Vesalius raises €120m with eye on digital health investments

Life sciences venture capitalist Vesalius Biocapital has raised 120 million euros in funding, focusing on investment in digital health as well as biotechs.

The fund Vesalius Biocapital III was launched in April last year and has executed three investments so far in late-stage drug development, medtech, and digital health.

It has the endorsement of the European Investment Fund (EIF) so that it can continue supporting science and businesses across life sciences.

The EIF is backed by the European Investment Bank, the European Union, represented by the European Commission, and a range of public and private banks and financial institutions and has invested 30 million euros in the latest round.

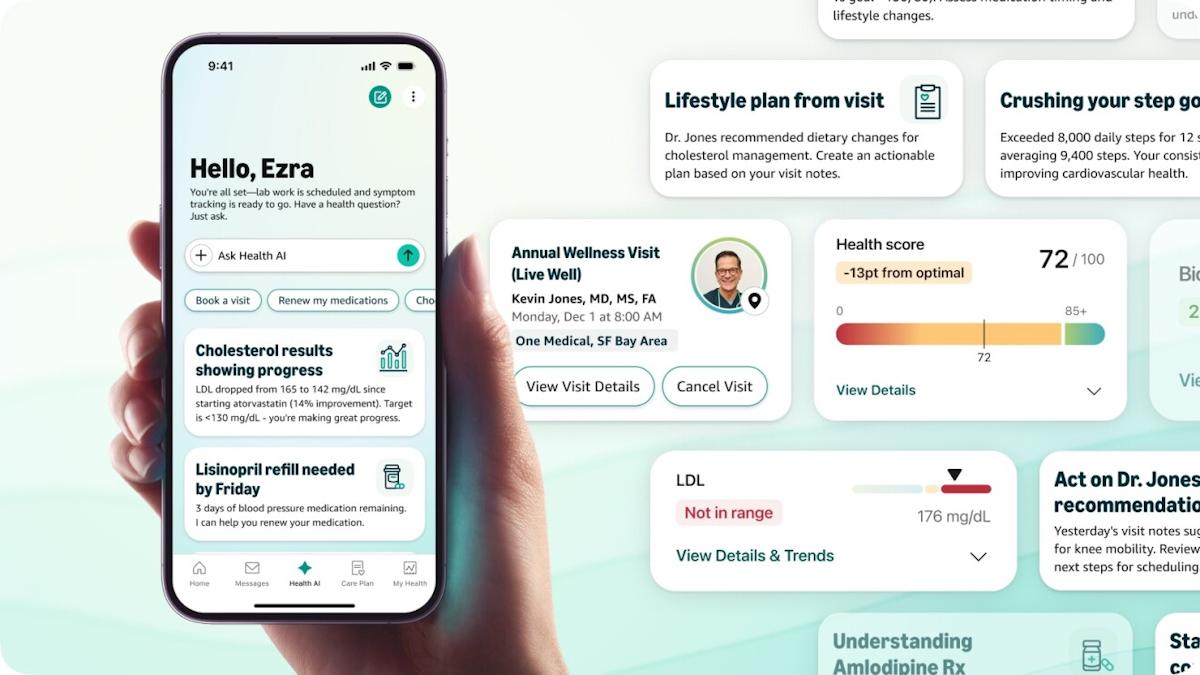

A recent investment includes SWORD Health, a tech enabled provider of physical therapy that pairs artificial intelligence (AI) digital therapists with human clinical teams to help patients recover faster and better.

The latest fundraiser will target later stage European life sciences in drug development, medtech, diagnostics and digital health.

It aims to invest in 10-15 companies over the lifetime of the fund.

Other investments so far also include Forendo, a clinical stage drug development company focused on novel treatments in women’s health.

Its other main investment is Mecuris, a Munich-based medtech developing an easy-to-use online platform for customisable and 3d-printed orthotics and prosthetics.

Partner Marc Lohrmann told pharmaphorum: “Digital health represents a growing portion of our later-stage European deal flow and we see appealing companies and concepts there.

"We focus on companies in Europe that already have or are close to regulatory approvals in the major markets, having commercial traction and a global business model; furthermore, we concentrate on B2B products, so addressing unmet medical & market needs.

"Our existing investments SWORD Health and Mecuris as well as several ones being in an advanced due diligence stage incorporate a strong digital component. For these deals, we are happy to syndicate with peer investors.”