Haven: The strategy that didn't fix healthcare

John Singer discusses the disbanding of Haven, the joint healthcare venture by Amazon, JP Morgan and Berkshire Hathaway, and the strategies that can help fix US healthcare.

“The market” was terrified when Warren Buffett, Jamie Dimon and Jeff Bezos got together to disrupt healthcare three years ago with the launch of Haven – in response to that news, healthcare stocks comprising a significant chunk of the $3.5 trillion health economy in the United States shed billions in value overnight.

CVS Health, Walmart, Cardinal Health and Express Scripts were among those affected. Few details about Haven emerged after the new venture was announced to the public in January 2018 and the Haven brand name did not appear until about a year later.

Haven kept its cards close to its chest, saying only that it was going to “explore a wide range of healthcare solutions, as well as pilot new ways to make primary care easier to access, insurance benefits simpler to understand and easier to use, and prescription drugs more affordable".

The fact that three companies came together to say they'd had enough with the status quo was a big deal, argued Matthew Holt, a managing director who specialised in health system vision and market innovation at private equity firm New Mountain Capital. “These execs have influence in the market by simply standing up and talking about inefficiency and cost,” he explained.

At JP Morgan’s annual health care conference in January 2018, Dimon hosted a private dinner for about 25 top executives from pharmaceutical companies and advocated for lower drug prices. He told his guests, “We are not happy with healthcare costs and want to help.” Dimon was peppered with questions about the end state vision for the joint-venture and its roadmap to get there, especially after Amazon purchased online pharmacy PillPack.

“America is flailing to reshape healthcare because the storyline of 'cost' and 'simplifying insurance' is perpetuating feedback loops that have not changed in more than 50 years.”

In January 2021, Haven announced it is shutting down. Little information came from the company on the reason for ending operations, merely stating that its founding companies would collaborate further in the future. Among the galaxy of analysis speculating about why ‘Project Haven’ didn’t work, a headline from Barron’s seemed to capture the root issue: ‘JP Morgan, Amazon, and Berkshire Hathaway’s Health-Care Venture Dies. Costs Remain a Problem.’

“Cost” is not the problem. The ‘production of health’ is.

The unmet need: a new conceptual framework

There is a perpetual short circuit in thinking about ‘the next healthcare'. In the early summer of 1967, President Lyndon B. Johnson convened a National Conference on Medical Costs. It brought together more than 300 US health leaders, representing providers of health services, as well as the ultimate consumers of health care services, patients themselves (the birth of "patient-centred" health care).

The membership of the conference included healthcare professionals specialising in medicine, dentistry, pharmacy, economics, administration, and in other relevant disciplines. They were the leading American medical minds and scientists the world had to offer at the time, representing a significant proportion of the men and women in the nation who studied the rising costs of healthcare and the effect of these costs "on the availability of medical care to all Americans". Then, as now, "urgency" and "crisis" dominated the storyline.

In its final report delivered to America’s executive leadership at the time, the members of the conference said there was “an urgent need for a wide range of actions to deal with the rising costs of medical care". There were projections of structural and supply chain problems arising from increasing demands for health manpower; how best to expand and strengthen the availability of health personnel was the subject of deep discussion and analysis, as it still is today (Some of the states hardest hit by COVID-19 are turning to retired healthcare workers and medical students to fill gaps left by an already tight labour supply and an influx of patients).

Their assessment: “Even the most optimistic estimates of future manpower in the health services indicate chronic shortages for the foreseeable future. Emphasis was placed not only on the need for more physicians, dentists, nurses and other health personnel, but for the development of new and better ways to utilise the available and future supplies.”

The US health economy is little changed since then – it is still organised as inputs for niche impacts, not outcomes from a coherent whole. We are governed by the logic of market fragmentation. At an individual level, the story is everyone doing the “right thing” to protect and grow their businesses, brands, and shareholders. At a system level, the story is collapse, a function of the design flaw in the orientation of the economics. The centre of gravity is value extraction for shareholder benefit, not value creation for stakeholder benefit.

America is flailing to reshape healthcare because the storyline of “cost” and “simplifying insurance” is perpetuating feedback loops that have not changed in more than 50 years. If the ambition is to “disrupt” the status quo, to transcend the current state and leap into a new orbit for action and imagination, we need different words to think different thoughts. Until then, we are flailing in a vacuum of new energy and ideas.

