Antibody drug conjugates – The time is now

The theory behind antibody drug conjugates (ADCs) is simple yet elegant: by combining the specificity of a monoclonal antibody with the cytotoxicity of a potent small molecule drug, ADCs can precisely deliver toxins to tumours while sparing normal tissues, increasing the therapeutic window of a drug.1

ADCs could bring a promising wave of innovation for patients across a broad range of cancers. If they fulfil the promise of “targeted” chemotherapy, they may displace classic chemotherapy in most cancer therapy cocktails.

Looking backwards to look forwards

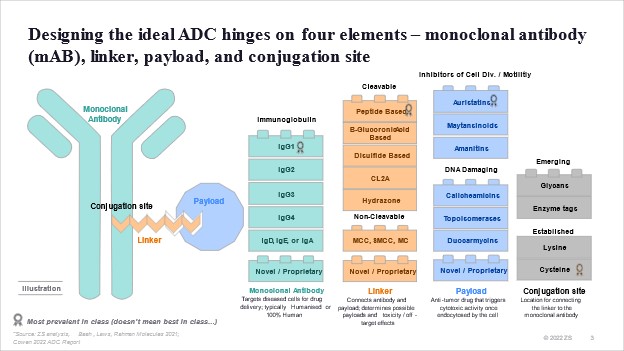

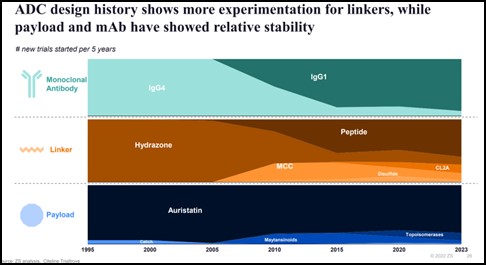

The story of ADCs is one of two decades of trial and error in drug design and solving for what and how to combine these four elements: the antibody, linker, payload, and conjugation site.

In 2000, the US Food and Drug Administration (FDA) first approved the ADC drug Mylotarg® (gemtuzumab ozogamicin) for adults with acute myeloid leukaemia (AML), which marked the beginning of the ADC era of cancer targeted therapy.2

While very promising, Mylotarg’s toxicity profile and tight therapeutic window raised concerns, and it was withdrawn from the market in 2010 after a post-marketing trial highlighted real-world validation of the trend that was observed in clinical trials and anecdotally in the scientific community. Mylotarg was reintroduced in 2017 after the FDA cleared it at a lower dose for a subset of leukaemia patients.

Following Mylotarg’s launch, it took 11 years for the next ADC to see the light of day with Adcetris (Seagen) in 2011, followed by Kadcyla in 2013. Today, both bring in more than $1 billion USD in sales annually.

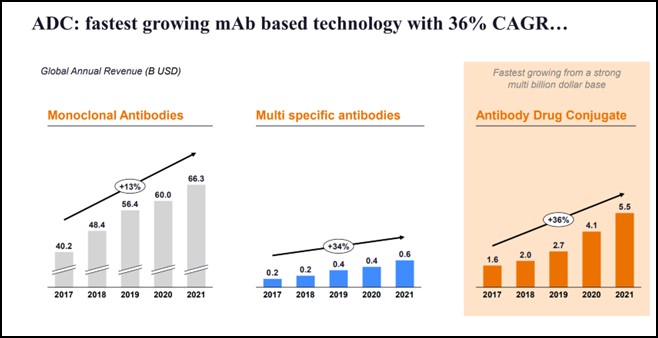

ADCs are now the fastest growing mAb-based technology with 36% percent CAGR (2017-2021). These have grown faster than even monoclonal and multi-specific antibodies.

Our research shows that ADCs will change the standard of care in oncology across the board.

The recent deal between Pfizer and Seagen put the spotlight on ADCs, but more than 60% of 2021 ADC revenues came from launches more than three years old.

To understand what the future might hold, we initiated research across multiple fronts. We analysed scientific literature and trials, used artificial intelligence to predict technical and regulatory success based on datapoints and entered into new partnerships.

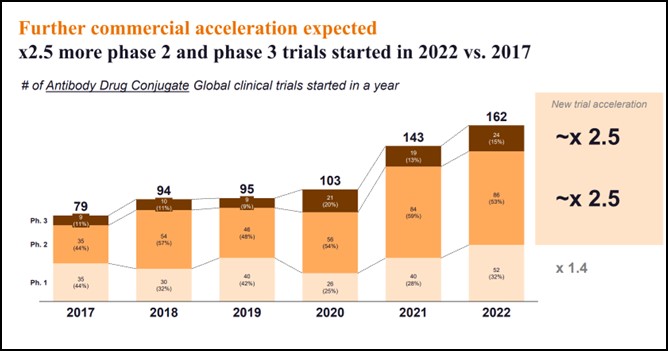

We can infer from the current ecosystem that there is a potential commercial acceleration for ADCs in the coming year. We have organised our findings along three dimensions: evolution of clinical trials volume, breadth of experimentation, and probability of technical and regulatory success (PTRS):

