Icahn takes stake in BMS, adding to takeover speculation

Activist investor Carl Icahn has reportedly bought a stake in Bristol-Myers Squibb, fuelling speculation that the pharma giant may be in line for a takeover.

It’s not known how big Icahn’s stake is, but it is thought to be large, giving leverage for the kind of interventionist strategies he has used in the past to try and force changes in big companies.

Icahn’s announcement that he has taken a position in BMS was enough to fuel speculation that it could be split up or sold, based on his previous attempts to shake up top-level management in pharma.

Shares in BMS have increased in value over the last few days as the rumour mill went into overdrive after Street Insider published a report that big pharma companies are “kicking the tyres".

BMS is a tempting target for a takeover despite a price tag that would likely exceed its market value of around $94 billion. Its share price has been depressed ever since a disastrous trial failure last summer when its cancer immunotherapy, Opdivo (nivolumab) failed in first-line lung cancer.

Merck’s rival Keytruda, which has been lagging behind in sales, has since been approved in this lucrative indication and is expected to catch up this year.

Much of BMS’ future hopes rest on finding further combinations for Opdivo, but it also has several other blockbuster drugs approved and returns a healthy dividend.

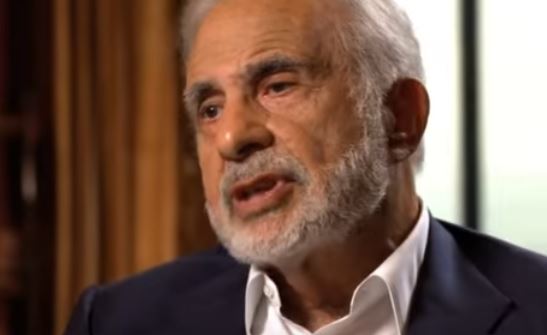

Earlier this month, speculation mounted that Icahn (pictured) may try and take a stake in fellow big-pharma-in-trouble, Gilead, which is having trouble getting new drugs approved after the massive success of its hepatitis C cures based around Sovaldi (sofosbuvir).

Like BMS, Gilead’s share price has been hit by problems in its pipeline, and has also posted disappointing results as the success of Sovaldi and rival therapies from the likes of Merck & Co and AbbVie mean the number of treatable patients is shrinking.

For around four years, Icahn became embroiled in a boardroom battle at Forest Laboratories, where he attempted to oust CEO Howard Solomon and parachute his own choice of board in to run the company.

Solomon eventually stepped down anyway and was replaced by Brent Saunders – and Icahn enjoyed a windfall when Actavis bought Forest in 2014 for $25 billion.

https://twitter.com/CNBCFastMoney/status/834898130856353792

It’s unclear what Icahn will attempt at BMS – but his intervention adds to the intrigue surrounding the future of the company, amid speculation that 2017 could turn out to be a bonanza year for pharma M&A.