Merck shows canny cancer strategy in $5.76bn Eisai milestones deal

Merck & Co and Eisai have reached a deal to co-develop and jointly market Keytruda and Lenvima in a deal that could generate $5.76 billion for the Japanese pharma company.

The deal represents a second strategic co-marketing deal for Merck in oncology, which has created a similar $8.5bn alliance with AstraZeneca on its PARP inhibitor drug Lynparza, which will also be tested in combination.

Two drug combinations will be fundamental to the future of immuotherapy, and Merck is battling with its rivals in the space, most especially BMS and its PD-1 drug Opdivo, to find the best pairings.

Both Merck and BMS have used the orthodox route signing major deals with biotechs who have promising novel oncology candidates. But Merck is also investing in these combinations with already approved drugs, and could find they provide the best synergies - both in the drug combinations and in the marketing alliances.

Merck clearly believes that these deals could be a better bet - and ultimately better value - than alliances based on combinations with as-yet-unapproved drugs.

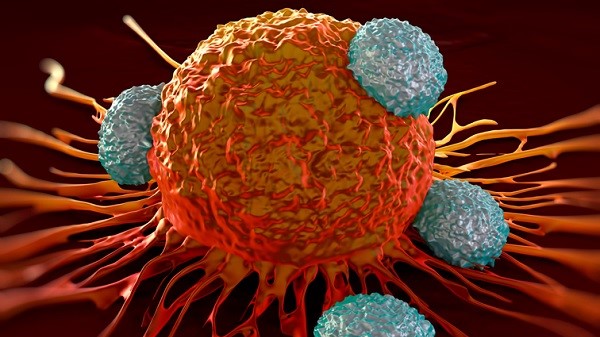

Eisai and Merck will develop and market Lenvima lenvatinib) jointly, both as monotherapy and in combination with Merck’s anti-PD-1 therapy, Keytruda (pembrolizumab) after early trial evidence suggested a positive interaction between the two drugs in solid tumours.

The companies plan trials in 11 potential indications in six types of cancer – endometrial cancer, non-small cell lung cancer, liver cancer, head and neck cancer, bladder cancer, and melanoma.

They also plan a “basket trial” in a range of different cancer types.

Merck will pay Eisai $300 million up front, and up to $650 million in options until March 2021, as well as $450 million to fund R&D.

But it’s sales milestones that are worth the most to Eisai, representing up to $3.97 billion in payments if Lenvima proves to be a commercial success.

The deal could be worth $5.76 billion to Eisai if all targets are met and the company's shares jumped 10% following the news.

Eisai will book Lenvima sales globally, as monotherapy and in combination, and Merck and Eisai will share gross profits equally.

Lenvima is approved as monotherapy in thyroid cancer, as well as in combination with Novartis’ Afinitor (everolimus) for renal cell carcinoma who have failed previous therapy.

The tie-up follows the FDA’s decision in January to grant breakthrough therapy designation for the Lenvima and Keytruda combination in advanced and/or metastatic renal cell carcinoma.

This was based on results from the ongoing KEYNOTE-146 phase 1b/2 trial testing the combination in solid tumours, including renal cell carcinoma and endometrial cancer.

The trial gave evidence for the “synergistic effects” on observed overall response rate – regardless of previous treatment or presence of PD-L1 biomarker.

Keytruda competes with Bristol-Myers Squibb's Opdivo (nivolumab) PD-1 checkpoint inhibitor, which was first to market and is still ahead in the sales race.

Opdivo generated revenues of just under $5 billion last year, compared with Keytruda’s $3.8 billion, according to the two companies’ recently-released full year results.

Eisai is testing separate combinations of Lenvima with Keytruda, or Lenvima with Afinitor, versus chemotherapy alone in renal cell carcinoma, in a phase 3 trial.