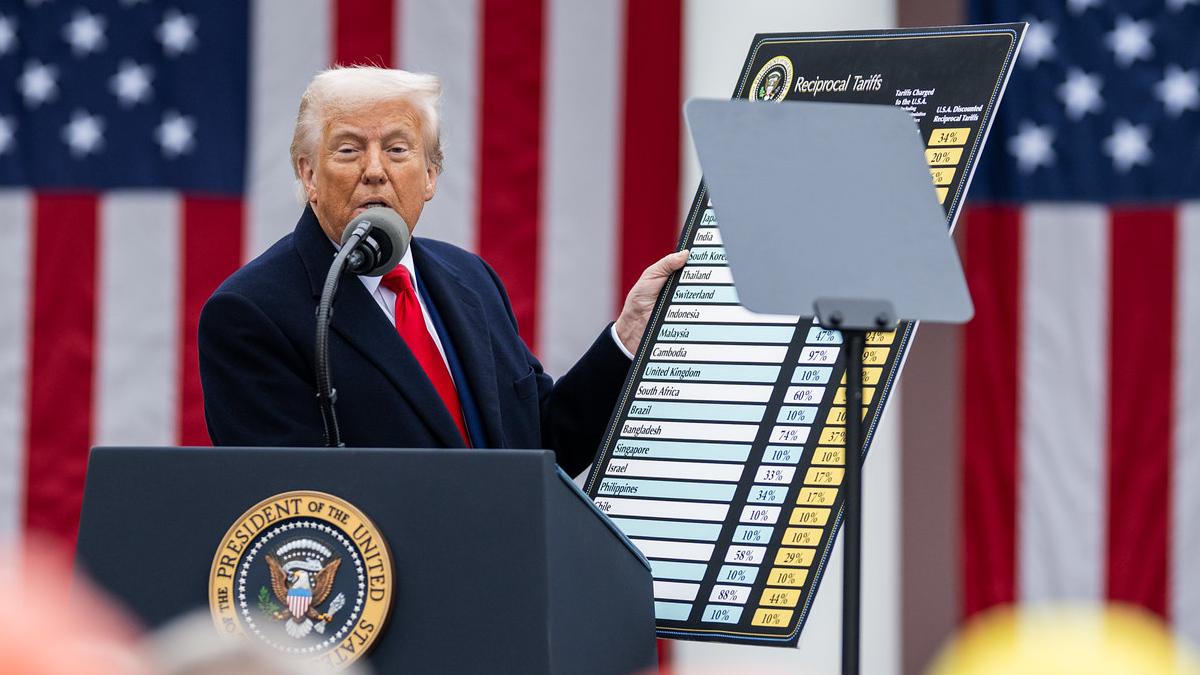

When licensing deals go bad - Novo sues KBP Bio for $830m

Novo Nordisk has accused Singapore-based biotech KBP Biosciences of concealing clinical data ahead of a $1.3 billion licensing agreement between the two companies in 2023 focused on blood pressure drug candidate ocedurenone.

A lawsuit filed in the Singapore International Commercial Court is seeking $830 million in damages from KBP, with Novo Nordisk claiming it "misled into believing the defendants had developed a new and effective drug to treat hypertension and kidney disease."

The court has already agreed to a freeze on KBP assets while the lawsuit plays out, according to Judge Philip Jeyaretnam, who said: "I am satisfied that Novo has shown that it has a good arguable case against KBP for fraud under New York law, which governs the dispute."

Specifically, the complaint alleges that KBP knowingly failed to disclose interim data from a phase 2 clinical trial dating back to 2022 that Novo Nordisk claims shows that ocedurenone was unlikely to show efficacy, and also concealed quality and compliance issues at an investigation site that produced "anomalous positive results."

At the time the licensing agreement was signed in October 2023, ocedurenone – an oral non-steroidal mineralocorticoid receptor antagonist (nsMRA) – was being tested in a phase 3 trial in patients with uncontrolled hypertension that had failed to respond to at least two other blood pressure-lowering drugs and advanced chronic kidney disease (CKD).

Novo Nordisk announced in June 2024 that it was halting the trial – called CLARION-CKD – after an independent data monitoring committee concluded that the trial met the prespecified futility criteria - meaning that the trial did not meet its primary endpoint of change in systolic blood pressure from baseline to week 12. The company took a DKK 5.7 billion ($797 million) charge in its interim results as a result, and confirmed it was abandoning the project a few months later.

Novo Nordisk said it had the potential to be a best-in-class therapy for uncontrolled hypertension that would complement other drugs in its portfolio, including GLP-1 agonist Ozempic (semaglutide), which was approved to lower the risk of worsening kidney disease and cardiovascular death in CKD patients earlier this year.

Judge Jeyaretnam said that Dr Zhenhua Huang – KBP's founder, executive chairman and a 40% shareholder in the company – "arguably knew and participated in these misrepresentations."

Court documents also note that $339 million was transferred out of FBP into its holding company, while $578 million in dividends were declared at the time the Novo Nordisk deal closed, which "show an intention on Dr Huang's part to remove assets from Novo's reach in anticipation of a claim."

Image by Gerd Altmann from Pixabay