- Clinical trial volumes have dramatically accelerated, with 2.5 times new phase 2 and phase 3 trials started in 2022 vs. 2017:

- From 35 phase 2 trials started in 2017 to 86 started in 2022, and from nine phase 3 trials to 24 in 2022

- Across all phases, the number of trials started in 2022 has doubled since 2017

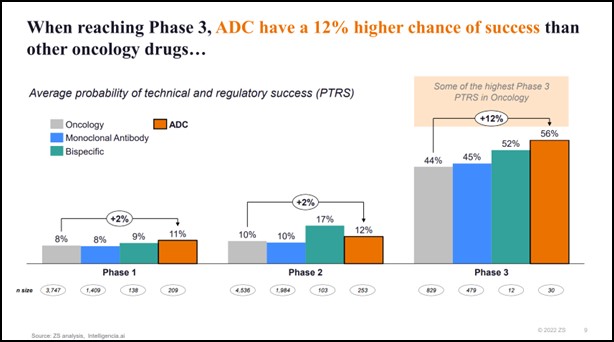

- When reaching phase 3, ADCs have a 12% higher chance of success than other oncology drugs, including monoclonal antibodies*

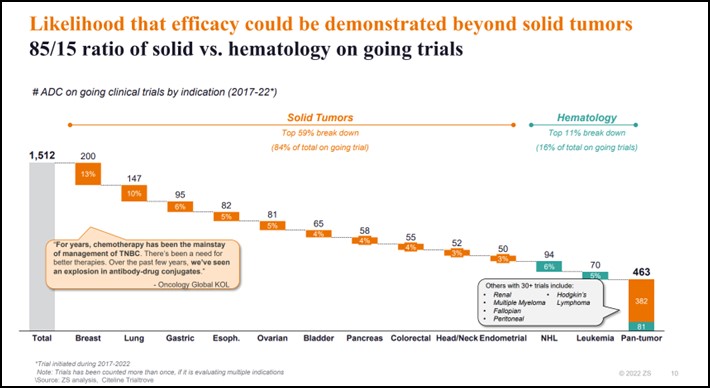

- Breadth of experimentation: out of more than 1,500 ongoing trials across dozens of cancers, approximately 85% are in solid tumours and 15% in haematology

- We still see the “usual suspects” in oncology clinical development, with breast and lung making up about 25% of ongoing trials

- We see the efficacy of ADCs being tested in cancers less responsive to checkpoint inhibitors (i.e. “cold tumours” in pancreatic or ovarian cancers)

- There is experimentation beyond solid tumours like in Hodgkin’s and Non-Hodgkin’s lymphoma or multiple myeloma

Given these three dimensions, we conclude that an increased number of trials combined with a higher probability of success and a broad experimentation space can lead to significant advances in the standard of care and an increased likelihood of commercial success for ADCs.

Clinical trial volumes have dramatically accelerated, with 2.5 as many new Phase 2 and Phase 3 trials started in 2022 vs. 2017.

Probability of technical and regulatory success: When reaching Phase 3, ADCs have a 12% higher chance of success than other oncology drugs, including monoclonal antibodies.

Breadth of experimentation: There is an increased likelihood that efficacy could be demonstrated beyond solid tumours. With an 85/15 ratio of solid vs. haematology out of more than 1,500 ongoing trials across dozens of cancers.

Researchers try to “crack the code”

Scientists have come a long way since the origins of ADCs. As the technology has evolved, so has our understanding of what and how to combine the four elements of an ADC: the antibody, the linker, payload, and conjugation site.

This evolution in “savoir faire” has helped in managing ADC side effects and overall safety profile. We continue to refine our understanding of the science with:

- Innovative payloads like the emergence of DNA damaging payload such as topoisomerases;

- Novel conjugation sites like those from lysine residues to cysteine residues, enabling the release of the payload inside the tumour cell and reducing off-target toxicity; &

- Target selection of mutant-type proteins vs. wild-type, resulting in superior likelihood of internalisation and efficacy

One industry leading example of this evolution is Enhertu. Launched in 2019 for HER2+ breast cancer, it had an additional indication in HER2+ gastric cancer and explored for non-small cell lung cancer in the 2025-2026 timeframe.

An increasing demand for ADC development and manufacturing capabilities

With almost 90% of 2022 ADC revenues generated by substantial players, it seems commercialisation requires large scale and reach. However, only around 40% of ongoing trials are sponsored by these global companies.

This suggests a potential increase in partnerships, business development & licensing, and merger & acquisition activities in the space to bring to market the plethora of ADCs currently in phase 2 and phase 3.

We already see multiple signs of widespread willingness to exchange ideas and technology, with Seagen, Immunogen, Synaffix, and Byondis leading the pack in a number of joint ventures. Recently, Lonza acquired Synaffix to strengthen their ADC manufacturing capacity and capabilities, showing that these resources are practically within reach.

In addition to a broad spectrum of development and manufacturing capabilities, global contenders like China could also play a leading role in ADC development and commercialisation.**

What’s next?

