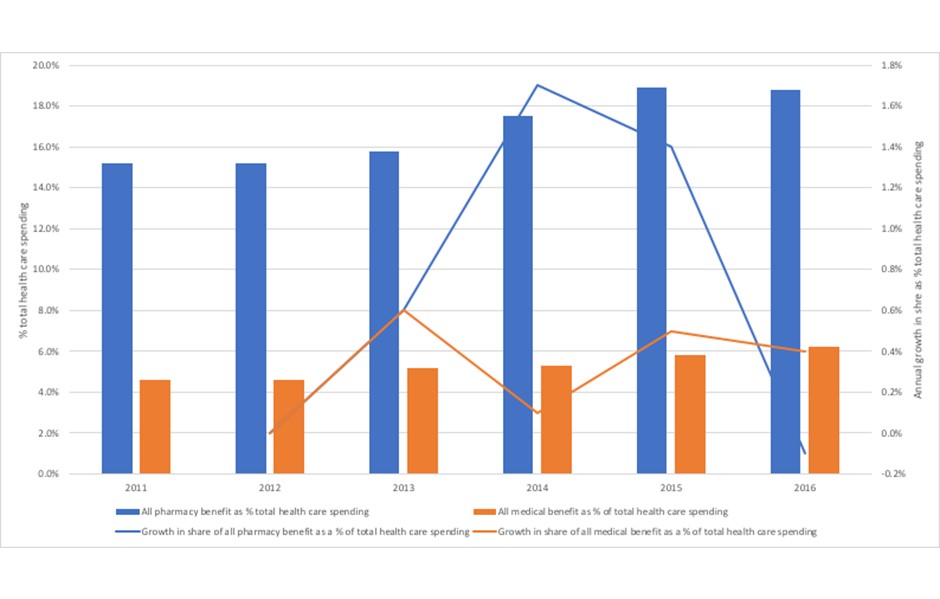

“We could see spending on pharmacy both at the drug store and within the clinical setting representing a large portion of total medical spending. Increases in this segment of spend was at a rate that was unstainable,” Schultz explained, and added: “The rate of increase was at a rate far above the increase in medical spending.” Schultz said this convinced him and colleagues that they needed to tackle the incentives driving the trend.

Just what the pressure has been for Harvard Pilgrim is clear from the latest analysis of spending trends (figure 3). That shows that both the share of spending on pharmacy has been creeping up, and at a rate of growth that outpaces that seen in medical spend for the majority of the 2011 to 2016 time period.

Figure 3: Trends in pharmacy benefit and medical benefit as a share of total health care spending, Harvard Pilgrim Health Care 2011 to 2016

Source: Analysis of data from Sherman, M., Curfman, G.G., Parent, J., and Wagner, A.K. (2018) Prescription Medications Account for One in Four Dollars Spent by a Commercial Health Plan. Health Affairs Blog 10.1377/hblog20180821.820628

Small steps to change pharmaceutical spending incentives

Schultz comes across as a pragmatist. Shifting the incentives away from pricing high and selling more needs “small steps at first”, he said. In large part it’s because the US has such a complicated health care system that results in the actual prices paid by both patients in their co-pays and deductibles, as well as their insurers or the state system.

Schultz noted: “It’s a very complex system in the US. There’s pharma, there’s PBM’s, and insurers.”

That complexity though should not stop payers from seeking to focus more on patients, something that Schultz also believes VBC can do. He said that he wanted to introduce “a contract that was focused more on patients and clinical utilisation”. This was something he felt was not traditionally part of how payers and pharma companies usually contract with one another. Schultz added that he “wanted to establish a payment system that said if outcomes or utilisation were not where we targeted them to be in negotiations, then there would be additional savings to consumers and payers”.

It’s not just about the patient in terms of the outcomes chosen to focus on in the contract where patient centricity features. Schultz explained that: “There needs to be a shared agreement between companies and payers to work together, not only on the information needed to assess a drug’s impact on patient outcomes and other outcomes, but help work with the patients to improve engagement on using the medicines.” VBCs then, are not just all about the dollars.

The steps are also small in terms of just how far and how fast VBCs can be done in practice. It’s no mean feat to come to an agreement with a pharma company in the first place, let alone collect, clean, analyse and make sure the dollars flow in line with the VBC. Schultz explained “It’s a challenge for all of us to implement VBCs. Right now, it’s a very manual process. It’s not inexpensive to administer a VBC. But we wanted to make a change, try it out, see what works, and share whatever we learned.”

More pharma companies are wanting to do VBCs

Schultz acknowledged that it’s too soon to really know if VBCs agreed at Harvard Pilgrim are delivering what he hoped for. He said: “We saw some changes, but more time is needed to measure the impact of these contracts.” He believes that it can take around two years of data to assess impact of a drug in a specific contract. That’s not a rule though; Harvard Pilgrim have agreed to a deal with Spark Therapeutics for Luxturna (voretigene neparvovec-rzyl) which includes a measure taken at 30-90 days and then again at 30 months (see timeline). That means that early results can be part of the deal too.

