Novartis files potential blockbuster eye drug with FDA

Novartis has filed its ophthalmology drug brolucizumab with the US regulator, a potentially strong competitor in the tough market for drugs for the degenerative eye condition wet AMD.

The Swiss pharma has cashed in a voucher allowing it to gain a faster six-month review for brolucizumab, hoping to win over patients and doctors with a less frequent dosing schedule.

The fast review will also help to steal march on a potential competitor from Bayer that was rejected by the FDA last year.

Novartis hopes to launch brolucizumab by the end of the year if the FDA review goes well.

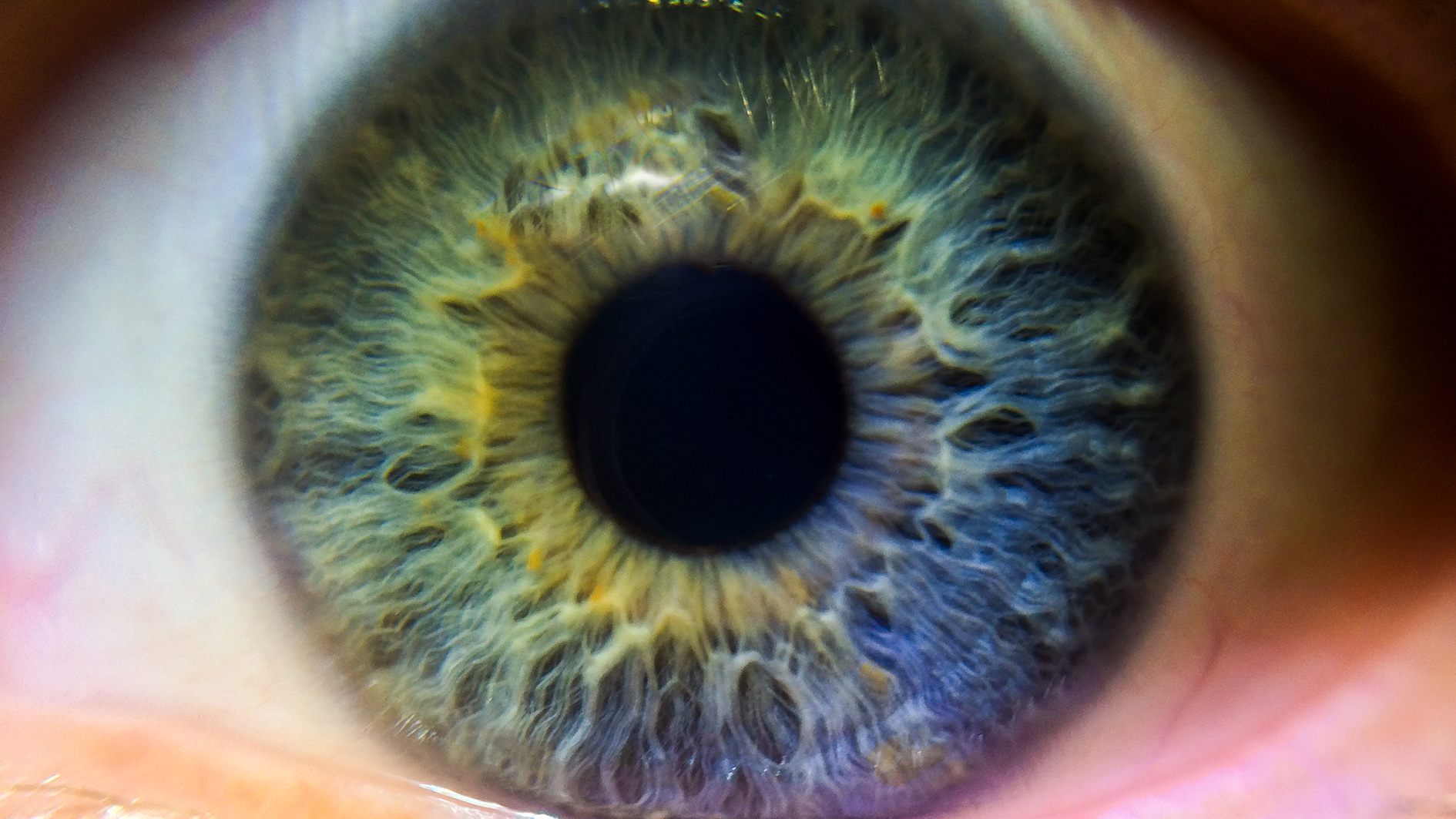

There are several drugs approved for wet age-related macular degeneration (AMD), which is caused by rogue blood vessels growing at the back of the eye, creating blurred vision and sometimes a blind spot in the centre of the field of vision.

Brolucizumab is a successor to Novartis’ already-approved Lucentis (ranibizumab), as well as Bayer and Regeneron’s Eylea (aflibercept), and is expected to become the market-leading drug if approved.

Analysts from GlobalData expect sales to break the billion dollars per year barrier by 2021.

GlobalData forecasts sales of around $4.1 billion by 2026, roughly the same amount of cash that Eylea generated last year.

Trials have shown brolucizumab to be as effective as Eylea, but is given less frequently every 12 weeks, compared with four to eight weeks with Bayer’s drug.

In the two trials comparing brolucizumab with Eylea, there were significantly fewer patients with disease activity treated with Novartis’ drug, and significant reductions in retinal fluid – markers that help doctors manage the disease.

Last year, the FDA rejected Bayer and development partner Regeneron’s filing for a 12-weekly injection formulation of Eylea, leaving a gap in the market that Novartis hopes to exploit.

If approved brolucizumab is also expected to steal sales away from Novartis’ already-approved wet AMD drug Lucentis (ranibizumab).

It’s unclear how brolucizumab will affect the joker in the pack – Roche’s Avastin (bevacizumab), which is approved to attack blood vessels that feed tumours in various cancers, but can also be used off-label to treat wet AMD and is much cheaper than Lucentis.

Brolucizumab is a humanised single-chain antibody fragment targeting VEGF – it is much smaller than conventional antibodies allowing for enhanced tissue penetration and rapid clearance from the body.