Business strategy and forecasting team: Ally or adversary?

It’s 2023 and pharma is moving ahead and leaving behind the COVID-19 aftermath. After all, it was not only an unprecedented time for humanity, but also particularly for the pharmaceutical industry it has been a challenge to overcome. No one ever in the modern era had imagined the ripple effect this would create, whether it was in healthcare systems running behind time to develop right medicines, or market access leaders trying to get access so that drugs reach the right patients at the right time.

Between all this, one team has been bearing the badge of agility and dynamism: yes, the business strategy and forecasting team.

Launches are becoming extremely complex

Pharma market access and launch management will be further complicated in 2023 by the continuing market shift towards premium-priced specialty drugs, and particularly targeted therapies for rare diseases that build lucrative franchises by stacking up successive indications for the same product.

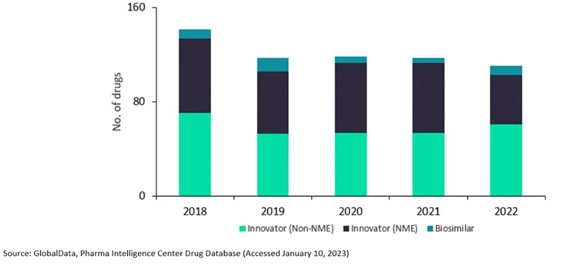

IQVIA’s ‘Global Use of Medicines 2023: Outlook to 2027’ reports the global market for medicines is expected to deliver a compound annual growth rate (CAGR) of 3–6% in 2023-2027, reaching around $1.9 trillion by the end of that period. This is without factoring in the impact of incremental spending on COVID-19 vaccines and therapeutics. However, on the other hand, the FDA approved fewer innovative drugs, New Molecular Entities (NMEs), in 2022 than it did in 2021: only 42 drugs compared to 59 drugs.

According to McKinsey, eighteen of the top 20 pharma companies have gene therapies in development, while 36% of launches are expected to involve new therapeutic modalities by 2025. With the advent of cell and gene therapies, and companies focusing on oncology and rare diseases, there is an unmet need for the companies to be able to hop this loop.

For companies to become successful in this time, they not only have to look at their R&D and supply side of the business, but also ensure that it carries the same attention to the commercial roles.

No decision is made in the pharmaceutical world, for that matter, without looking at the numbers. More importantly, companies are forward looking on how they will perform, how they will enter and capture the international market, how they will eventually win.

In the pharmaceutical world, business strategy and forecasting hold an important role and function in the central decision-making process. Typically, this function resides in the commercial excellence or business excellence function. These varied uses, and the effect of forecasting on many functional areas in an organisation, reflect the first major challenge of forecasting – meeting the needs of varied and diverse stakeholders.

This is where it becomes imperative to consider this team as their ally. The most successful organisations integrate commercial strategy teams right from the time the drug is considered in pre-launch stage. Each assumption or input used to develop deliverables like market sizing potential or go- no go business assessments lead to crossing the business strategy and forecasting team. And rightly so, too.

The revenue numbers generated by this team are distributed cross functionally in the organisation. It will go to finance to budget the resources and P&L; it goes to supply chain to develop resourcing and capacity planning (outsource vs inhouse decisions), HR will decide if there is new talent needed to drive this launch, market access will start understanding the current payor environment and developing strategies, the regulatory team will go ahead and start using the forecasted numbers for their environmental impact, and the marketing team will look into field force alignment, segmentation and targeting, etc.

The critical impact of this role cannot be discounted for. So, the earlier the forecasting and business strategy is integrated into the decision-making processes, the more robust and all rounded outputs flow out as a “one source of truth”.

With the advent of big data and AI in the pharmaceutical world, machine learning models can improve the judgment of a human pool, but we also need to highlight the importance of accounting for trust and cognitive biases involved in the human judgment process. Unlike a prediction, a forecast must have a logic to it. The forecaster must be able to articulate and defend that logic. If not, then all the post COVID-19 forecasts would have been showing industry demand going down - which isn’t the case.

The wise forecaster is not a naïve spectator but a participant and, above all, a decision maker, and a critic. Forecasters will continue to be realigned, reimagined, and amplify and be the flagbearers of the intersection of data and science.

Joining hands cross-functionally to create an integrated approach

The following are some of the successful approaches gathered by top pharma giants in their efforts to pivot to “new ways of working”:

- Identifying the unmet need or key insights gaps by thoroughly evaluating needs and pathway implications of their individual customers (HCPs, patients, payors, and other stakeholders), both in the immediate term and in the scenarios that lie ahead.

- Launching a scenario-based strategic planning team to prepare for widely different scenarios: identifying the scenario and the assumption needed and then getting a consensus with the key stakeholders.

- Appropriate usage of AI and judgement to prevail in the decisions. It is very important that the decisions are not skewed between machines or humans. Striking the right balance is key.

- Mobilise strategic working groups to scale up and accelerate the changes that have previously been contemplated for the commercial model, but have not had the resources, remit, or required urgency to be pushed forward.

- Integrated change management mindset and ensure it is drilled not only from top-bottom, but is organic from bottom-top. This will happen when the team is empowered and considered as an ally, rather than an adversary.

The insights gap is holding the life sciences industry decision making in silos and unstructured outputs. Identifying where to play, who to target and where to win are all critical elements in good decision making, and right now teams are scampering with all the data and information overload.

Moreover, when you have different geographies and regions to be rolled up into an organisation level forecast, they should have the same ingrained structure to be on the same page. Resource allocation, budgeting, inventory & supply management, P&L, and finance are some of the functions impacted by the presence of sharp insights. One of the human level challenges can be shifting priorities, attrition or layoffs, data quality issues, etc. Both the organisation and human level challenges persist, but the show must always go on.

After all, we know the importance of this business strategy will eventually help in delivering drugs to patients. That’s why, if teams can integrate under one umbrella, it will allow senior leadership and decision makers to close the insights gap across the full cross-functional process. In 2023 and beyond, an integrated approach is the way to go. This can be very effectively achieved if business strategy and forecasting is considered truly an ally, rather than an adversary.

About the author

Sanobar Syed has over 14 years in the field of pharmaceutical strategic forecasting and business analytics in North America. With a Master’s degree in Organic Chemistry, coupled with an MBA in Marketing, she has established and successfully led market research and strategic forecasting and business analytics for multiple brands. She is repeatedly invited to speak and represent this field at various reputed and leading industry conferences across North America and Europe, and is considered an industry subject matter expert in the field of business strategy, forecasting, and business analytics.