It is only a matter of time until ADCs reach patients and improve the standard of care across cancers.

We anticipate an inflow of investments in key platforms in the coming years, either developed organically, through targeted acquisitions, or through rented capacity and capabilities with CDMOs.

Companies who have ADC programmes commercialised and in the pipeline, or which are in the process of rethinking their clinical development roadmap strategy, need to immediately make the most of their ADC platform by:

1. Nurturing and safeguarding talent

The rush for scientific talent who deeply understand the mechanics and opportunities of ADCs will increase. For large companies, safeguarding development and manufacturing teams and seamless talent integration is critical. For all companies, smart resource allocation and securing appropriate funding is key. Companies need to manage requirements from key, in-demand talent within the organisation.

2. Getting the science right, prioritising and experimenting faster

As outlined earlier, the pace and scale of experimentation is high. Multiple CDMOs are offering solutions to experiment at-speed multiple linker, payloads, or conjugation combinations. For larger pharma companies, we often see sub-optimal trial design choices: coordination across commercial and R&D is often cumbersome and inline portfolio rethink is rarely done.

3. Shaping the commercial landscape

The price of innovation will remain a challenge, especially considering ADCs are expected to displace the current standard of care of chemotherapy and small molecules. Capturing the full value of the ADC opportunity will be about onboarding not only KOLs and prescribers, but also payers and patient associations to support rapid and broad access to innovation.

If you are an oncology player and contemplating acquiring or partnering to explore the potential of ADCs, act now. This is the right time for a holistic rethink of your company’s portfolio strategy, strategic clinical roadmap, resource allocation, and R&D to commercial operating model.

It is on industry leaders to continue to push the boundaries of science and commercialise appropriately.

References

- Colombo R, Rich JR. Cancer Cell. 2022, 40, 1255-1263.

- Norsworthy, K. J., et al. FDA approval summary: mylotarg for treatment of patients with relapsed or refractory CD33‐positive acute myeloid leukemia. Oncologist 23, 1103 (2018).

* In Phase 3, ADCs have a 56% PTRS vs. 52% for bispecific antibodies and 44% for the overall Oncology segment. Some of the drivers include the recent approvals (e.g., Enhertu, Padcev, Trodelvy, Zylonta…) and the synergistic effect of combination therapy (~65% of Phase 3 trials started in 2022 were in combination).

** With some linkers coming off patent, a faster pace of R&D execution, superior investment, and globally trained talents coming back to China, companies such as Innovent Biologics, RemeGen, or KeyMed Biosciences are positioned to bring ADCs to market in the near to mid-term.

About the authors

Hensley Evans is principal, Zurich, at ZS Associates. She is proud of working with leaders in pharma and biotech to evaluate and adapt organisational capabilities based on patient trends and the evolving healthcare landscape. As leader of ZS’s global transformation practice, Evans helps clients pull through key strategic decisions and ensures that the organisation is able to realise the intended benefits of these choices. She co-authored the book “Reinventing Patient Centricity”, published in 2022, and has worked with some of the world’s largest pharmaceutical companies to define patient-centric strategy. Before joining ZS, Evans was executive vice president of strategy and analytics at Saatchi & Saatchi Health and Wellness, where she led consumer and patient marketing strategy across multiple brands and therapeutic categories. Evans holds an MBA from the Wharton School and a BA in Economics from Duke University.

Hensley Evans is principal, Zurich, at ZS Associates. She is proud of working with leaders in pharma and biotech to evaluate and adapt organisational capabilities based on patient trends and the evolving healthcare landscape. As leader of ZS’s global transformation practice, Evans helps clients pull through key strategic decisions and ensures that the organisation is able to realise the intended benefits of these choices. She co-authored the book “Reinventing Patient Centricity”, published in 2022, and has worked with some of the world’s largest pharmaceutical companies to define patient-centric strategy. Before joining ZS, Evans was executive vice president of strategy and analytics at Saatchi & Saatchi Health and Wellness, where she led consumer and patient marketing strategy across multiple brands and therapeutic categories. Evans holds an MBA from the Wharton School and a BA in Economics from Duke University.

Romain Bonnot is an (equity) partner at ZS Associates. He is a core member of ZS Strategy and the next generation business transformation team. Bonnot enables life science organisations (including pharma, medtech, private investment/ private equity companies, and health insurance) in strategic topics across the value chain. He rejoined ZS from Novartis, where he was VP and global head of strategy for oncology. Bonnot is a trained pharmacist. He holds a Master’s in Business from ESCP Europe, and is an alumnus of INSEAD Executive Education programs.

Romain Bonnot is an (equity) partner at ZS Associates. He is a core member of ZS Strategy and the next generation business transformation team. Bonnot enables life science organisations (including pharma, medtech, private investment/ private equity companies, and health insurance) in strategic topics across the value chain. He rejoined ZS from Novartis, where he was VP and global head of strategy for oncology. Bonnot is a trained pharmacist. He holds a Master’s in Business from ESCP Europe, and is an alumnus of INSEAD Executive Education programs.