AbbVie is big pharma’s first mover in ‘in situ’ cell therapy

AbbVie has signed a wide-ranging collaboration with Umoja Biopharma in the area of ‘in situ’ or in vivo cell therapy, an emerging strategy that does away with the need to harvest, modify, and grow cells outside the body.

The big pharma company has forged two separate agreements with Seattle-based Umoja, one covering the use of its technologies to generate multiple CAR-T therapy candidates for cancer and a second giving AbbVie rights to lead candidate UB-VV111, a CD19-directed in situ CAR-T for blood cancers in preclinical development, as well as follow-up therapies.

The overall value of the alliance is $1.44 billion, which includes an undisclosed upfront payment and equity investment in Umoja and, according to the partners, marks the first time that any large pharma company has ventured into the emerging field.

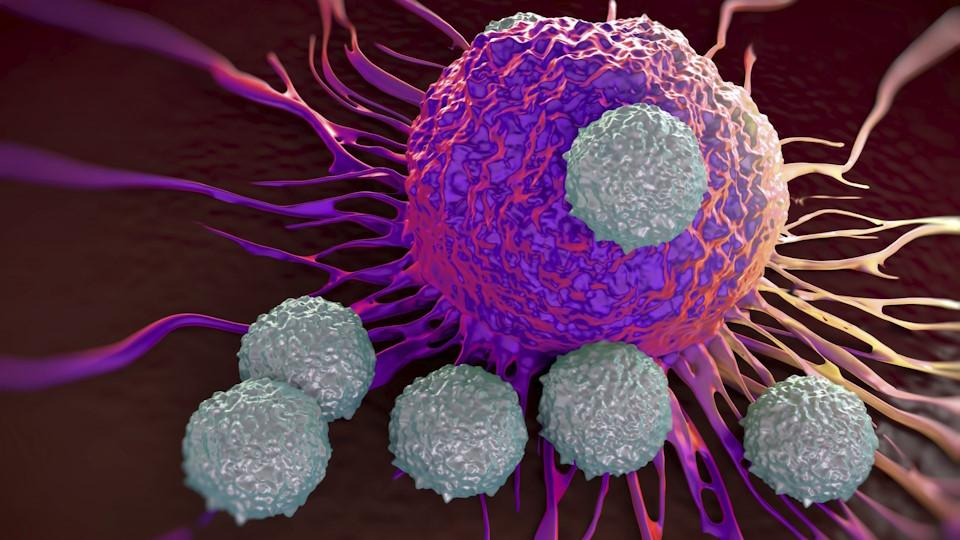

Umoja’s approach involves using a lentiviral vector (VivoVec) to deliver a genetic sequence to T-cells within the body, modifying them so they are stimulated into making their own cancer-fighting CAR-T cells in the body.

That eliminates the need for ex vivo manufacturing processes that involve harvesting cells from patients, modifying and amplifying the cells in the lab, and reinfusing them to fight the cancer – which can take weeks and are resource-intensive.

Conventional CAR-T treatment can also be hazardous to patients, as patients have to undergo lymphodepletion therapy to destroy their bone marrow, placing them at risk of infections, and the delay before the cells can be reinfused can lead to reduced anticancer activity, according to Umoja.

UB-VV11 is also using a second technology called RACR – based on the immune-suppressing drug rapamycin – to both enhance the activity of the endogenously-produced CAR-Ts and eliminate the need for lymphodepletion by inhibiting the effects of other immune cells.

According to AbbVie’s head of discovery research Jonathon Sedgwick, the approach could lead to a “paradigm shift” in genetic medicine and may potentially “expand the patient populations and indications benefitting from conventional CAR-T approaches.”

At the moment, commercially available CAR-Ts – including CD19-directed therapies such as Gilead Sciences’ Yescarta (axicabtagene ciloleucel), Novartis’ Kymriah (tisagenlecleucel), and Bristol-Myers Squibb’s Tecartus (brexucabtagene autoleucel) and Breyanzi (lisocabtagene maraleucel) – all require the ex vivo production process.

Some companies are working on off-the-shelf therapies based on allogeneic or donated cells that could sidestep that need, but so far none have reached the market. Umoja’s solution is a variation on the off-the-shelf model, but does not require donated cells. Rather, it reprogrammes a patient’s own cells, which should reduce the risk they will be rejected by the immune system and allow repeat dosing.

“AbbVie is an ideal partner for Umoja, given their broad expertise in development and commercialisation of novel therapeutics in haematology, oncology, and beyond,” said David Fontana, Umoja’s chief operating and business officer.

The deal is the second for Umoja in two days, coming after it partnered with China’s IASO Biotherapeutics to create off-the-shelf CAR-Ts for cancer and autoimmune diseases.