Recurring revenue from 75% of the US Population

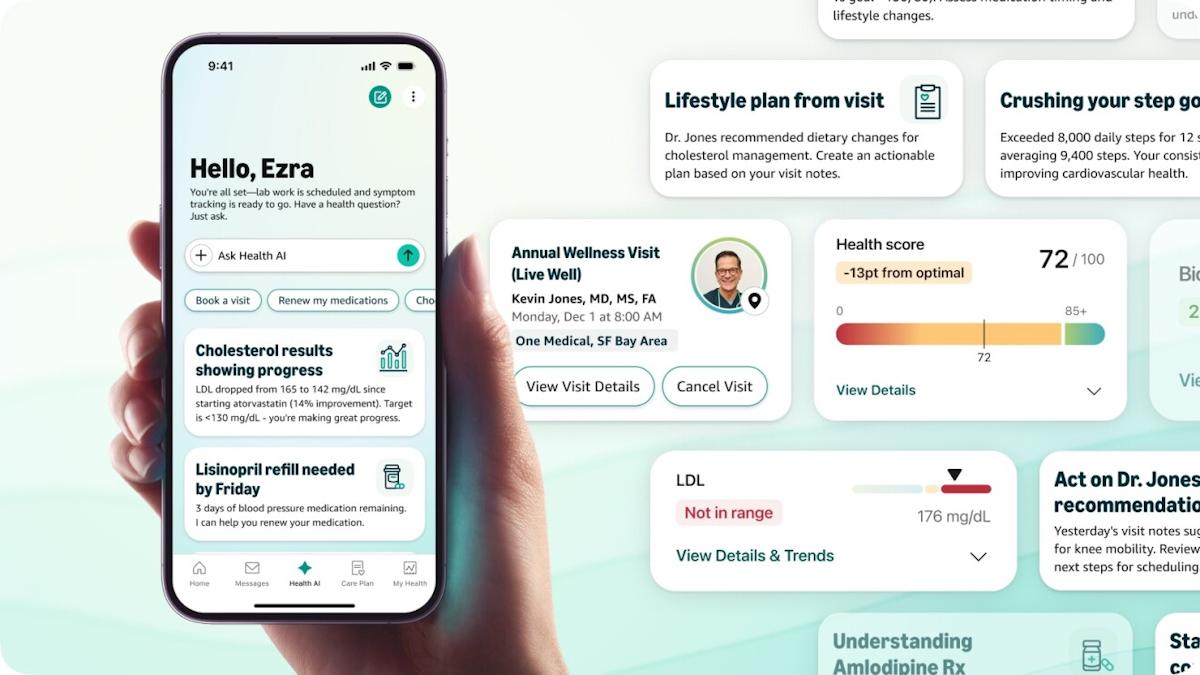

‘Continuous health engagement’ is the real disruption in healthcare. Which is where the “old” Amazon already excels – the company is managing a growing economic system that generates $322 billion in recurring revenue a year from approximately 75 percent of the US population. Strategy and innovation at a system level is the story behind all other stories about what it means to “transform” the dominant perceptions constraining healthcare (+ life sciences). It means adapting to a massive shift underway in how the world works and thinks, and what consumers expect.

Positioning business models for value-based success comes from thinking outside the clinical setting – less "patient engagement” and “patient adherence" to a drug or device, more "consumer engagement" and experience within a larger context of health system innovation. Less about “cost", more about ‘the production of health’ over time.

Shortly before the news of Haven’s disbanding came out, Atul Gawande, the ex-CEO of the venture, talked with Fast Company about his experience at Haven and the evolving business of healthcare in the US. He shared this perspective: “Places like a Walmart or an Amazon or others who are in the services side have paid a huge amount of attention to the experiences of the person who comes through to make it a better experience for them, with a lot of discipline around cost and a recognition of how important it is to drive for scale. Those are the things we do not bring in healthcare.

"They need to marry that with a deep understanding of the complexities in healthcare and building relationships that are not just about the momentary transaction, but the reality that people need someone who will stay with them for years of their life. You can create incredible outcomes for people when you enable that relationship.”

The roadmap is about creating and competing with durable systems of engagement. Like Amazon and Apple (and Epic), the end state is positioning yourself as an infrastructural technology, to become the dominant design for healthcare delivery in the United States, the backbone to match clinical outcomes with business and administrative processes. New Strategy starts with interoperability at a national level. The complex reality of the current chaos of collapse – including that of Haven – is that we all are going to have to re-examine some of our dearest shibboleths. The rules governing and constraining mindsets no longer work for multiple shifting paradigms. The unmet need is a new science of synthesis, a new conceptual frame to solve for market fragmentation.

Which is to say the "Strategy That Will Fix Healthcare" will have little to do with fixing healthcare; it has more to do with large-scale system change to invent an economy from new source material. We are standing astride a stark rupture in the historical timeline. The world is in motion, searching for an alternative equilibrium, a different consciousness from which to see, think and act. "Haven’s [demise], and the fact that its anticipated disruption of the health care insurance space never materialised, also underlines the difficulty inherent lowering healthcare costs for employers," wrote Josh Nathan-Kazis, a reporter at Barron’s covering the healthcare industry. "Even with some of the best minds in the business on staff, and the resources of three of America's largest corporations at their disposal, Haven doesn't seem to have cracked the problem."

“Costs remain a problem.” Perhaps everyone is trying to crack the wrong problem. If we have learned anything from 2020, it should be that public health is not separate and distinct from economic health. “Healthcare” is a meta-market around which $142 trillion in global GDP is linked and flows. New strategy comes from the ability to artfully see and select combinations of capabilities from across a vast assemblage of resources, and then intentionally cohere them on a market shaping roadmap to achieve desired effects across multiple domains simultaneously and interactively. It is about creating, managing, and leading with an ecological sensibility.

The gap between computation and culture is not just a gulf between different systems of symbolic logic, of representation and meaning: it is also a gap between different modes of imagination. The next healthcare (+ life sciences) will emerge in the zone where human and computational assemblages can do extraordinary things.

Which is what Amazon already knows how to do better than anyone.

About the author

John G. Singer advises business and government on large-scale system change. He is the managing partner of Blue Spoon Consulting.