What Schultz has seen as a wider impact of signing up to VBCs is a greater willingness of companies to approach payers with VBCs in mind. “One thing that I started to see was an interest and willingness among the companies to participate in VBCs,” he said. Schultz added that “a couple of years ago VBC was not a comfortable concept with many of the companies”.

Not all VBCs offered are going to work for payers

More companies wanting to do VBCs brings its own challenges though. Now Schultz noted: “It’s a challenge for payers to pick and choose where they can create the best outcomes.” In essence, payers can’t do every deal that they’re offered, so companies need to be offering the best deal, not just in terms of the level of guarantee offered, but also in terms of the most expedient way of getting at the data that underpins the guarantee. Companies are competing for limited capacity within payers to do the deals.

So, if payers won’t always want to cut a value-based deal, under what circumstances do they really want to? In Schultz’s experience, it makes sense to do a VBC when “there is some competition”, because as Schultz noted, companies then want to do a better deal to secure their share of volume in that segment of the market.

Competition isn’t the only driver for when payers want VBCs though. Schultz added, “you want to do a VBC when there is a real opportunity to align treatment with the right patient. So if we’re talking about a new cancer treatment, you want to work with the treating physician and PBM to get the right drug to the right patient.” A VBC can give incentives to help target use to those patients who benefit most and mitigate drug spend in scenarios where a treatment is not medically indicated for a specific patient condition.

Of course, it matters too that it’s a prize worth winning. “Where there’s a large amount of spend and competition,” said Schultz, “is where you also want to focus.”

Schultz thinks that payers need to drive more VBCs, where they make sense, and that some should be pushing harder for them. That means changing relationships with PBMs for many, according to Schultz. He said: “Payers should be pursuing or putting pressure on their PBMs to implement VBCs.” So what’s stopping adoption? Schultz explained: “Some payers think that they don’t have enough market share, but I would tell them, you have more influence than you think.”

His advice to companies who haven’t yet done a VBC or are still new to them, is to talk to those in the know. “Companies should connect with organisations like the American Health Insurance Plan, Alliance of Community Health Plans and those that represent Medicaid and Medicare,” said Schultz. He added that “they are excellent leaders, and they know who is interested in doing VBCs”.

More than one way to focus on value: Value-based pricing

Schultz recognises that VBCs have their limits. They might help in some circumstances, but he points to the role of agencies like the US Institute for Clinical Effectiveness Review (ICER) – think of it as the US cousin of the UK’s National Institute for Health and Care Excellence (NICE), coming from the same roots of cost-effectiveness, but operating in a different culture – as being able to “put pressure on companies”. ICER, Schultz notes, is able to “consider price in light of quantified value of a drug.”

Schultz expanded on why he sees the potential of ICER to help payers make value-based decisions, even if not a VBC. He explained: “When I think of ICER, it’s an independent organisation, it’s supported by a governance board and an advisory board. It’s a panel of individuals that are very smart, and very independent.” That independence is important for credibility in what is inevitably an area that is politically difficult.

Schultz also highlighted the way that ICER goes about looking at the value of a drug, and how that lines up to the price, or not, as the case may be. “ICER uses a transparent methodology,” Schultz noted, and said: “What I like about the method, and while it’s not perfect, but it is a balanced starting point for considering the value of a drug and a value-based price.”

Payers, according to Schultz, already make use of ICER’s work. He described how Harvard Pilgrim drew on it when he was there. “We would look at ICER’s work. It would feed our knowledge base and it was good to look at to inform our medicine policy.” He believes that payers can use ICERs work as “one data point”. He also notes that payers in the US look at what NICE says too. He described how, “we used NICE reports to help inform us,” and not just for medicines policy but also to “help our thinking about what we could introduce in a VBC”.

According to Schultz, more work like ICERs is needed in the US. He said: “We need more of this in the US. I’d like to see our elected officials say ‘let’s look at the top 50 drugs and look at the clinical effectiveness of them, and what the value-based price would be.’ That would be an effective counter pressure on company price setting and price increase.”

Companies shouldn’t see VBCs as a way to completely address criticisms of high drug prices at launch or persistent drug price rises over time; at best they can help, but the pressure on industry isn’t going to go away even if VBCs really took off.

A value focus will remain

It’s likely that Harvard Pilgrim will keep their value focus, and that could very mean more VBCs, as well as drawing on the work of ICER and their value-based prices as Harvard Pilgrim and other US payers face decisions on the new drugs coming to market, even with Schultz’s departure.

What about Schultz himself? Schultz resigned from Harvard Pilgrim in June 2018. Media has described the departure as ‘unexpected’. Looking forward, Schultz describes how he wants to build on his experience but that might mean working for a different kind of organisation. He explained: “I’m a big believer that vertical integration could bring about truly meaningful and sustainable change.” Wherever he works next, the value-focus will remain.

About the author

Leela Barham is an independent health economist and policy expert who has worked with all stakeholders across the health care system, both in the UK and internationally. Leela works on a variety of issues: from the health and wellbeing of NHS staff to pricing and reimbursement of medicines and policies such as the Cancer Drugs Fund and Patient Access Schemes.